XRP investment products saw substantial inflows amidst a broader downturn in digital asset investments. The overall crypto market experienced significant outflows due to regulatory delays and profit-taking.

What to Know:

- XRP investment products saw substantial inflows amidst a broader downturn in digital asset investments.

- The overall crypto market experienced significant outflows due to regulatory delays and profit-taking.

- XRP’s resilience and positive inflows suggest growing institutional interest and confidence in its market prospects, potentially driven by ETF anticipation.

Digital asset investment products have recently faced a wave of outflows, primarily driven by regulatory disappointments and profit-taking. However, amidst this downturn, XRP-linked investment products have demonstrated remarkable resilience, attracting significant inflows. This divergence highlights the nuanced dynamics within the digital asset space, where specific assets can outperform broader market trends based on unique factors like regulatory developments and ETF prospects. Here’s a deeper look at the recent shifts in crypto investment flows and what they mean for XRP and the institutional landscape.

Ethereum and Bitcoin Funds Experience Outflows

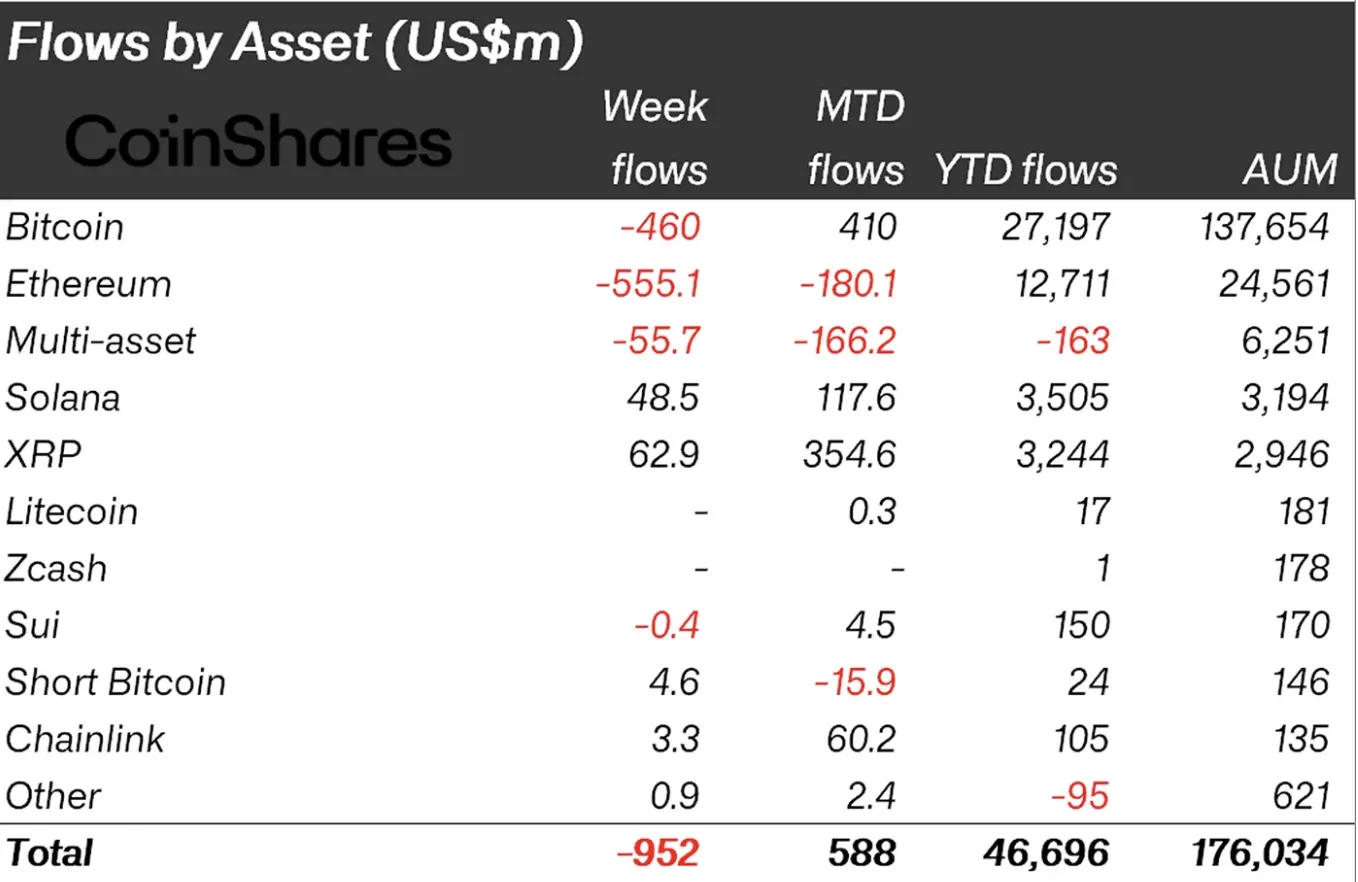

Last week saw a notable shift in digital asset investments, with total outflows reaching $952 million across various crypto investment products. Ethereum bore the brunt of this movement, with outflows totaling $555.1 million, bringing its total assets under management (AUM) down to $24.56 billion. Bitcoin followed suit, experiencing outflows of $460 million. This pullback can be attributed to a combination of factors, including profit-taking after recent rallies and investor apprehension following delays in the Clarifying Lawful Oversight of Restricting Illicit Use of Payments (CLARITY) Act. The anticipated passage of this legislation had fueled optimism, and its delay triggered a reassessment among investors.

XRP Defies the Trend with Substantial Inflows

In stark contrast to the outflows experienced by Bitcoin and Ethereum, XRP investment products attracted $62.9 million in inflows last week. This surge elevated month-to-date flows to $354.6 million, pushing cumulative AUM to $2.94 billion. This performance underscores growing institutional interest in XRP, driven by increasing clarity around its regulatory status and anticipation of potential spot ETFs. Such positive flow data amid a broader market downturn suggests a strong conviction among investors regarding XRP’s long-term prospects.

Spot XRP ETF Momentum

The steady inflows into spot XRP ETFs since November, totaling $1.07 billion, have been a significant catalyst for XRP’s recent performance. The anticipation surrounding these ETFs has created a positive feedback loop, attracting more investment and driving up demand. This dynamic is reminiscent of the early days of Bitcoin ETFs, where similar anticipation led to substantial price appreciation. While regulatory approval for XRP ETFs is not yet guaranteed, the current momentum suggests a growing likelihood, further bolstering investor confidence.

Regional Flow Discrepancies

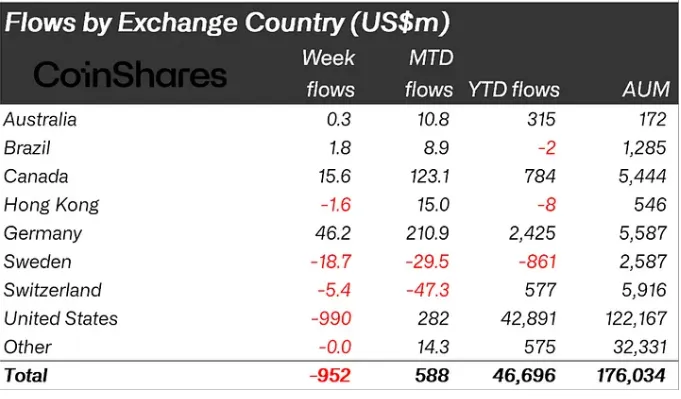

An analysis of regional flows reveals that the United States accounted for the majority of last week’s outflows, totaling $990 million. Sweden, Switzerland, and Hong Kong also saw outflows, albeit on a smaller scale. Conversely, Germany, Canada, and Brazil recorded inflows, indicating varying levels of investor sentiment across different geographies. These discrepancies could be attributed to differences in regulatory environments, local market dynamics, and the availability of investment products.

Broader Implications and Future Outlook

While XRP has shown relative strength, the broader crypto market remains sensitive to regulatory developments and macroeconomic factors. The delay in the CLARITY Act serves as a reminder of the regulatory uncertainties that can impact investor sentiment. However, the positive inflows into XRP suggest that specific assets with favorable regulatory outlooks and strong community support can still thrive. Looking ahead, the potential approval of spot XRP ETFs could unlock further institutional investment, driving additional growth and solidifying XRP’s position in the digital asset landscape.

In conclusion, while the broader crypto market experienced significant outflows, XRP defied the trend with substantial inflows, driven by ETF anticipation and growing regulatory clarity. This divergence underscores the importance of asset-specific factors in navigating the dynamic digital asset space. The coming months will be crucial in determining whether XRP can sustain this momentum and capitalize on its unique position.

Related: XRP Inflows Jump: What Derivatives Data Shows

Source: Original article

Quick Summary

XRP investment products saw substantial inflows amidst a broader downturn in digital asset investments. The overall crypto market experienced significant outflows due to regulatory delays and profit-taking. XRP’s resilience and positive inflows suggest growing institutional interest and confidence in its market prospects, potentially driven by ETF anticipation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.