A small percentage of XRP accounts hold significant amounts, suggesting potential accumulation by larger players. This data surfaces amid speculation about institutional interest in XRP and potential supply squeezes. The concentration of XRP holdings may influence future price action and market dynamics.

What to Know:

- A small percentage of XRP accounts hold significant amounts, suggesting potential accumulation by larger players.

- This data surfaces amid speculation about institutional interest in XRP and potential supply squeezes.

- The concentration of XRP holdings may influence future price action and market dynamics.

Recent on-chain data reveals a concentrated distribution of XRP, with a small fraction of accounts holding the majority of the tokens. This observation has fueled speculation about institutional accumulation and the potential for future supply shocks. While the long-term implications remain uncertain, the current distribution patterns offer insights into the evolving XRP market structure.

Scarcity Narrative

The narrative that the XRP market remains “early” gains traction from data showing that only a small fraction of total accounts hold substantial XRP amounts. This scarcity perception is further amplified by the belief that institutional players may be strategically accumulating XRP, potentially squeezing retail holdings. Such dynamics, if true, could lead to significant price appreciation as demand outstrips available supply, a scenario familiar to seasoned crypto investors.

XRP Rich List Details

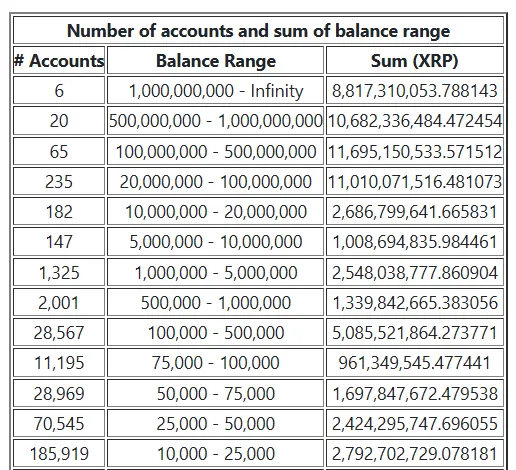

Analysis of the XRP Rich List indicates that only approximately 330,000 accounts hold more than 10,000 XRP. This figure represents a mere 4.39% of the total existing XRP wallets. Further stratification reveals that a tiny fraction, just 0.026%, hold at least 1 million XRP, while only 508 accounts globally possess over 10 million XRP. These statistics highlight the concentration of XRP wealth within a relatively small group of holders.

Comparison with Bitcoin Distribution

Comparing XRP’s distribution to that of Bitcoin reveals stark differences. While approximately 330,000 wallets hold at least $22,400 worth of XRP (10,000 XRP), a significantly larger number of Bitcoin wallets hold comparable amounts. On-chain data shows that over 4.4 million wallets hold at least 0.1 BTC, and nearly 1 million hold more than 1 BTC. This disparity underscores the relative concentration of XRP holdings compared to the more widely distributed Bitcoin.

Institutional Accumulation Speculation

The concentration of XRP holdings has fueled speculation about potential institutional accumulation. Market commentators suggest that larger entities may be strategically acquiring XRP, aiming to control a significant portion of the supply. Such accumulation could be driven by anticipation of future regulatory clarity, potential use cases for XRP in institutional settlement systems, or simply a bullish outlook on the asset’s long-term prospects. However, these remain speculations, and concrete evidence of widespread institutional accumulation remains elusive.

Market Outlook and Cautions

While the data on XRP distribution may suggest potential upside, investors should exercise caution and conduct thorough due diligence. The crypto market is inherently volatile, and past performance is not indicative of future results. Regulatory developments, technological advancements, and broader macroeconomic factors can all significantly impact XRP’s price and market dynamics. Investors should carefully consider their risk tolerance and investment objectives before allocating capital to XRP or any other cryptocurrency.

The concentrated distribution of XRP, coupled with speculation about institutional accumulation, presents an intriguing narrative for market participants. While potential upside exists, investors must remain vigilant and approach the XRP market with a balanced perspective. Further monitoring of on-chain data and market developments will be crucial in assessing the long-term implications of these trends.

Related: XRP Analysis: ETF Stacking, Momentum Fades

Source: Original article

Quick Summary

A small percentage of XRP accounts hold significant amounts, suggesting potential accumulation by larger players. This data surfaces amid speculation about institutional interest in XRP and potential supply squeezes. The concentration of XRP holdings may influence future price action and market dynamics.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.