XRP is showing resilience against Bitcoin as February concludes, avoiding a significant breakdown. Vitalik Buterin continues strategic ETH sales to support philanthropic causes, minimizing market impact. Shiba Inu is closing in on PayPal USD’s market cap, potentially signaling a shift towards speculative assets.

What to Know:

- XRP is showing resilience against Bitcoin as February concludes, avoiding a significant breakdown.

- Vitalik Buterin continues strategic ETH sales to support philanthropic causes, minimizing market impact.

- Shiba Inu is closing in on PayPal USD’s market cap, potentially signaling a shift towards speculative assets.

As February draws to a close, the cryptocurrency market is presenting a mixed bag of signals, with XRP’s performance against Bitcoin, Vitalik Buterin’s continued ETH distributions, and Shiba Inu’s potential market cap overtake of PayPal USD all capturing investor attention. These developments offer insights into market sentiment, liquidity flows, and the evolving landscape of digital asset valuations. Institutional investors are closely monitoring these trends to gauge risk appetite and identify potential opportunities in a dynamic market environment.

XRP’s Fight to Hold Ground

XRP has been closely watched as it teetered on the edge of a multi-year low against Bitcoin. The fact that it managed to close the month above the critical 0.00002 BTC level is a testament to its underlying resilience. This level represents a key support area, and a break below it could have triggered a significant sell-off. The ability of XRP to defend this level suggests that there is still demand for the asset, even amidst broader market uncertainty. This dynamic is similar to other instances in crypto history where a large cap coin holds a key level despite negative sentiment.

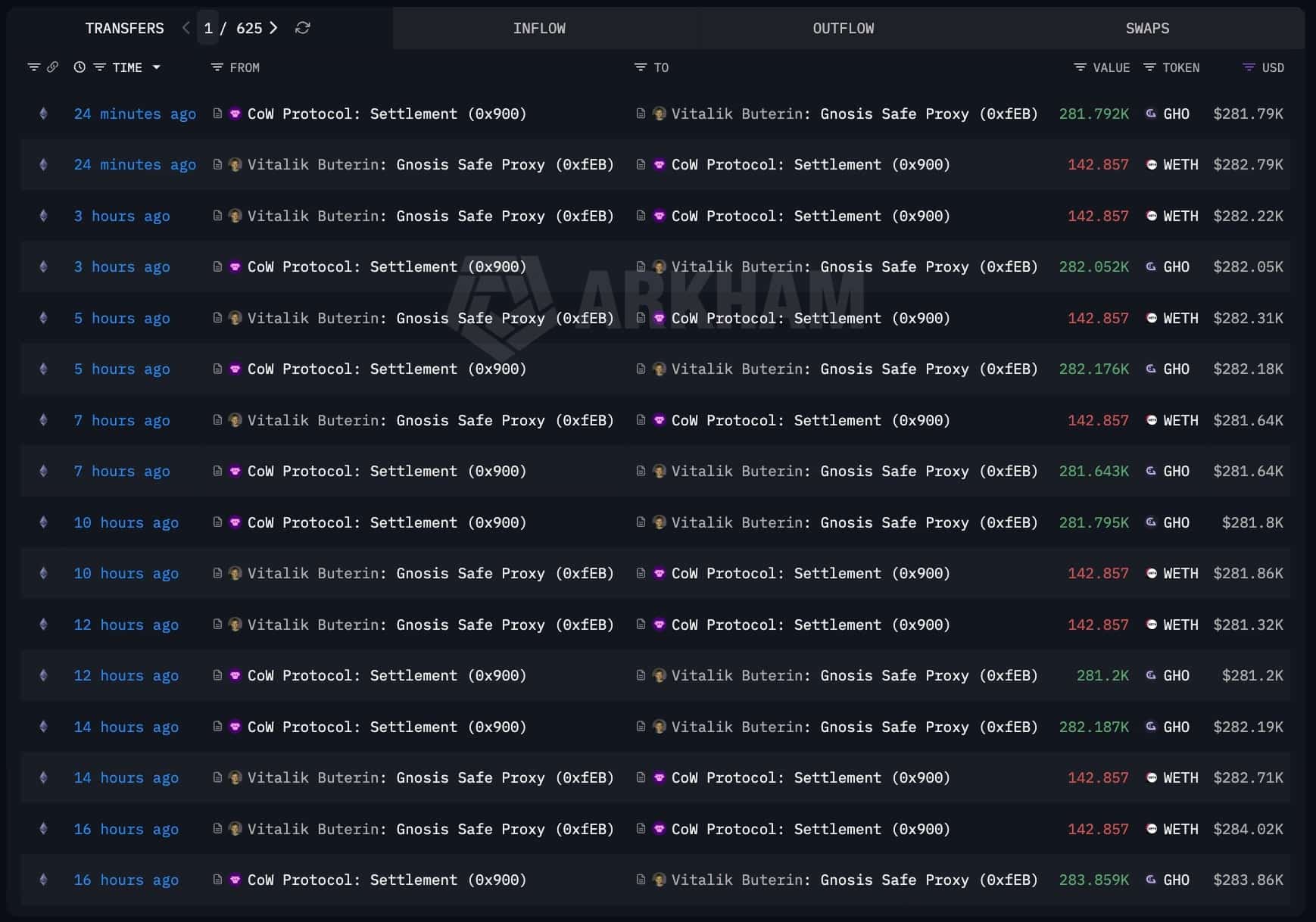

Buterin’s Calculated Philanthropy

Vitalik Buterin’s ongoing sales of ETH to fund philanthropic endeavors highlights a unique aspect of the crypto market – the ability to directly translate digital assets into real-world impact. What’s particularly noteworthy is the strategic approach Buterin is taking, utilizing decentralized exchanges and batch auctions to minimize the impact on ETH’s price. This sophisticated approach to distribution reflects a growing maturity in the market, where large holders are becoming more conscious of their influence on liquidity and price discovery. By using CoW Swap and Aave, Buterin is setting a new standard for responsible asset management within the crypto space.

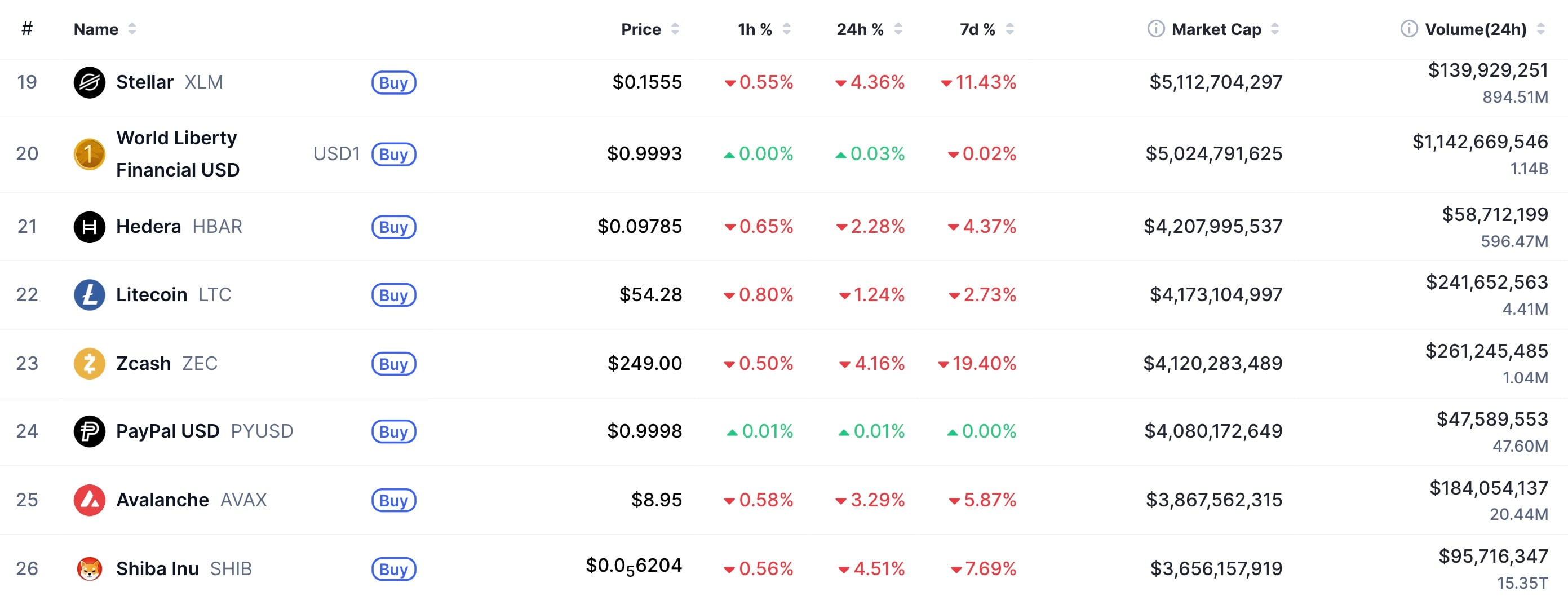

SHIB vs. PYUSD: A Symbolic Showdown

The potential for Shiba Inu to surpass PayPal USD in market capitalization is more than just a numerical milestone; it represents a symbolic shift in market sentiment. PYUSD, as a stablecoin backed by a traditional financial institution, embodies stability and institutional adoption. SHIB, on the other hand, represents the speculative and community-driven side of the crypto market. If SHIB were to overtake PYUSD, it would signal a renewed appetite for risk and a resurgence of retail interest in the meme coin sector. This dynamic is reminiscent of the 2021 bull run, where meme coins often led the charge, capturing the imagination of investors and driving significant inflows into the market.

Key Levels and Market Outlook

As we approach the end of February, it’s crucial to focus on key support and resistance levels for these assets. For XRP, maintaining the 0.0000205 level against Bitcoin is critical to avoid further downside. Ethereum needs to hold the $1,900-$2,100 range despite Buterin’s distributions to maintain bullish momentum. For Shiba Inu, the $4 billion market cap mark is the key level to watch, as a break above this could trigger a significant rally. These levels provide a framework for assessing risk and identifying potential entry and exit points.

Derivatives Positioning and ETF Impact

An important consideration for institutional investors is the derivatives positioning in these assets. Open interest in XRP, ETH and SHIB futures can provide insights into market sentiment and potential for leveraged liquidations. Additionally, the launch of spot Bitcoin ETFs has had a ripple effect on the broader market, impacting liquidity and price discovery across various altcoins. The ETF inflows have primarily benefited Bitcoin, but a portion of these funds may eventually rotate into other digital assets, potentially providing a boost to XRP, ETH, and SHIB.

In conclusion, the developments surrounding XRP, ETH, and SHIB offer a snapshot of the current state of the cryptocurrency market. While XRP is showing resilience, Ethereum continues to be used for social good, and Shiba Inu is vying for a symbolic victory. These trends, combined with broader market factors such as derivatives positioning and ETF inflows, provide a nuanced picture for institutional investors navigating the digital asset landscape.

Related: XRP Price Tumbles as ETF Demand Signals Drop

Source: Original article

Quick Summary

XRP is showing resilience against Bitcoin as February concludes, avoiding a significant breakdown. Vitalik Buterin continues strategic ETH sales to support philanthropic causes, minimizing market impact. Shiba Inu is closing in on PayPal USD’s market cap, potentially signaling a shift towards speculative assets.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.