XRP’s social sentiment has plummeted to levels not seen since October, often a contrarian indicator preceding price rallies. Despite recent price drops, XRP has maintained a key support level around $2, bolstered by significant institutional inflows into spot XRP ETFs.

What to Know:

- XRP’s social sentiment has plummeted to levels not seen since October, often a contrarian indicator preceding price rallies.

- Despite recent price drops, XRP has maintained a key support level around $2, bolstered by significant institutional inflows into spot XRP ETFs.

- While XRP ETF inflows have slowed this week, the overall trend since launch remains positive, indicating sustained institutional interest.

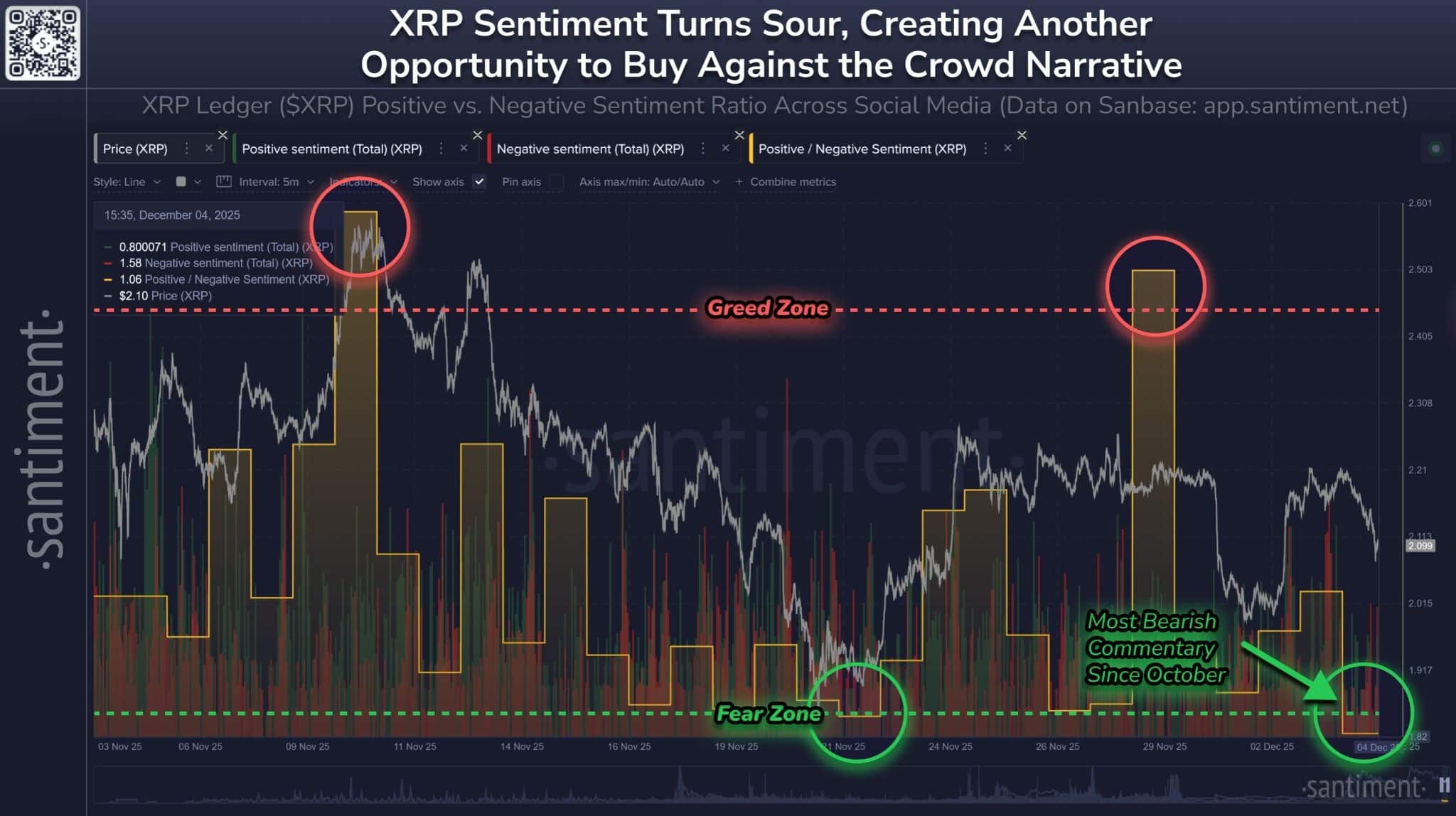

The digital asset XRP is currently navigating a landscape of mixed signals. On one hand, social sentiment has plunged into what market analysts are calling a “fear zone.” On the other, the cryptocurrency is demonstrating resilience around the $2 mark, supported by inflows into new spot XRP ETFs. This divergence presents both a challenge and a potential opportunity for institutional and high-net-worth investors.

According to data from Santiment, social media chatter surrounding XRP reflects levels of fear, uncertainty, and doubt (FUD) not seen since October. Historically, such capitulation-like sentiment has preceded notable price rallies. For example, a similar dip in social sentiment in November 2024 was followed by a 22% price surge within days. This suggests a potential contrarian buying opportunity for those willing to take a position against the prevailing bearish narrative. Seasoned investors often look for these types of dislocations between price and sentiment as signals for potential entry points.

“As of now, an opportunity appears to be emerging just like two weeks ago.”

However, it’s essential to acknowledge the current market context. XRP has experienced a 4.6% drop in the last 24 hours, making it the worst performer among the top 10 cryptocurrencies by market capitalization. The token is also trading significantly below its all-time high. This underperformance could be attributed to various factors, including broader market corrections, regulatory uncertainties, or profit-taking following the initial excitement surrounding the launch of spot XRP ETFs.

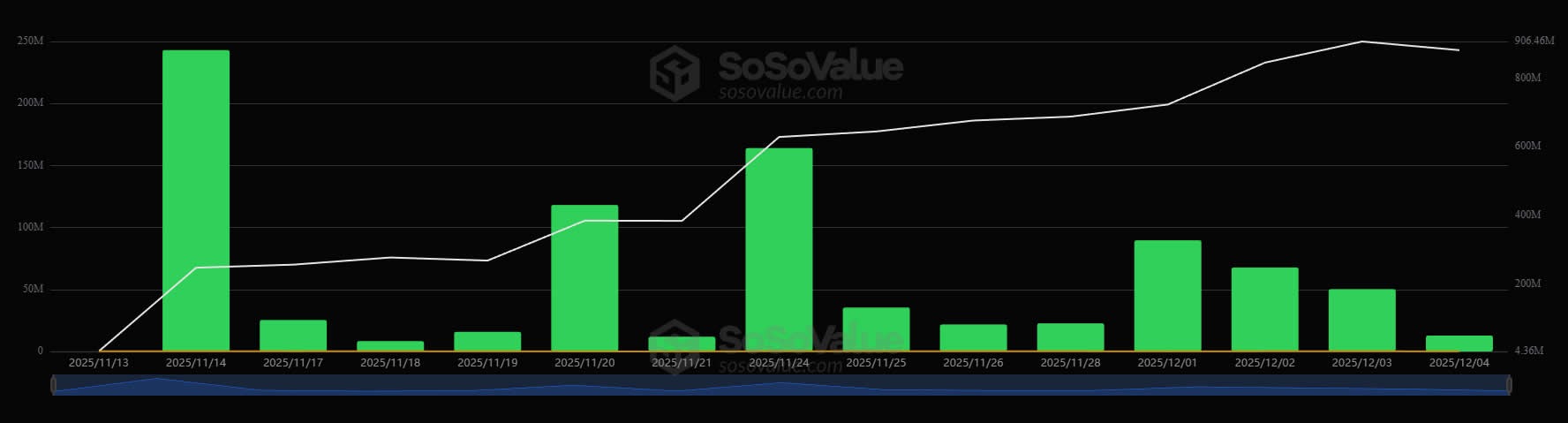

Despite the negative sentiment, XRP has demonstrated a notable ability to hold above the $2 level. This resilience is partially attributed to substantial institutional inflows into spot XRP ETFs. According to LVRG Research, these inflows have exceeded $750 million this month alone, indicating sustained institutional interest even amidst broader market volatility. This level of institutional backing can provide a cushion against further price declines and potentially fuel future rallies.

“This isn’t all bearish, though, as those often mark a bottom that can then capitalize on legal wins, regulatory clarity, a US-first approach, and a long-standing cross-border payment value.”

The launch of spot XRP ETFs represents a significant step toward mainstream adoption. This mirrors the early days of Bitcoin ETFs, which initially experienced volatile flows before establishing themselves as a core component of many institutional portfolios. The presence of these ETFs provides a regulated and accessible avenue for institutions to gain exposure to XRP, further legitimizing the asset class.

However, recent data indicates a slowdown in XRP ETF inflows. While still positive, the inflows on Thursday were the lowest since November 21. This could be a temporary pause, reflecting profit-taking or a broader market correction. It’s crucial to monitor these flows in the coming weeks to gauge the sustained appetite for XRP exposure among institutional investors. A continued decline in inflows could signal a weakening of institutional support and potentially lead to further price declines.

Currently, the five spot XRP ETFs collectively hold $881 million in net assets. This figure represents a substantial commitment to the asset class and provides a solid foundation for future growth. The success of these ETFs will depend on various factors, including the overall performance of XRP, regulatory developments, and the ability of fund managers to effectively market these products to institutional investors.

In conclusion, XRP finds itself at a critical juncture. The combination of negative social sentiment and slowing ETF inflows presents a challenge, but the cryptocurrency’s resilience around the $2 level and the overall positive trend in ETF assets offer a glimmer of hope. For institutional investors, this situation demands a balanced approach: carefully monitoring market sentiment, tracking ETF flows, and assessing the broader regulatory landscape. While the path forward is uncertain, XRP’s demonstrated ability to navigate turbulent waters suggests it remains a contender in the evolving digital asset landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP’s social sentiment has plummeted to levels not seen since October, often a contrarian indicator preceding price rallies. Despite recent price drops, XRP has maintained a key support level around $2, bolstered by significant institutional inflows into spot XRP ETFs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.