XRP regulation is once again in the spotlight following South Korea’s recent move to pause all new crypto lending products, highlighting growing unease around excessive leverage in digital asset markets.

XRP regulation is once again in the spotlight following South Korea’s recent move to pause all new crypto lending products, highlighting growing unease around excessive leverage in digital asset markets.

South Korea Suspends New Lending Products Amid Market Volatility

South Korea’s Financial Services Commission (FSC) has instructed crypto exchanges to stop launching any new lending features. This regulatory step aims to curb the escalating risks related to over-leveraged trading, which regulators say could threaten market stability and investor security.

The FSC’s decision follows a recent case involving Bithumb, where over 27,000 users enrolled in lending programs during June. Alarmingly, 13% of those users were forced to liquidate positions after collateral prices rapidly dropped.

Concerns Over Rising Leverage in Crypto Markets

This intervention comes shortly after Galaxy Digital released a market analysis that flagged the surge in crypto leverage as a major concern. According to the firm, crypto-collateralized loans jumped 27% in Q2 of 2025, bringing the total volume to an eye-watering $53.1 billion—the highest since early 2022.

The report also noted how a recent $1 billion liquidation event was sparked when Bitcoin fell sharply from $124,000 to $118,000. This decline triggered mass forced sell-offs across leveraged positions, shaking investor confidence.

How the New Directive Impacts Lending Platforms

Under the FSC’s new guidelines, ongoing loans can continue to term. However, crypto platforms are banned from rolling out any further lending functions until formal standards are established. The regulator cautioned that non-compliant firms could face audits or further supervisory action. Final lending policy details are expected to be released later this year.

Market observers believe South Korea’s move mirrors global concerns as leverage levels inch back toward those seen during the last crypto bull run. This includes issues such as on-chain liquidity bottlenecks, Ethereum staking withdrawal queues, and discrepancies between decentralized and over-the-counter lending rates.

Chart illustrating the surge in crypto collateralized loans, raising leverage concerns among regulators.

Industry Voices: Reactions Divided Over Blanket Restrictions

Not all industry participants support the FSC’s sweeping restrictions. According to DNTV Research’s Bradley Park, a more nuanced strategy would better serve the public. Park emphasized that instead of suspending offerings, regulators should focus on improving lending transparency, user interfaces, and clearer risk communications.

“The rational approach is to upgrade UI/UX, risk disclosures, and LTV controls to manage exposure safely,” said Park. He also pointed out that much exchange lending revolves around stablecoins used for shorting assets, not risky margin loans on volatile tokens.

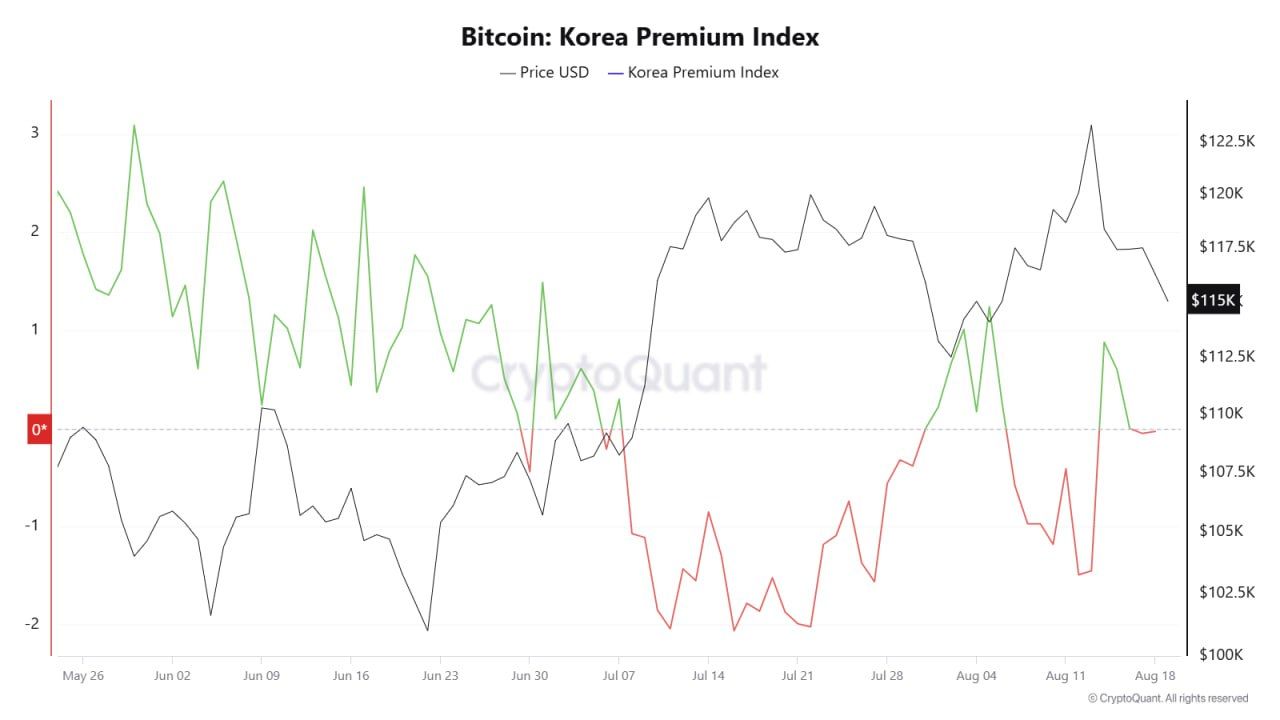

Park suggested the FSC’s real motive could be tied to addressing market structure distortions like the negative ‘kimchi premium’—a situation where cryptocurrencies trade at lower prices on Korean exchanges compared to international platforms.

Opaque Lending Practices Fuel Regulatory Scrutiny

Park also highlighted the lack of transparency from some major platforms. For instance, Bithumb fully reports its lending figures, whereas Upbit—the largest crypto exchange in South Korea—does not. This opacity could inhibit regulators’ ability to assess systemic risk and might explain the need for a temporary freeze across all platforms.

“Until these structural issues are addressed, reopening may take time,” Park concluded. He urged authorities to focus on data-driven policies rather than blanket suspensions, allowing innovation to continue under strict but practical safeguards.

Related: XRP Price: $12M Max Pain for Bears

Read more: Crypto for Advisors: Asian Stablecoin Adoption

Quick Summary

XRP regulation is once again in the spotlight following South Korea’s recent move to pause all new crypto lending products, highlighting growing unease around excessive leverage in digital asset markets.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.