XRP’s recent price action is mirroring Cardano’s 2022 performance, sparking concerns about a potential further decline. The broader crypto market is currently experiencing a period of uncertainty, with mixed indicates and varying expert opinions.

What to Know:

- XRP’s recent price action is mirroring Cardano’s 2022 performance, sparking concerns about a potential further decline.

- The broader crypto market is currently experiencing a period of uncertainty, with mixed signals and varying expert opinions.

- For institutional investors, this analysis highlights the importance of understanding historical patterns and diverse expert opinions when evaluating XRP’s potential.

XRP is exhibiting signs of instability, prompting analysts to scrutinize its potential future price movements. Amidst the uncertainty, market participants are seeking clarity on XRP’s trajectory. This analysis delves into the factors influencing XRP’s price and explores potential scenarios for institutional and high-net-worth investors.

Market Sentiment and Technical Analysis

Predicting XRP’s next move is proving difficult, with the current market trend being described as a “goblin town situation,” indicative of a persistent downtrend. Despite a recent 1.5% increase to $1.86, XRP has faced a 13.7% retracement over the past month and a significant 49% correction from its July peak of $3.66. These market conditions, while concerning, are not uncommon and often precede decisive market shifts. The current “chop” reflects a period of consolidation before the next major move.

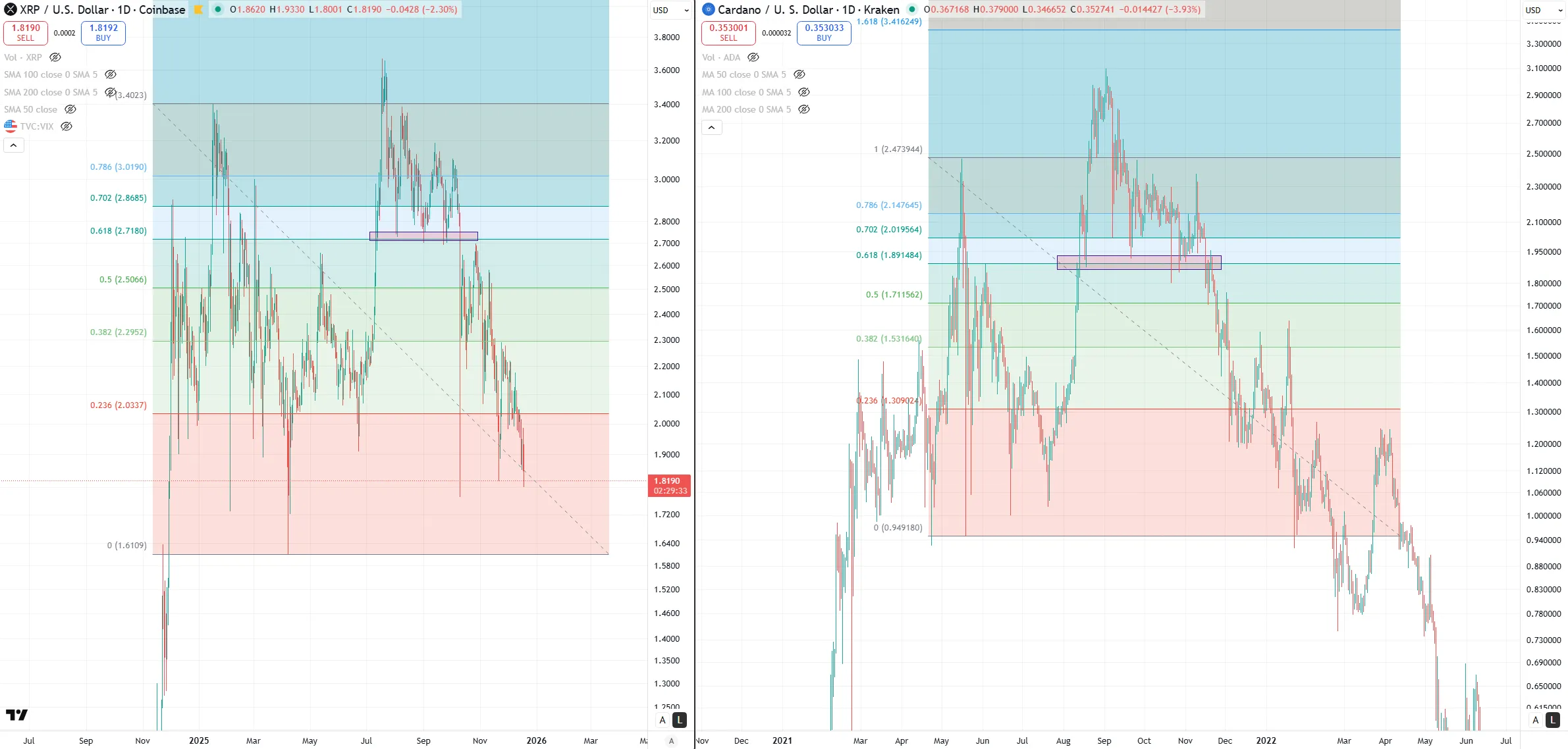

Historical Parallels with Cardano

A comparative analysis reveals striking similarities between XRP’s current price action and Cardano’s performance in 2022. After reaching an all-time high of $3.10 in September 2021, Cardano retested a support level around $1.82. This support level was tested multiple times before ultimately succumbing to bearish momentum in November 2021. Subsequently, Cardano experienced a significant decline, breaking through multiple Fibonacci levels to reach bear market lows of $0.22.

XRP’s Current Trajectory

XRP’s recent behavior mirrors this pattern. Following a breakout from a descending channel in early July, XRP reached a peak of $3.66 before retracing to the $2.72 support level. After three bounces from this demand zone, it broke down in early October, leading to a substantial correction. The asset has now breached the 0.5, 0.382, and 0.236 Fibonacci levels at $2.50, $2.29, and $2.03, respectively. Should this pattern persist, XRP could potentially decline to the next Fibonacci level at $1.61, representing a further 13.4% correction. Investors should monitor these levels closely, considering the potential for increased volatility and the impact on market structure.

Conflicting Price Predictions and Market Uncertainty

Despite the bearish outlook suggested by the Cardano comparison, conflicting price predictions add to the uncertainty. Some analysts suggest that the recent bounce from $1.83 could indicate the end of a breakout retest, with targets set at $3.72, $9, and even $27. These divergent viewpoints highlight the inherent risks in forecasting crypto asset prices. Institutional investors must weigh these competing narratives, considering both technical indicators and broader market sentiment.

Institutional Implications and Risk Management

For institutional investors, the current market dynamics underscore the importance of robust risk management strategies. The potential for further downside, as suggested by the Cardano parallel, necessitates careful portfolio allocation and hedging strategies. Conversely, the possibility of a bullish reversal, as posited by some analysts, warrants consideration of strategic entry points. A balanced approach, incorporating both technical analysis and fundamental research, is crucial for navigating the current market environment. Understanding the nuances of XRP’s market structure, liquidity, and regulatory posture is paramount for making informed investment decisions.

In conclusion, XRP’s price trajectory remains uncertain, with conflicting signals from technical analysis and expert opinions. The comparison to Cardano’s 2022 performance raises concerns about potential further declines, while other analysts foresee a bullish reversal. Institutional investors must carefully assess these competing narratives, employing robust risk management strategies to navigate the current market volatility. Ultimately, a balanced approach, combining technical analysis, fundamental research, and a thorough understanding of market dynamics, is essential for making informed investment decisions in the XRP market.

Related: XRP Buy Signal: Analyst Turns Bullish

Source: Original article

Quick Summary

XRP’s recent price action is mirroring Cardano’s 2022 performance, sparking concerns about a potential further decline. The broader crypto market is currently experiencing a period of uncertainty, with mixed signals and varying expert opinions.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.