XRP experienced a price drop following significant token sales by major holders, indicating continued market sensitivity to large transactions. Key long-term support levels remain intact, potentially offering a foundation for price stabilization despite recent downward pressure.

What to Know:

- XRP experienced a price drop following significant token sales by major holders, indicating continued market sensitivity to large transactions.

- Key long-term support levels remain intact, potentially offering a foundation for price stabilization despite recent downward pressure.

- On-chain metrics reveal a substantial portion of XRP holders are currently at a loss, reflecting broader market challenges and cautious sentiment.

XRP has faced renewed challenges as substantial selling activity from major holders has impacted its price. The digital asset is currently trading near $2.11, marking a notable decrease for the week, influenced by ongoing large-scale token transfers. This situation underscores the importance of monitoring whale activity for understanding potential market shifts in XRP.

Blockchain data indicates that wallets holding between 1 million and 10 million XRP have moved approximately 190 million tokens in the last 48 hours. This reduction in holdings among larger wallets correlates with XRP’s recent price decline to just over $2 on various exchanges. The ongoing trend of whale exits suggests that XRP is still navigating a sensitive phase, with large holders consistently reducing their positions, thereby amplifying downward trends.

190 million $XRP sold by whales in the last 48 hours! pic.twitter.com/nB0P7jADCx

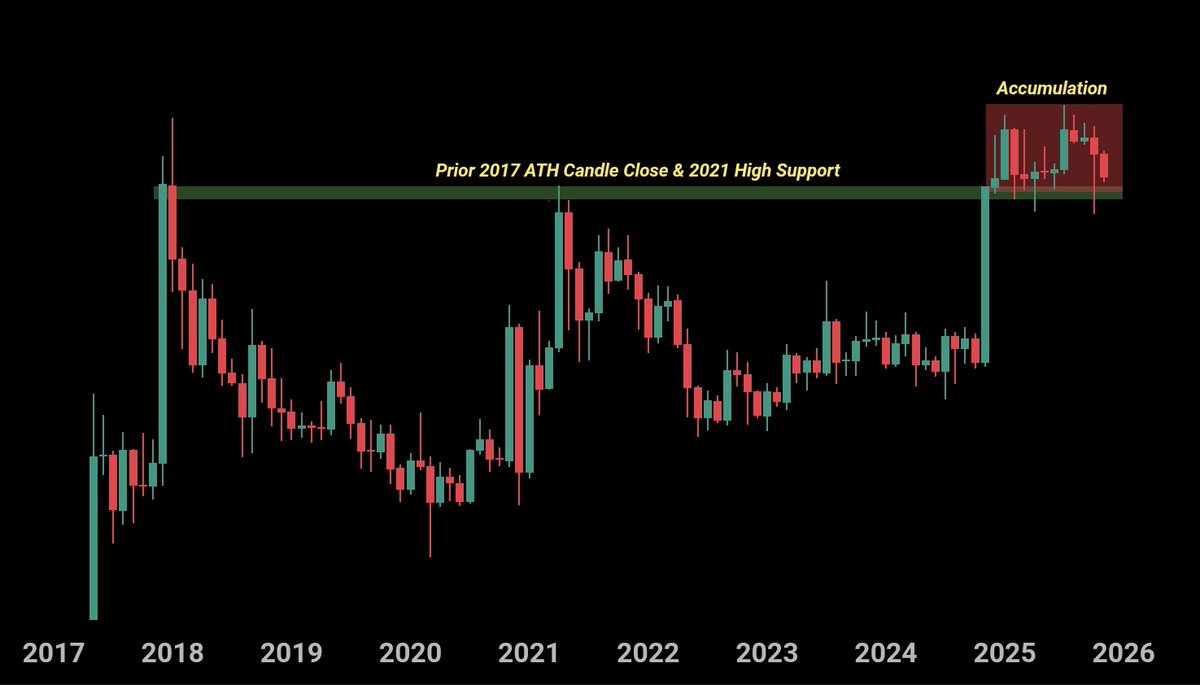

Despite the selling pressure, long-term support levels remain a critical area to watch. The zone that encompasses the 2017 monthly candle closes and the 2021 highs has consistently provided support for nearly a year. This level’s resilience suggests its ongoing significance, even as shorter-term momentum weakens.

Recent on-chain data reveals that almost half of XRP’s circulating supply is currently held at a loss, reflecting increased pressure on wallets that acquired the asset near its peak. While XRP has entered oversold territory, potentially attracting short-term traders, the overall market sentiment remains cautious. The interplay between these technical factors and the behavior of major holders will likely determine XRP’s next significant move.

In conclusion, XRP’s trajectory hinges on its ability to maintain key support levels amid persistent selling pressure and cautious market sentiment. Monitoring whale activity and broader market conditions will be essential for investors and traders navigating the XRP landscape. As the digital asset space evolves, understanding these dynamics is vital for making informed decisions.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP experienced a price drop following significant token sales by major holders, indicating continued market sensitivity to large transactions. Key long-term support levels remain intact, potentially offering a foundation for price stabilization despite recent downward pressure.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.