XRP is experiencing a wave of unusually strong optimism across the crypto community, even as Ripple faces continued legal resistance in its battle with the SEC.

XRP is experiencing a wave of unusually strong optimism across the crypto community, even as Ripple faces continued legal resistance in its battle with the SEC. Despite a recent courtroom development that stalled a proposed settlement, XRP holders and traders show persistent confidence in the asset’s long-term trajectory.

On June 26, U.S. District Judge Analisa Torres declined a joint request by Ripple and the U.S. Securities and Exchange Commission aimed at accelerating the final stages of their long-running legal standoff. This motion, which was an attempt to settle for $50 million, was effectively denied by the court, citing that legal standards must be fulfilled before dismissing previous rulings.

The judge was firm in her reasoning, emphasizing that legal clarity cannot be overridden simply because both parties now seek closure. As a result, the court battle continues, and the resolution process returns to a state of uncertainty. Instead of wrapping up years of legal tension, the path forward now appears more prolonged as further appeals are expected.

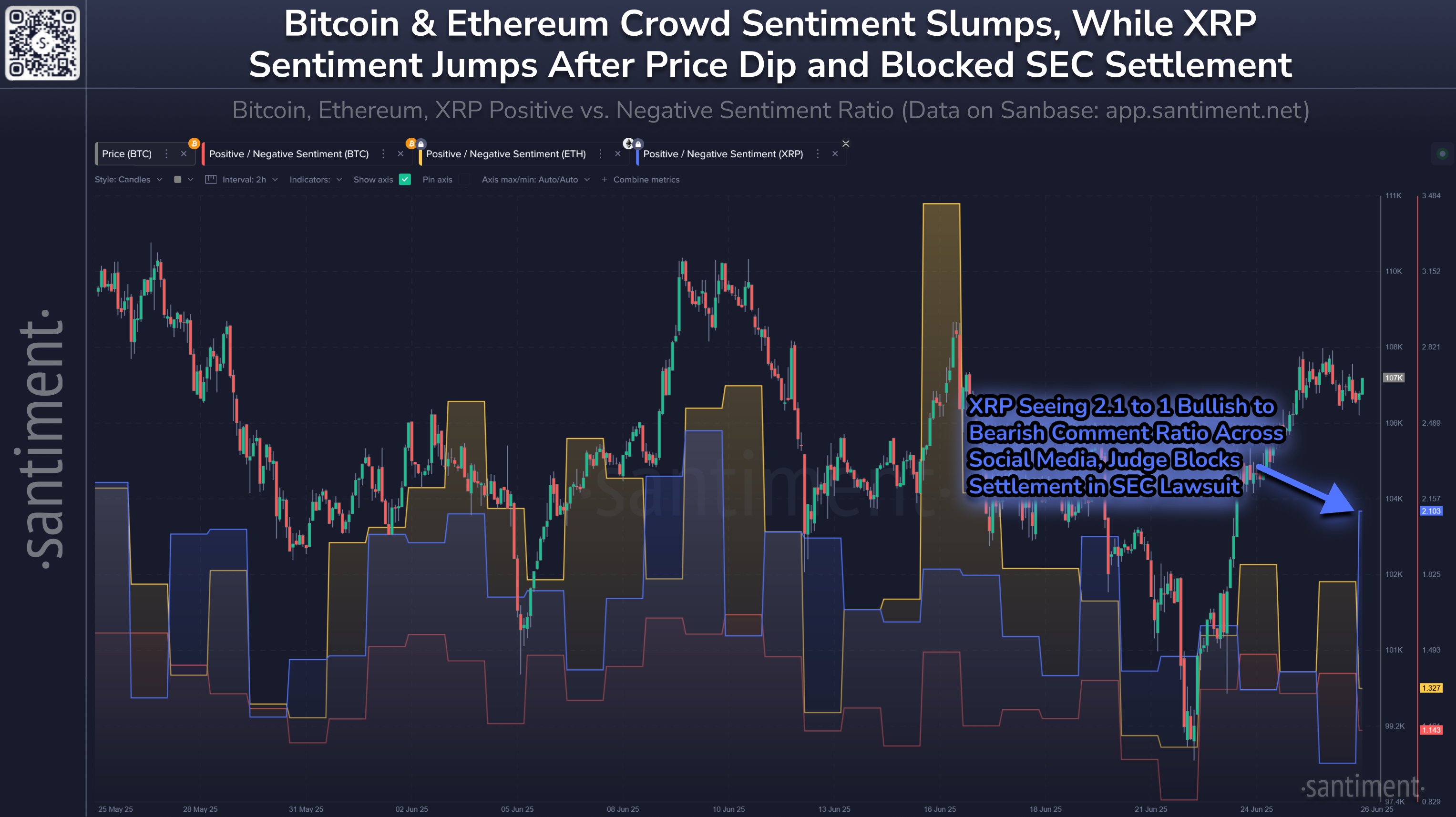

While one might expect this development to cause uncertainty or bearish attitudes in the market, investor sentiment around XRP has bucked the trend. Recent data reveals that XRP saw its ratio of bullish to bearish comments soar to 2.1:1, marking its most optimistic reading in the past 17 days. This surge contrasts with a decline in sentiment for other leading cryptocurrencies like Bitcoin and Ethereum.

The surprising upswing in mood is making its rounds across social platforms, with on-chain analytics provider Santiment attributing this bullish pattern to increased community engagement and support. XRP-related messages continue trending positively despite the broader hesitation seen in other segments of the crypto market.

Some analysts suggest this leap in positivity could be influenced by minor upward price movements occurring simultaneously, which are bolstering hope among retail investors. That said, the catalyst might not be purely based on numbers. There’s a growing perception among XRP supporters that each new courtroom clarification, even if it’s a delay, is a step toward eventual regulatory definition. For many, this represents progress in itself.

The sentiment gap between XRP and other top assets like BTC and ETH hints at potential reallocation of emotional and trading capital. While uncertainty looms over the overall market due to macroeconomic and judicial variables, the resilience of the XRP community underlines the asset’s unique standing.

It’s also worth noting that this mood swing is not happening in isolation. The XRP crowd seems increasingly hopeful that once legal proceedings conclude, the digital asset could be positioned to benefit from regulatory clarity more than its competitors.

Related: Expert Advice: Sell XRP If You’re Confused

Despite the courtroom delay, the outlook from XRP supporters remains bright, underscoring the token’s strong engagement levels and perceived long-term value. As the SEC case moves back into legal deliberations, XRP continues to capture attention not just for its legal drama, but for its unwavering backing by its global community.

Quick Summary

XRP is experiencing a wave of unusually strong optimism across the crypto community, even as Ripple faces continued legal resistance in its battle with the SEC. Despite a recent courtroom development that stalled a proposed settlement, XRP holders and traders show persistent confidence in the asset’s long-term trajectory. On June 26, U.S.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.