XRP investment products saw record institutional inflows in late 2025, contrasting with a weak spot price performance. The divergence suggests a shift from retail to institutional ownership, driven by new XRP ETFs.

What to Know:

- XRP investment products saw record institutional inflows in late 2025, contrasting with a weak spot price performance.

- The divergence suggests a shift from retail to institutional ownership, driven by new XRP ETFs.

- Ripple’s expansion into traditional financial infrastructure may be fueling renewed interest in XRP.

XRP presents a unique situation as 2025 concludes, marked by unprecedented institutional investment juxtaposed with a disappointing price trend. Despite significant inflows into XRP investment products, the token’s spot price has struggled to keep pace. This divergence highlights a potential transition in market dynamics for XRP, favoring long-term institutional strategies over short-term retail speculation.

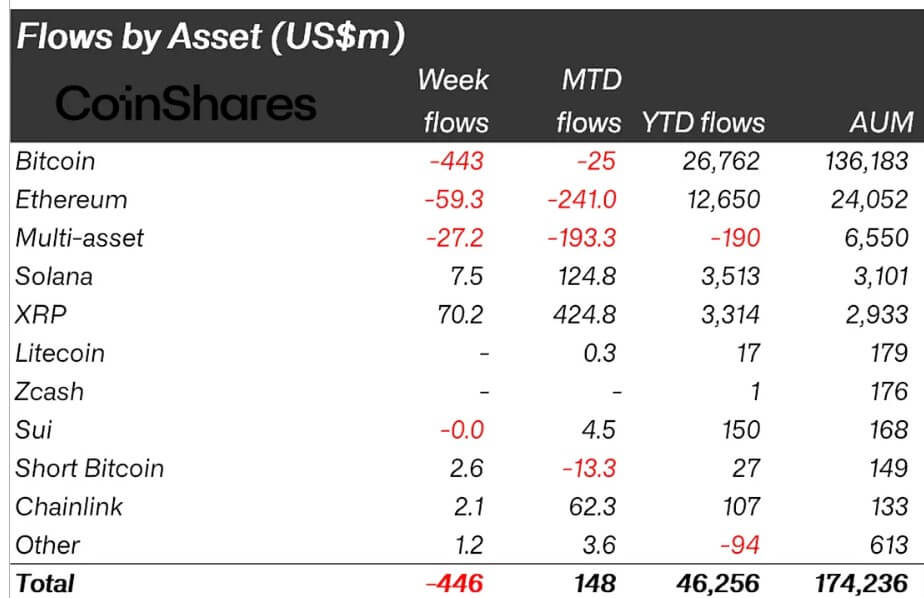

The final trading week of December saw XRP investment products attract approximately $70.2 million, pushing the monthly inflow to over $424 million, making it the top-performing crypto investment product for the month. Conversely, Bitcoin and Ethereum products experienced outflows during the same period.

Since the introduction of US-listed spot XRP ETFs in mid-October, these products have absorbed over $1 billion in net inflows. This consistent demand contrasts with the more volatile flows observed in established crypto ETPs, indicating a different investment approach among XRP buyers.

Ripple’s strategic moves into traditional finance, including acquisitions in prime brokerage and treasury management, may be influencing investment decisions. Some analysts believe these moves position Ripple as a comprehensive provider of digital asset infrastructure for financial institutions.

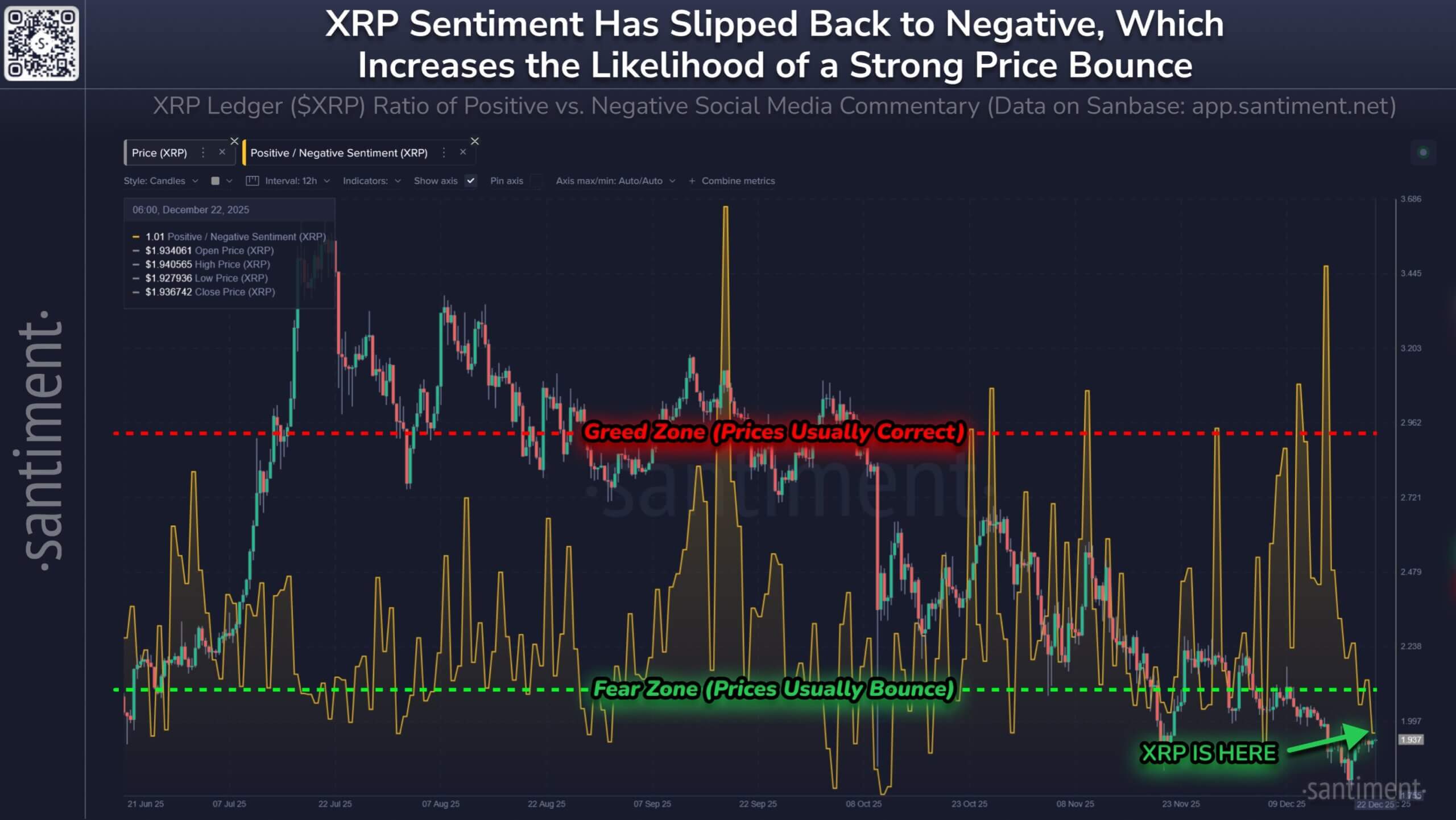

The mechanics of ETF inflows are impacting XRP’s float, reducing the readily available supply on exchanges. This creates a potentially “spring-loaded” market where increased demand could lead to more significant price movements. Sentiment in public forums has also turned negative, potentially setting the stage for a contrarian rebound.

As XRP moves into 2026, the contrast between its trading performance and the allocation of capital into its investment products will be crucial. The token’s future may depend on whether institutional interest and Ripple’s strategic positioning can overcome current market skepticism.

Related: XRP Targets 2026, Bitcoin ETF Flows Show Weakness

Source: Original article

Quick Summary

XRP investment products saw record institutional inflows in late 2025, contrasting with a weak spot price performance. The divergence suggests a shift from retail to institutional ownership, driven by new XRP ETFs. Ripple’s expansion into traditional financial infrastructure may be fueling renewed interest in XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.