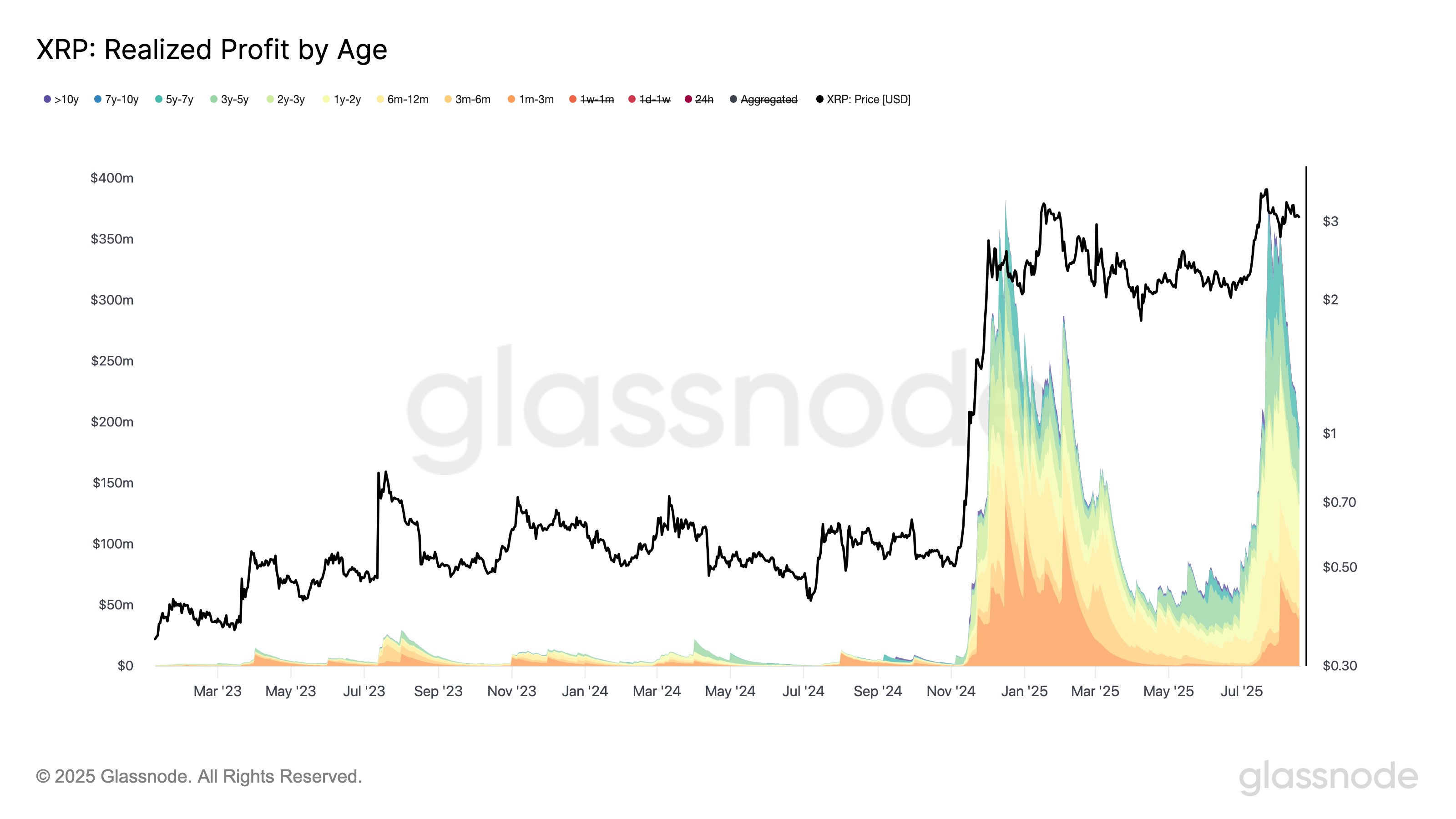

XRP profit-taking volume spiked to its highest level of the year, reaching $375 million in late July, a move that echoes the strong sell-off seen during the December 2024 rally. This data insight comes from Glassnode, which attributes the recent market turbulence partly to a wave of profit-taking by long-term holders.

XRP profit-taking volume spiked to its highest level of the year, reaching $375 million in late July, a move that echoes the strong sell-off seen during the December 2024 rally. This data insight comes from Glassnode, which attributes the recent market turbulence partly to a wave of profit-taking by long-term holders.

What Triggered the $375 Million XRP Sell-Off?

The price of XRP climbed to a peak of $3.66 earlier in July 2025, continuing a strong recovery. However, this rally soon reversed course, culminating in a sharp 10.34% single-day drop on July 23. The following day, panic set in across the XRP market, prompting wide-scale profit-taking that totaled $375 million—XRP’s highest exit volume for the year.

This mass sell-off was not solely driven by recent investors. Instead, Glassnode’s data reveals that the largest profit-taking volumes came from holders who had maintained their positions for at least two years. Shorter-term investors (one month to one year) also contributed significantly to the sell pressure.

Massive XRP distribution event captured by Glassnode on July 24, 2025.

Historical Parallel to December 2024

The massive July activity is reminiscent of XRP’s behavior in December 2024, when the crypto surged nearly 290% from November levels, retesting the $3 mark. That rally triggered aggressive investor selling similar to what has now occurred in July 2025. These recurring patterns may reflect systematic behaviors among experienced investors looking to secure gains at psychological price thresholds.

Following the July 24 spike in selling pressure, XRP attempted to stabilize but entered another downward spiral, ultimately falling by 13.2% by August 2. Since then, the asset has staged a measured comeback, although analysts suggest the recovery may be fragile because of lingering sell pressure.

Address Profitability Supports Bullish Case

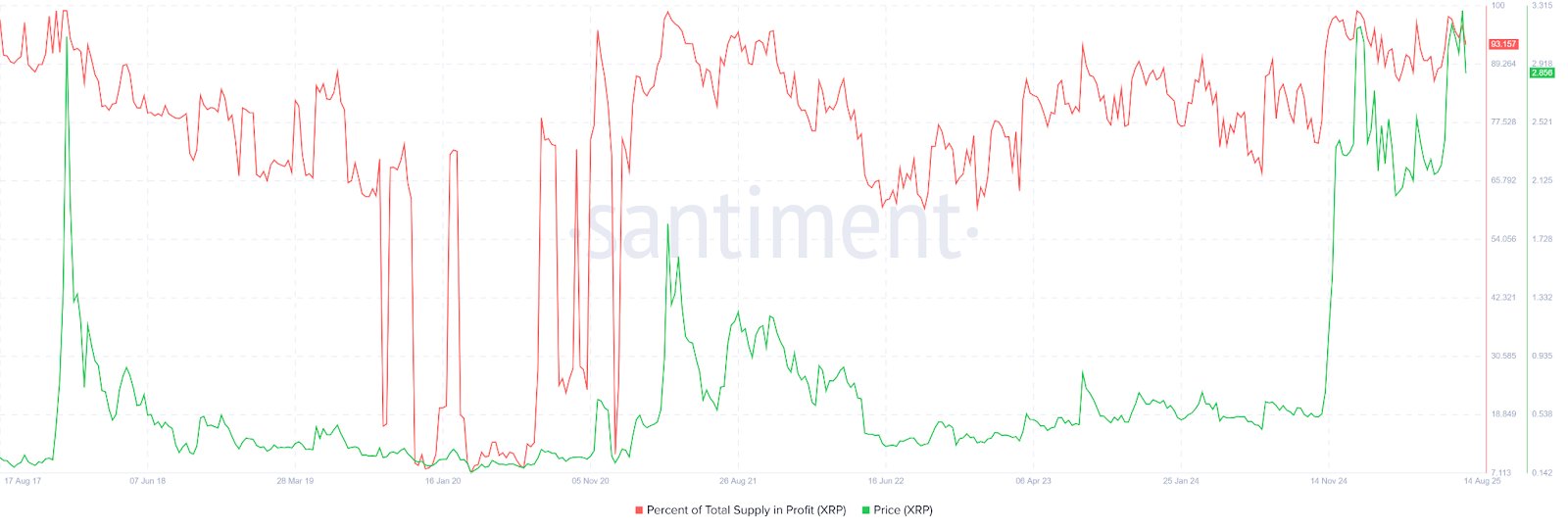

Despite recent declines, XRP address profitability remains notably high. A previous report from The Crypto Basic cited Glassnode data indicating that 94% of XRP-holding addresses were in profit while the token traded above $3.

Market analysts like Winny flagged this high profitability as a potential catalyst for further profit-taking—which ultimately manifested during the July downturn. Nonetheless, the broader resilience of XRP is being supported by bullish indicators and market fundamentals.

As noted by crypto trader Xaif Crypto, a recent update confirmed that 93% of XRP wallets remain in the green according to Santiment analytics. This suggests that—even post-correction—the majority of holders are still sitting on gains, and further selling pressure could emerge if prices rise again.

Recent Santiment data shows consistent high profitability across XRP-holding wallets.

Final Takeaways: What’s Next for XRP?

The recent XRP sell-offs underscore how market sentiment and historical patterns often repeat in the crypto landscape. With most long-term holders still in the profit zone and a track record of selling after price spikes, cautious optimism is warranted. If XRP breaks above key resistance points again, it may be accompanied by another wave of exits.

For now, XRP remains one of the more resilient digital assets, despite its volatility. Investors should watch both address profitability and macro market movements to gauge potential upcoming shifts in the XRP trendline.

Read more about XRP’s recent performance in this article: XRP Surges Past $3 – What’s Next?

Related: XRP Price: $12M Max Pain for Bears

Further analysis on the cause of the July downturn is available here: Why This XRP Fall Was Always On The Cards

Quick Summary

XRP profit-taking volume spiked to its highest level of the year, reaching $375 million in late July, a move that echoes the strong sell-off seen during the December 2024 rally. This data insight comes from Glassnode, which attributes the recent market turbulence partly to a wave of profit-taking by long-term holders.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.