Institutional interest in XRP is surging, driven by ETF inflows and shrinking exchange supply. On-chain activity on the XRP Ledger (XRPL) is declining, raising concerns about the decoupling of financial demand and network utility.

What to Know:

- Institutional interest in XRP is surging, driven by ETF inflows and shrinking exchange supply.

- On-chain activity on the XRP Ledger (XRPL) is declining, raising concerns about the decoupling of financial demand and network utility.

- The future of XRP hinges on bridging the gap between institutional investment and the revitalization of its native ecosystem.

The XRP market in early 2026 presents a bifurcated reality, with institutional enthusiasm contrasting sharply with on-chain metrics. Spot XRP ETFs are attracting significant capital, while activity on the XRP Ledger (XRPL) lags, creating a complex investment landscape. This divergence between financial demand and network utility defines the key narrative for XRP in 2026.

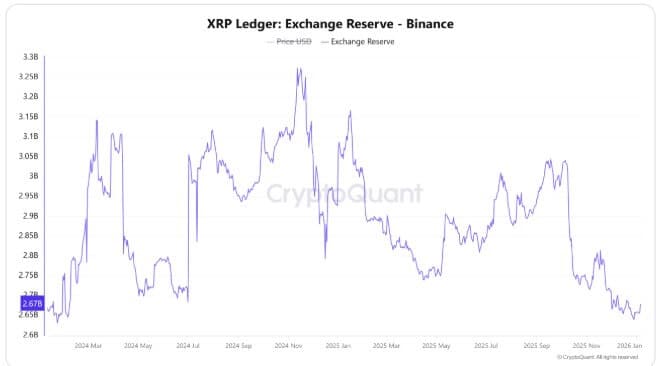

The bull case for XRP is primarily driven by its structural dynamics. The introduction of spot ETFs has absorbed a substantial amount of circulating supply, effectively creating a regulated vacuum that signals new money entering the market. Data indicates a significant decrease in XRP holdings on exchanges like Binance, suggesting investors are moving assets into long-term storage.

Furthermore, Ripple is expanding its institutional presence globally. In the UK, Ripple is solidifying its operational footprint amidst improving regulatory clarity, while in Japan, initiatives are underway to support compliant solutions on the XRPL. Ripple-backed Evernorth Holdings’ collaboration with Doppler Finance aims to enhance treasury management and institutional liquidity on the XRPL, targeting traditional finance infrastructure.

However, the bear case stems from the weakening demand profile for the XRPL network itself. The ETF complex experienced net outflows in early January, indicating that ETF demand is not a guaranteed, permanent bid. The dominance of derivatives over spot markets further exacerbates the risk, making XRP vulnerable to leveraged liquidations rather than organic adoption.

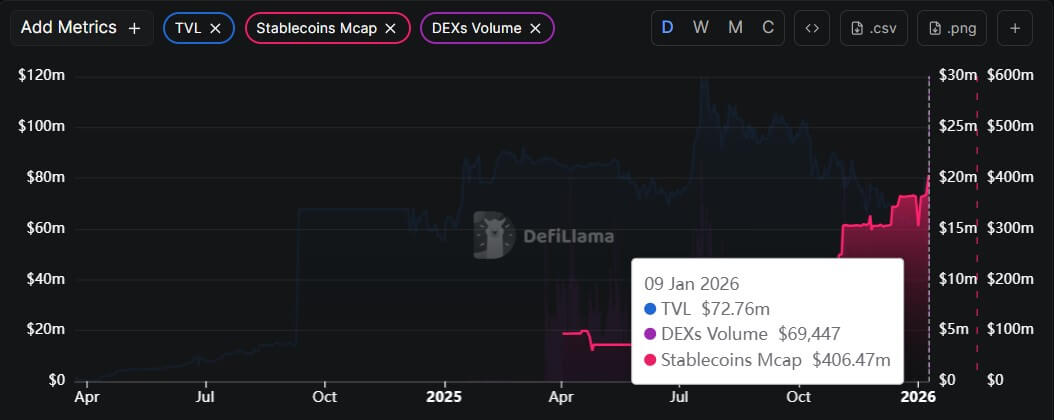

On-chain metrics highlight the network’s struggles. The Total Value Locked (TVL) on the XRPL remains low compared to other high-throughput chains, and the network generates minimal fees. Usage metrics, including decentralized exchange (DEX) volumes and active traders, are also declining, indicating a lack of engagement with the XRPL ecosystem.

In conclusion, the future trajectory of XRP hinges on bridging the gap between institutional investment and on-chain utility. If initiatives such as RLUSD adoption and strategic partnerships can successfully drive liquidity back onto the XRPL, the network could validate its valuation through increased fundamental activity. Conversely, if the institutional “wrapper” trade continues to thrive without corresponding growth in the XRPL ecosystem, XRP risks becoming a purely speculative asset disconnected from its underlying technology.

Related: XRP License Signals UK Expansion

Source: Original article

Quick Summary

Institutional interest in XRP is surging, driven by ETF inflows and shrinking exchange supply. On-chain activity on the XRP Ledger (XRPL) is declining, raising concerns about the decoupling of financial demand and network utility.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.