XRP has recorded four consecutive red monthly candles, a pattern last seen nearly eight years ago. Historical data suggests a potential reversal, with a 70% chance of closing February higher.

What to Know:

- XRP has recorded four consecutive red monthly candles, a pattern last seen nearly eight years ago.

- Historical data suggests a potential reversal, with a 70% chance of closing February higher.

- This pattern matters for institutional investors as it highlights potential accumulation phases and shifts in market momentum for XRP.

XRP is at a potential inflection point, having posted four consecutive months of negative returns, a trend unseen since 2017. This rare occurrence has caught the eye of seasoned market participants who closely monitor historical patterns for clues about future price movements. The question now is whether history will repeat itself, setting the stage for a relief rally.

Rare Pattern Not Seen Since 2017

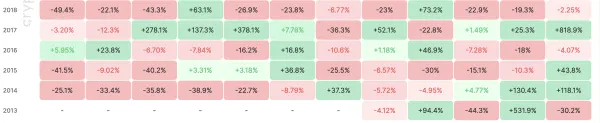

An XRPL developer pointed out XRP’s fourth consecutive monthly negative close on X, noting that XRP has not printed five red monthly candles in a row since 2017. Over the past eight years, similar conditions have consistently led to a green monthly close.

Drawing on past data, the developer estimates the probability of XRP closing a fifth straight red month at roughly 30%, implying a 70% chance that February breaks the streak and finishes higher.

History Favors XRP Bounce, Not More Selling

Previous market cycles indicate that extended monthly weakness in XRP often signals seller exhaustion. Historically, after three or four consecutive months of losses, the following month often turns positive.

For example, in 2022, XRP closed April, May, and June with losses ranging from 21% to 28.4%, then posted 14.6% gains in July. Later that year, it recorded losses from October to December and posted 20% gains in January 2023.

In 2018, XRP posted losses of 26.9%, 23.8%, 6.77%, and 23% from May to August. By September, it surged 73%. The trend repeated later that year, with losses from October to January, followed by a 1.13% gain in February 2019.

The monthly chart highlights how extended red streaks have often aligned with accumulation phases preceding a relief rally.

Market Context Still Matters

While historical probabilities lean bullish, broader market conditions remain a key factor. Bitcoin’s direction, overall crypto sentiment, and liquidity trends could influence whether XRP follows its historical pattern or deviates from it.

Moreover, in 2015 and 2014, XRP recorded streaks of five and six consecutive monthly losses, respectively, before gains of 43.8% and 37.3%. This suggests that while there is optimism for a rebound in February, XRP’s price could still close the month in red.

Still, the rarity of the current setup has drawn attention from traders who view February as a pivotal month for XRP’s medium-term direction.

Institutional Implications

For institutional investors, these historical patterns offer potential insights into XRP’s market behavior. Understanding these cycles can inform strategic accumulation and trading decisions, particularly when considering the asset’s long-term potential within a diversified portfolio. However, it’s crucial to balance historical analysis with current market dynamics and risk management strategies.

For now, history suggests the odds favor a break in the losing streak and a potential shift in momentum for XRP. The coin is currently trading at $1.60, attempting to recover from the latest dip.

Related: Bitcoin Signals Relief Rally After Weekend Selloff

Source: Original article

Quick Summary

XRP has recorded four consecutive red monthly candles, a pattern last seen nearly eight years ago. Historical data suggests a potential reversal, with a 70% chance of closing February higher. This pattern matters for institutional investors as it highlights potential accumulation phases and shifts in market momentum for XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.