A crypto trader publicly shared details of a $302,000 profit from a single XRP trade executed in two weeks. The trade was based on a strategy of aligning Bitcoin and XRP breakout patterns. This indicates the importance of market timing and correlation analysis for institutional crypto portfolio managers.

What to Know:

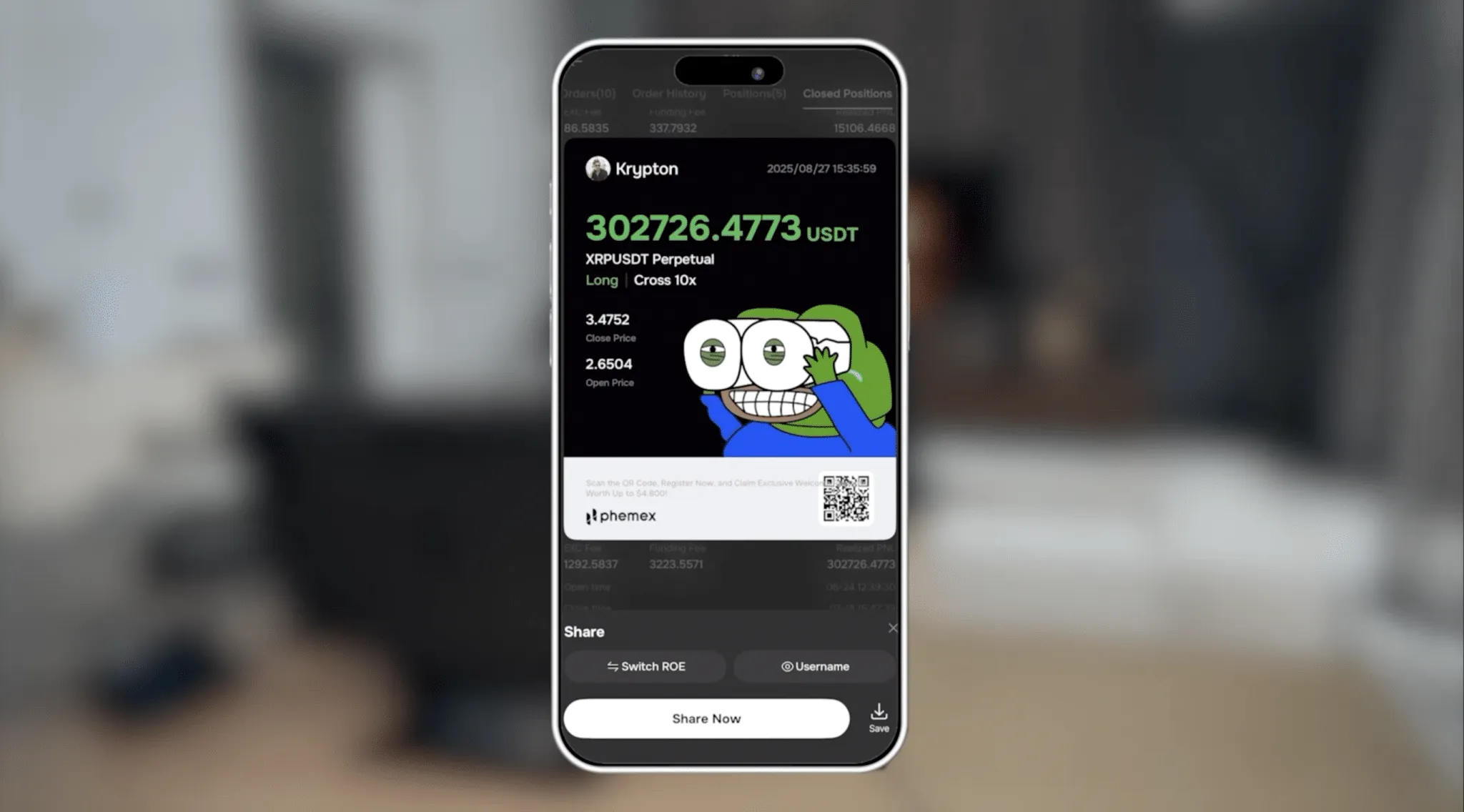

- A crypto trader publicly shared details of a $302,000 profit from a single XRP trade executed in two weeks.

- The trade was based on a strategy of aligning Bitcoin and XRP breakout patterns.

- This highlights the importance of market timing and correlation analysis for institutional crypto portfolio managers.

A veteran crypto trader recently revealed a highly profitable XRP trade, generating substantial returns in a short timeframe. The trader, Cameron Fous, attributed the success to a specific alignment strategy between Bitcoin and XRP. This event underscores the potential for strategic trading in the digital asset space, especially when identifying correlated movements.

The Alignment Strategy

Fous identified a confluence of technical factors that set the stage for the trade. Bitcoin was entering a late-stage bullish pattern, signaling strong upward momentum. Simultaneously, XRP was consolidating below a key resistance level, indicating a potential breakout. This alignment suggested that XRP would likely follow Bitcoin’s upward trajectory once it breached its resistance.

Trade Execution and Profitability

The trader initiated positions in XRP around the $2.60 range, anticipating the breakout. As expected, XRP surged upwards, reaching the mid-$3 range. At this point, signs of weakening momentum prompted the trader to exit the position. The trade yielded a profit of over $300,000 in approximately two weeks, marking it as the trader’s most successful single trade to date. Prudent risk management was evident in the decision to close the position upon observing a failed bullish continuation.

Altcoin Trading Dynamics

Fous emphasized a common pitfall in altcoin trading: entering positions after Bitcoin has already made a significant move. In such scenarios, altcoins often underperform and are more susceptible to sharp corrections. The success of the XRP trade was attributed to the simultaneous breakout potential of both Bitcoin and XRP, a relatively rare but highly lucrative alignment.

Historical Performance and Market Timing

This is not the first time Fous has reported substantial profits from XRP. In 2024, he shared how an initial investment in XRP at $0.20 grew significantly, contributing to a substantial increase in his overall portfolio value. These instances highlight the critical role of market timing in achieving favorable outcomes in the crypto markets. For institutional investors, understanding these dynamics is crucial for optimizing portfolio performance and managing risk.

Implications for Institutional Investors

The reported success of this XRP trade offers several insights for institutional investors. First, it underscores the importance of correlation analysis and identifying potential breakout patterns. Second, it highlights the need for disciplined risk management, including setting clear exit strategies based on market signals. Finally, it reinforces the idea that strategic timing can significantly enhance returns in the digital asset space, even in assets like XRP that have faced regulatory scrutiny.

While past performance is not indicative of future results, this trade provides a valuable case study for understanding market dynamics and strategic decision-making in the crypto markets. For institutional and high-net-worth investors, these insights can inform more sophisticated and potentially profitable trading strategies.

Related: Crypto ETF Flows Show $454M Weekly Outflow

Source: Original article

Quick Summary

A crypto trader publicly shared details of a $302,000 profit from a single XRP trade executed in two weeks. The trade was based on a strategy of aligning Bitcoin and XRP breakout patterns. This highlights the importance of market timing and correlation analysis for institutional crypto portfolio managers.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.