Multiple XRP ETFs are potentially launching soon, with several already listed on the DTCC website. The price of XRP has seen a rally, increasing more than 12% in the last 24 hours. Market analysts are optimistic, suggesting the end of the government shutdown could open the doors for more crypto ETFs.

What to Know:

- Multiple XRP ETFs are potentially launching soon, with several already listed on the DTCC website.

- The price of XRP has seen a rally, increasing more than 12% in the last 24 hours.

- Market analysts are optimistic, suggesting the end of the government shutdown could open the doors for more crypto ETFs.

The crypto community is buzzing with anticipation as multiple XRP exchange-traded funds (ETFs) are expected to launch shortly. This follows a deal in the U.S. Senate aimed at resolving the government shutdown, sending positive signals across various markets, including the crypto space. With several XRP ETFs already appearing on the Depository Trust and Clearing Corporation (DTCC) website, a potential launch this month seems increasingly likely.

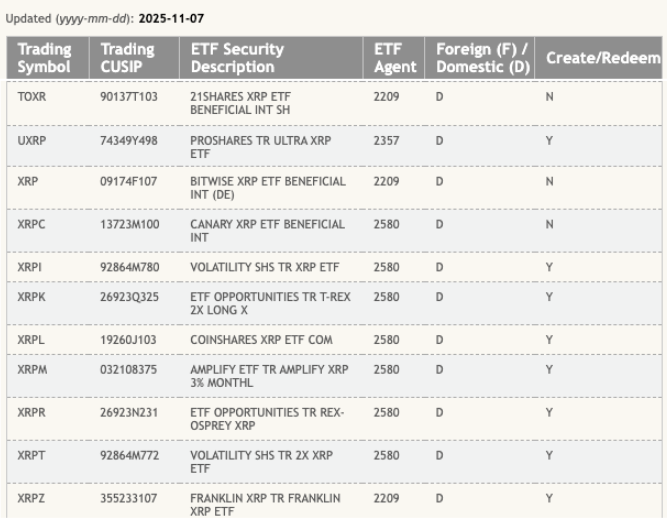

As of Monday, the DTCC website listed 11 XRP ETF products under the “active and pre-launch” category. Notable firms such as 21Shares, ProShares, and Bitwise are among those with listed XRP ETF products. While a DTCC listing doesn’t guarantee regulatory approval or immediate launch, it indicates the infrastructure is being prepared for trading on U.S. markets.

ETF expert Nate Geraci shared his bullish outlook on X, suggesting the end of the government shutdown could lead to a surge in spot crypto ETF approvals. He also speculated that the first spot XRP ETF launch could occur this week. Bloomberg ETF analyst Eric Balchunas also noted the positive momentum with a tweet highlighting the uptick in U.S. equity futures following the shutdown’s end.

Government shutdown ending = spot crypto ETF floodgates opening

In meantime, could see first ’33 Act spot xrp ETF launch this week.

One analyst believes the launch of spot XRP ETFs represents a turning point for crypto regulation. The SEC’s previous litigation against Ripple, which lasted for five years, concluded three months ago. The approval and launch of these ETFs could signify a more favorable regulatory environment moving forward.

The potential launch of multiple XRP ETFs signals growing institutional interest in XRP and the broader crypto market. As regulatory landscapes evolve and mature, the introduction of such investment vehicles provides traditional investors with easier access to digital assets. This increased accessibility could further drive adoption and market growth.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Multiple XRP ETFs are potentially launching soon, with several already listed on the DTCC website. The price of XRP has seen a rally, increasing more than 12% in the last 24 hours. Market analysts are optimistic, suggesting the end of the government shutdown could open the doors for more crypto ETFs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.