XRP is exhibiting price behavior similar to historical bullish cycles, maintaining position above its 21-month EMA. This pattern, characterized by consolidation, expansion, and correction phases, has previously led to significant price appreciation.

What to Know:

- XRP is exhibiting price behavior similar to historical bullish cycles, maintaining position above its 21-month EMA.

- This pattern, characterized by consolidation, expansion, and correction phases, has previously led to significant price appreciation.

- Continued adherence to this pattern could signal renewed institutional interest and substantial inflows into XRP.

XRP is showing signs of repeating a historically bullish price pattern, a behavior that has caught the attention of market analysts. This pattern, observed over the past decade, involves distinct phases of consolidation, expansion, and correction. The ability of XRP to hold above its 21-period exponential moving average (EMA) is a critical factor in sustaining this pattern, suggesting potential for future gains if history repeats.

Historical Price Behavior

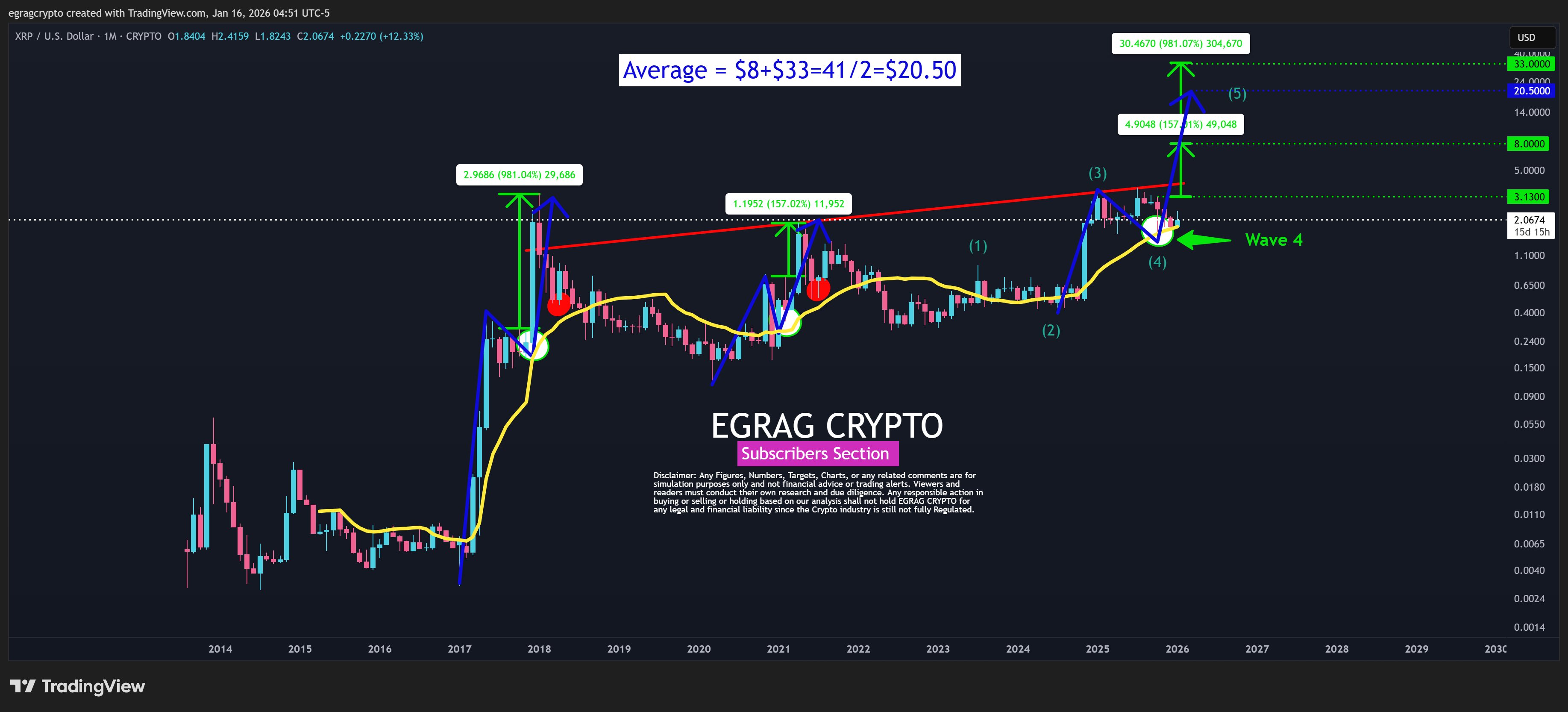

EGRAG Crypto, a chartist, has highlighted this pattern, noting that from 2014 to early 2017, XRP consolidated between $0.004 and $0.29. During this phase, the 21-month EMA remained flat, indicating weak momentum. The consolidation ended in Q2 2017 when XRP broke above the 21 EMA, initiating a strong upward trend. This expansion phase saw XRP peak at around $3.31 in January 2018, a 981% increase. A sharp correction followed, but XRP stabilized above earlier macro lows, maintaining its market structure.

From 2018 through 2020, XRP underwent a corrective phase, repeatedly pulling back toward the rising 21 EMA, which acted as support. After respecting this EMA, XRP launched another impulsive move, reaching approximately $1.96 by April 2021, a 157% increase, followed by another pullback.

Current Pattern and Potential Trajectory

EGRAG suggests that each historical pullback followed a consistent pattern: momentum cooled, structure held, buyers stepped in early, and price formed higher lows, indicative of structural consolidation rather than market weakness. Currently, XRP appears to be mirroring this pattern amid ongoing consolidation.

Elliott Wave Analysis

The analyst interprets XRP’s price action within a 5-wave Elliott Wave structure. Wave (1) began in late 2023, lifting the price from the $0.50 to $0.60 range. Wave (2) followed in early 2024 as a corrective pullback. Wave (3) then played out from late 2024, potentially pushing XRP above $3.4 by January 2025. Currently, XRP is in Wave (4), involving correction and consolidation.

Price Targets and Validation

Currently trading near $2.06, XRP is consolidating above the rising 21-month EMA. This phase resembles previous Wave 4 periods, where the price retraced modestly without breaking the broader trend. If XRP continues to follow this pattern, it could replicate rallies similar to those seen in 2017 and 2021. A replication of the 2017 rise could potentially drive prices to $33, while a repeat of the 2021 upsurge could push the price to $8. Averaging these scenarios, the analyst suggests a target of $20 for XRP.

Risk Considerations

The structural thesis would be invalidated if XRP loses its macro support and decisively breaks below its long-term structure. As of the latest monthly candle, XRP continues to hold above rising structural support, but market participants should remain vigilant. While historical patterns offer insights, they are not guarantees of future performance, and prudent risk management is essential.

Related: XRP Volume Explodes: Korean Exchange Anomaly

Source: Original article

Quick Summary

XRP is exhibiting price behavior similar to historical bullish cycles, maintaining position above its 21-month EMA. This pattern, characterized by consolidation, expansion, and correction phases, has previously led to significant price appreciation. Continued adherence to this pattern could signal renewed institutional interest and substantial inflows into XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.