Bitcoin experienced significant price volatility, nearing $95,000 before a sharp rejection. The cryptocurrency market is showing mixed performance, with some altcoins gaining while others face corrections.

What to Know:

- Bitcoin experienced significant price volatility, nearing $95,000 before a sharp rejection.

- The cryptocurrency market is showing mixed performance, with some altcoins gaining while others face corrections.

- XRP saw a notable surge followed by a pullback, reflecting broader market uncertainties and potential liquidity shifts.

Bitcoin’s price movements have intensified, reflecting the ongoing uncertainty in the cryptocurrency market. While some altcoins are posting gains, the overall market capitalization has seen a slight decrease. This mixed performance underscores the complex dynamics influencing the crypto space as we move into a new week.

Bitcoin’s Rollercoaster

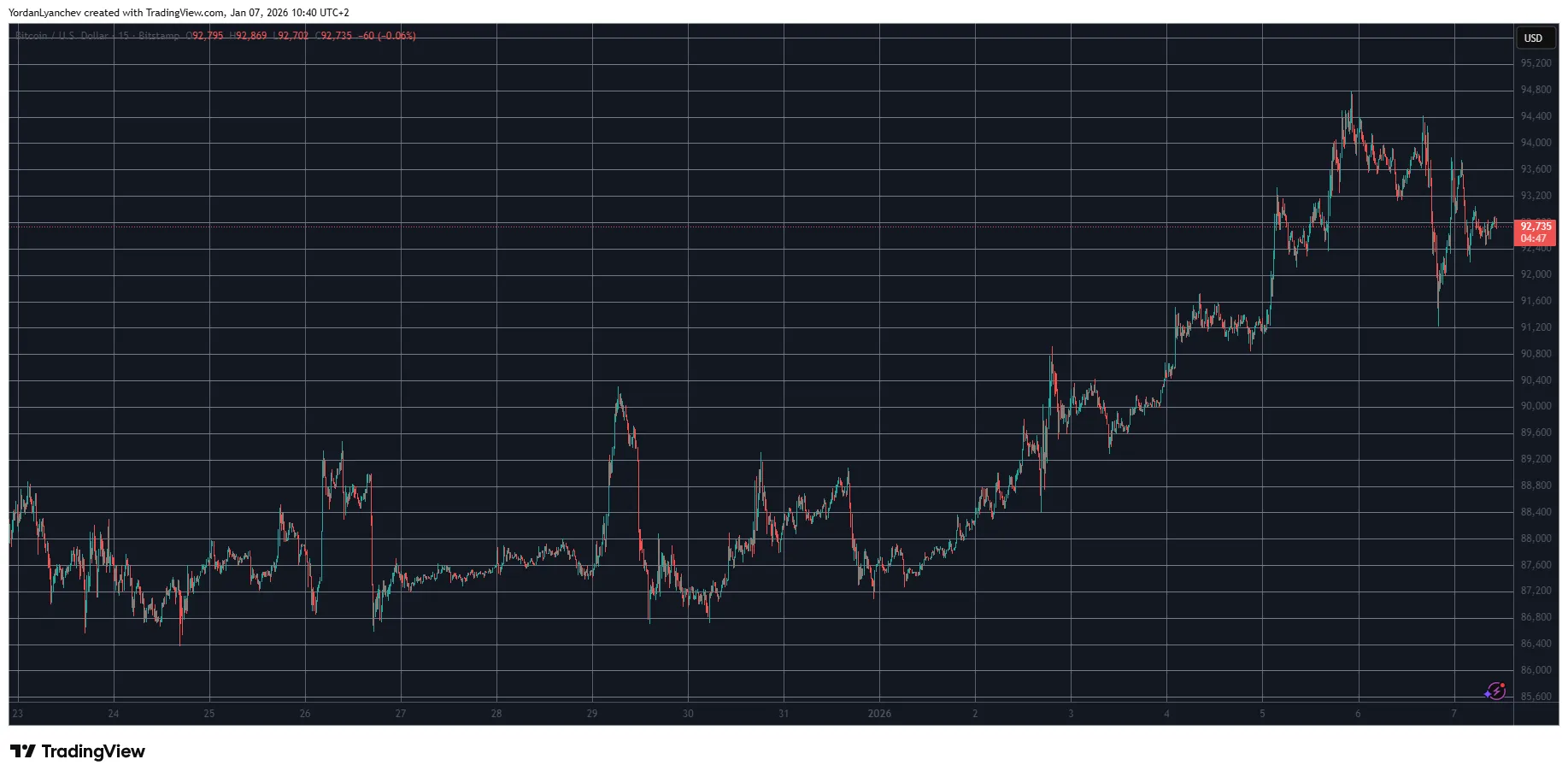

Bitcoin started the year strong, recovering from late December losses and reclaiming the $90,000 level. This positive momentum continued, with Bitcoin reaching a multi-week peak of nearly $95,000. However, this rally was short-lived, as BTC faced rejection and subsequently declined, highlighting the inherent volatility of the market.

Altcoin Performance: Mixed Signals

The altcoin market presents a varied landscape. Ethereum (ETH) has seen a positive uptick, reaching $2,500, while Binance Coin (BNB) is approaching $920. Other altcoins like Solana (SOL) and Monero (XMR) have also demonstrated positive movement. However, Ripple’s XRP experienced a surge to $2.40 before facing rejection and a subsequent decline, illustrating the volatile nature of altcoin trading.

XRP’s Price Action

XRP demonstrated significant volatility, surging to a multi-month high before retracing. This price action underscores the speculative nature of the token, influenced by factors such as Ripple’s ongoing legal battles and developments in cross-border payment solutions. The rejection at $2.40 suggests a potential resistance level that traders should monitor.

Market Capitalization and Dominance

The total crypto market capitalization has decreased to $3.275 trillion, reflecting the recent corrections in Bitcoin and some altcoins. Bitcoin’s dominance has slightly decreased to 56.5%, indicating a potential shift in market share towards altcoins. This shift could be influenced by factors such as the growth of decentralized finance (DeFi) and the increasing adoption of Ethereum-based applications.

Broader Market Considerations

The cryptocurrency market’s volatility is influenced by a range of factors, including macroeconomic trends, regulatory developments, and institutional investment. The potential approval of Bitcoin ETFs, for example, could significantly impact market liquidity and price discovery. Investors should remain vigilant and conduct thorough research before making investment decisions.

Conclusion

The cryptocurrency market is currently experiencing a period of volatility and mixed performance. Bitcoin’s price fluctuations, coupled with the varied movements of altcoins, highlight the inherent risks and opportunities in this asset class. Investors should closely monitor market trends, regulatory developments, and macroeconomic factors to make informed decisions.

Related: XRP Outperforms: Investor Signals Bitcoin Shift

Source: Original article

Quick Summary

Bitcoin experienced significant price volatility, nearing $95,000 before a sharp rejection. The cryptocurrency market is showing mixed performance, with some altcoins gaining while others face corrections. XRP saw a notable surge followed by a pullback, reflecting broader market uncertainties and potential liquidity shifts.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.