Key takeaway #1 — XRP’s onchain market structure mirrors a concerning pattern reminiscent of a setup that led to a significant price drop in 2022. Key takeaway #2 — Spot XRP ETFs experienced substantial outflows of $53.32 million, making it their second outflow day and the largest since their launch.

What to Know:

- Key takeaway #1 — XRP’s onchain market structure mirrors a concerning pattern reminiscent of a setup that led to a significant price drop in 2022.

- Key takeaway #2 — Spot XRP ETFs experienced substantial outflows of $53.32 million, marking their second outflow day and the largest since their launch.

- Key takeaway #3 — XRP bulls must reclaim the $2 level to prevent a deeper correction, potentially targeting $1.10, amid growing psychological pressure on holders.

XRP’s on-chain market structure is raising concerns as it mirrors a setup from February 2022, which preceded a substantial price decline. Data indicates that XRP investors active over shorter time frames are accumulating below the cost basis of longer-term holders, creating a potentially unstable market dynamic. This situation increases the risk of further price corrections for XRP if key support levels are not maintained.

Previous signal preceded 68% XRP price drop

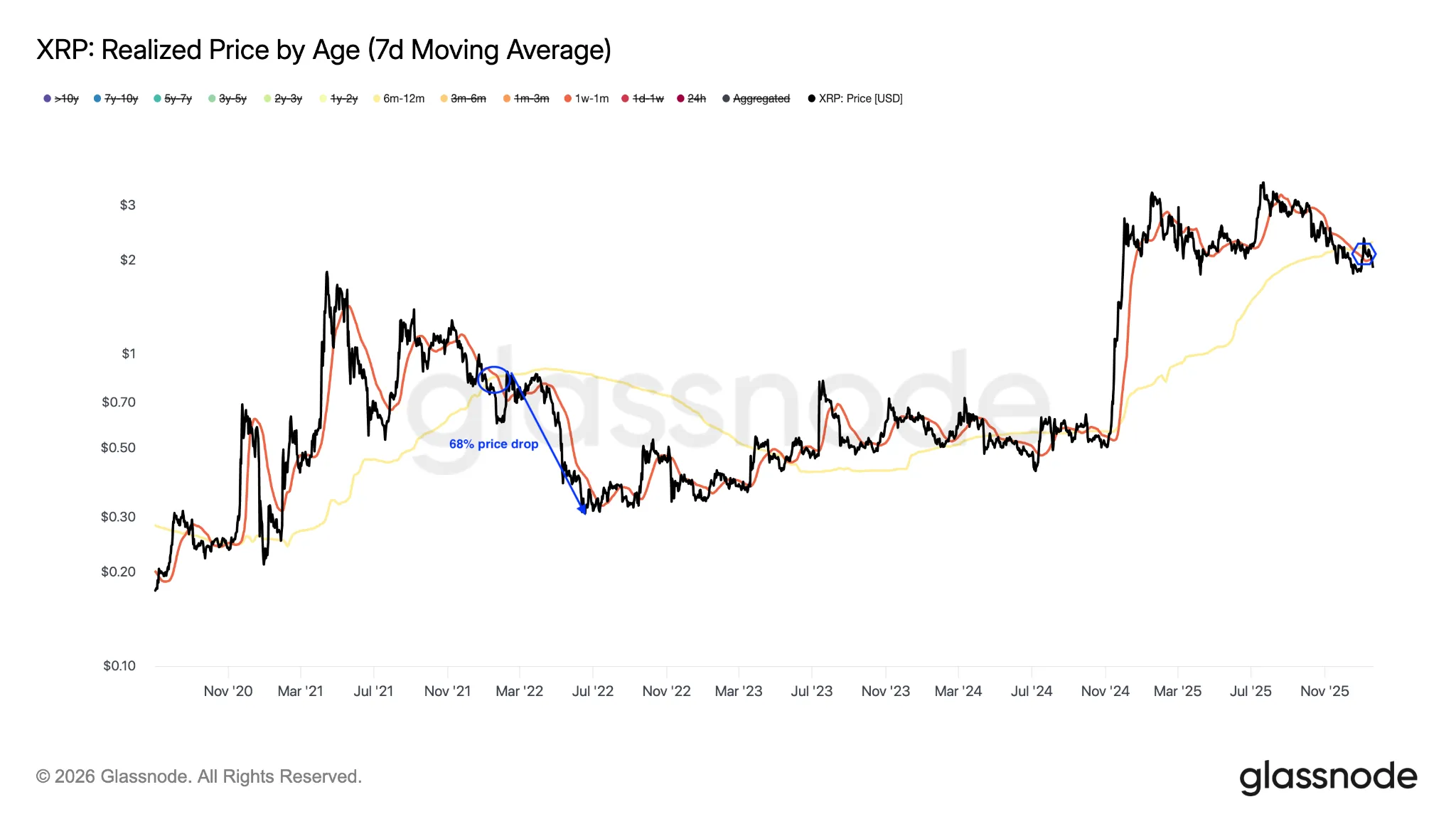

Data from Glassnode suggests a worrying parallel between XRP’s current market structure and that of February 2022, which preceded a significant downturn. According to their analysis, XRP investors active over the 1-week to 1-month window are now accumulating below the cost basis of those holding for 6-12 months.

This dynamic creates a situation where newer buyers are in profit, while mid-term holders face losses, potentially leading to overhead pressure if critical support levels are breached. The presence of this gap can exert psychological pressure on top buyers over time, amplifying the risk of a price correction.

Drawing parallels with February 2022, when XRP traded at $0.78, a similar pattern preceded a 68% drop to $0.30 by June 2022. Should history repeat itself, XRP could potentially fall to as low as $1.40 if the $1.80 to $2 support range fails to hold.

Why is the $2 level a key psychological zone for XRP?

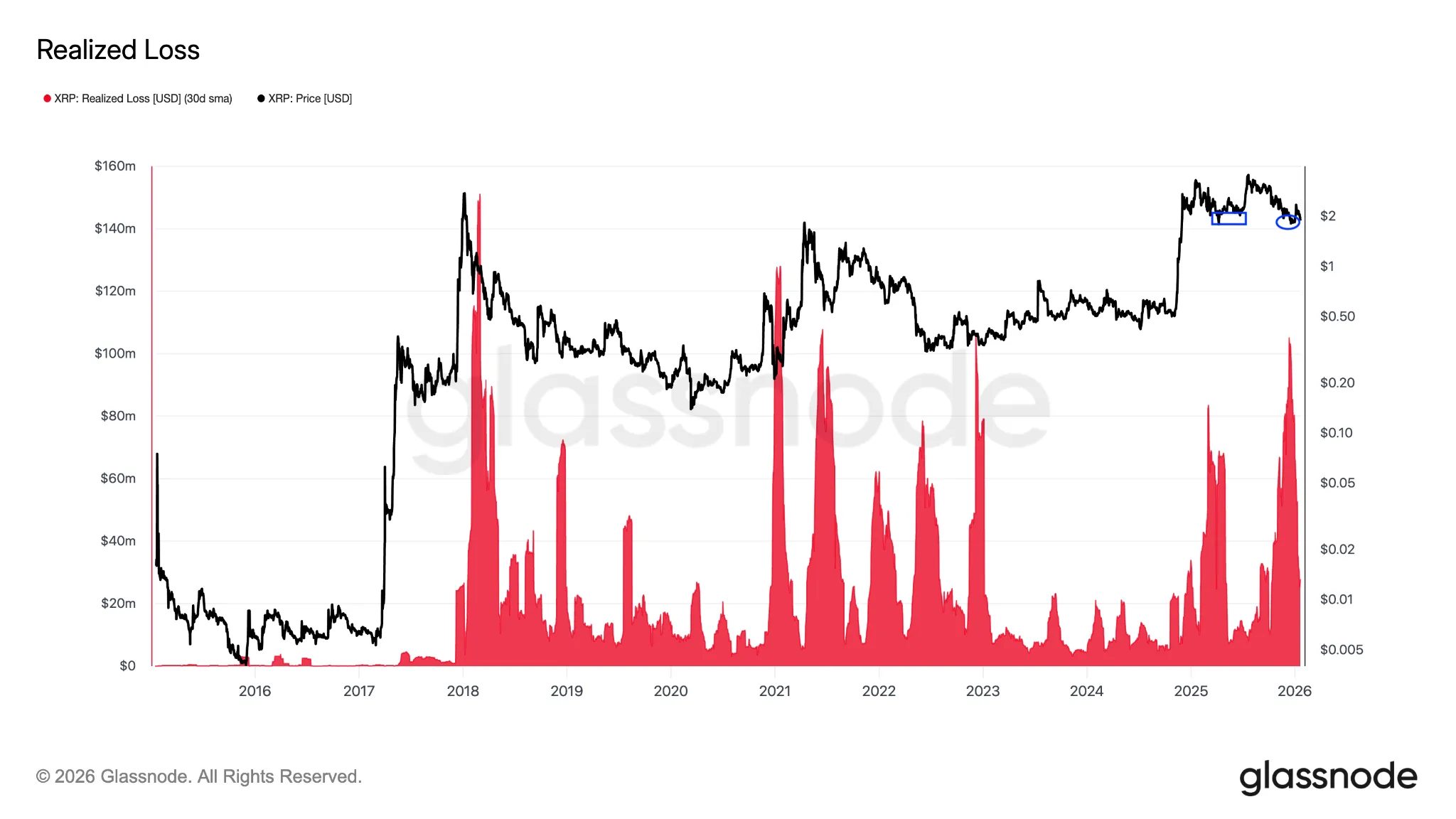

The $2 level holds significant psychological importance for XRP in the short to medium term. Glassnode’s earlier analysis revealed that each retest of this level since early 2025 triggered $500 million to $1.2 billion in weekly realized losses, suggesting that holders chose to exit positions and cut losses at this point.

This behavior underscores the significant influence of the $2 level on investor spending behavior and market sentiment. When the price of XRP dips below this critical threshold, it intensifies pressure on holders who acquired XRP at higher levels, while newer buyers accumulate at lower prices.

A 2022 fractal pattern reinforces the significance of this level, indicating that a failure to reclaim it soon could lead to a deeper price correction. For instance, the $0.55 level served as a crucial support from April 2021 to May 2022, but each subsequent retest weakened it until it eventually broke in May 2022, resulting in a 48% drop to $0.28.

Similarly, if the $2 support level is lost, it could set off a downward spiral, potentially bottoming just below the 200-week moving average at $1.03, reminiscent of the 2022 scenario. The inability to maintain this level may trigger further sell-offs and increase volatility.

XRP ETFs record their second day of outflows

On Tuesday, spot XRP ETFs experienced their second day of outflows since their launch, totaling $53 million, according to data from SoSoValue. This figure surpassed the previous outflow of $40 million recorded on January 7 by $13 million, highlighting a significant shift in institutional sentiment.

These outflows suggest a growing caution among institutional investors or potential profit-taking amid broader crypto market weakness and risk-off sentiment. The substantial outflows from spot XRP ETFs contribute to increased sell-side pressure, potentially exacerbating the downward trend.

The recent ETF flows reflect the broader market’s sensitivity to macroeconomic factors and regulatory developments impacting the XRP Ledger. Monitoring these flows is crucial for gauging institutional sentiment and potential future price movements.

How do derivatives data and funding rates influence XRP’s price?

Derivatives data, including futures and options, provide critical insights into market sentiment and potential volatility for XRP. High funding rates in perpetual futures contracts can indicate an overleveraged market, increasing the risk of sharp price corrections if traders are forced to unwind their positions.

Conversely, negative funding rates may suggest a bearish outlook, where traders are paying to short XRP, potentially setting the stage for a short squeeze if positive news emerges. Analyzing open interest and trading volumes in XRP derivatives markets can reveal the level of speculative activity and potential areas of price instability.

Furthermore, tracking the ratio of long to short positions can provide a gauge of overall market sentiment. Extreme imbalances in either direction may signal potential for a trend reversal or increased volatility, affecting XRP’s price dynamics.

Institutional sentiment and liquidity analysis

Institutional sentiment plays a significant role in the price dynamics of XRP, particularly with the introduction of spot ETFs. Positive sentiment from institutional investors can drive increased demand and liquidity, supporting upward price momentum, while negative sentiment can lead to significant sell-offs.

Liquidity, or the ease with which XRP can be bought or sold without significantly impacting its price, is another critical factor. Higher liquidity typically reduces volatility and enhances market stability, attracting larger investors. Analyzing order book depth and trading volumes across major exchanges can provide insights into XRP’s liquidity profile.

As Cointelegraph reported, XRP’s break below the 50-day simple moving average (SMA) at $2 signals a potential return of bearish momentum, with downside risks extending to $1.25. Monitoring institutional flows and liquidity metrics will be crucial in assessing XRP’s future price trajectory.

The current on-chain structure and ETF outflows highlight potential challenges for XRP, mirroring patterns that previously led to significant price declines. Maintaining the $2 level is crucial to avoid further corrections, as the market navigates broader volatility and shifting institutional sentiment, affecting the future valuation of XRP.

Related: XRP Validator Signals Bullish Sentiment

Source: Original article

Quick Summary

Key takeaway #1 — XRP’s onchain market structure mirrors a concerning pattern reminiscent of a setup that led to a significant price drop in 2022. Key takeaway #2 — Spot XRP ETFs experienced substantial outflows of $53.32 million, marking their second outflow day and the largest since their launch.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.