John Bollinger sees XRP following Bitcoin’s bullish pattern, albeit with less strength. Bollinger’s analysis uses Bollinger Bands to identify bases, squeezes, and breakouts, indicating potential price movements.

What to Know:

- John Bollinger sees XRP following Bitcoin’s bullish pattern, albeit with less strength.

- Bollinger’s analysis uses Bollinger Bands to identify bases, squeezes, and breakouts, indicating potential price movements.

- While XRP’s breakout lags Bitcoin’s, the analysis suggests continued bullish momentum for XRP.

Veteran market technician John Bollinger, famous for inventing Bollinger Bands, has weighed in on XRP’s price action. His analysis suggests XRP is mirroring Bitcoin’s bullish pattern. However, he cautions that XRP’s pattern is currently weaker than what he’s observed in Bitcoin and Ethereum.

Bollinger’s Bitcoin Base Case

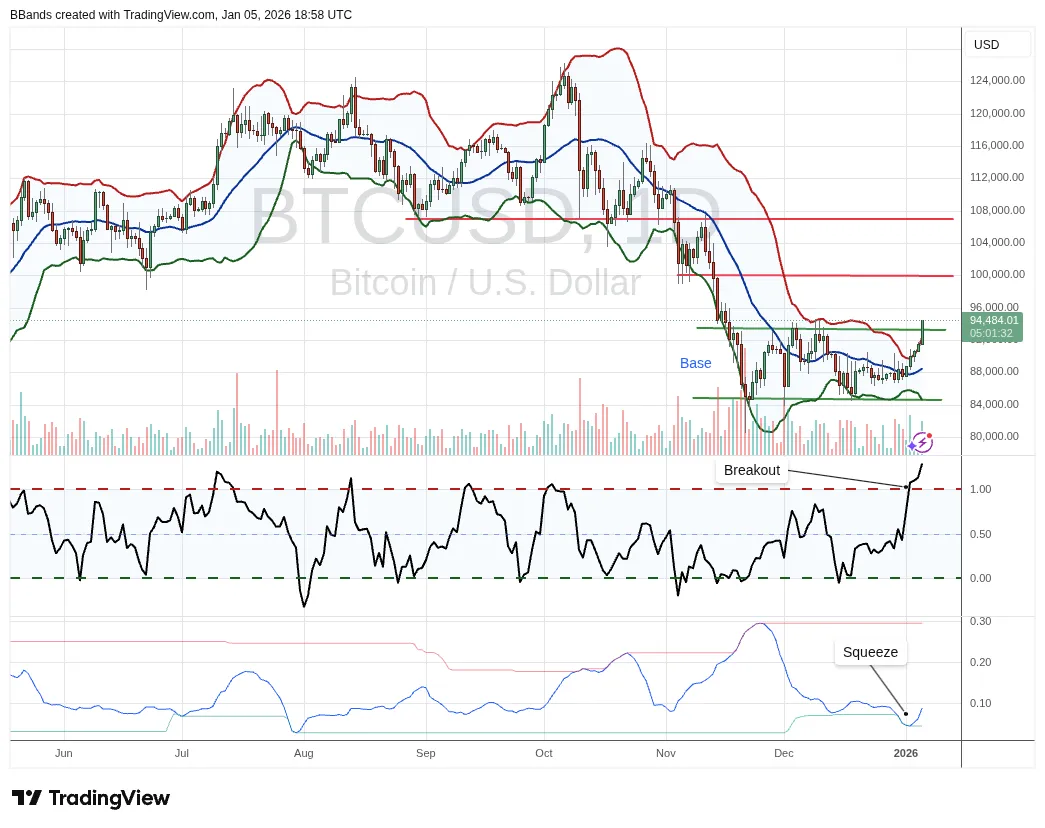

Earlier this month, Bollinger highlighted what he considered a “near perfect” base formation for Bitcoin. He leveraged the Bollinger Band squeeze and subsequent breakout to illustrate the bullish setup, implying further gains ahead for the leading cryptocurrency. According to his analysis, Bitcoin established a solid base within the Bollinger Bands around the $85,000 level. Even after a brief dip to $80,620 in late November, Bitcoin quickly recovered, maintaining its position above $85,000. This support level effectively cushioned Bitcoin during its consolidation phase.

XRP Follows the Pattern, But Lags

Bollinger’s recent commentary indicates that XRP is tracing a similar path to Bitcoin, but with less intensity. This observation comes even after XRP’s recent surge, which saw it outperform Bitcoin, Ethereum, and most other top-tier crypto assets. While XRP has gained 12% in the last 24 hours and 28% over the past week, outpacing Bitcoin’s 1.3% and 7% gains and Ethereum’s 2% and 9.5% respectively, Bollinger suggests its breakout isn’t as pronounced as Bitcoin’s.

Broader Market Context

It’s worth noting that Bollinger also mentioned Ethereum exhibiting a similar, albeit delayed, pattern. At the time of his analysis, Ether had yet to surpass its December 2025 high of $3,445. This comparison to both Bitcoin and Ethereum provides a broader context for understanding XRP’s current market position and potential trajectory. The relative strength of Bitcoin compared to altcoins could signal continued capital rotation into BTC as institutions gain exposure.

Targets and Sentiment

Despite noting XRP’s relative weakness compared to Bitcoin, Bollinger didn’t dismiss the possibility of continued bullish momentum. Given his forecast for further upside in Bitcoin, it’s reasonable to assume that XRP could benefit from this overall positive trend. Interestingly, the $8 price target for XRP has been a recurring theme among analysts. Standard Chartered, for instance, projects this level by the end of 2026, and other analysts share similar targets. Whether these targets are achievable remains to be seen, but they reflect a generally optimistic outlook for XRP’s long-term potential.

Derivatives Positioning and Market Structure

Institutional investors often look at derivatives positioning to gauge sentiment and potential market movements. XRP’s derivatives market, while less mature than Bitcoin’s, can still offer insights into how traders are positioning themselves. Additionally, the market structure of XRP, including liquidity across various exchanges and trading pairs, plays a crucial role in its price discovery and volatility. Improved liquidity and deeper order books can contribute to more stable and efficient price action.

Regulatory Landscape and Ripple’s Role

The regulatory landscape surrounding XRP and Ripple continues to be a key factor influencing investor sentiment. Clarity on XRP’s regulatory status could unlock further institutional adoption and investment. Ripple’s ongoing efforts to expand its enterprise solutions and partnerships also contribute to the long-term value proposition of XRP. As Ripple continues to develop its ecosystem and navigate the regulatory environment, XRP’s potential for growth remains significant.

In conclusion, John Bollinger’s analysis offers a nuanced perspective on XRP’s current market position. While XRP may be lagging Bitcoin in terms of bullish momentum, the overall pattern suggests potential for further gains. As always, investors should conduct their own due diligence and consider the various factors influencing the crypto market before making any investment decisions.

Related: Crypto Signals: Bitcoin (BTC) Buy Window

Source: Original article

Quick Summary

John Bollinger sees XRP following Bitcoin’s bullish pattern, albeit with less strength. Bollinger’s analysis uses Bollinger Bands to identify bases, squeezes, and breakouts, indicating potential price movements. While XRP’s breakout lags Bitcoin’s, the analysis suggests continued bullish momentum for XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.