Key takeaway #1 — XRP’s technical and onchain indicates hint at a bullish breakout, with analysts eyeing a rally toward $2.80 by the month’s end. Key takeaway #2 summarizing major data from spot taker CVD and bull flag patterns.

What to Know:

- Key takeaway #1 — XRP’s technical and onchain signals hint at a bullish breakout, with analysts eyeing a rally toward $2.80 by the month’s end.

- Key takeaway #2 summarizing major data from spot taker CVD and bull flag patterns.

- Key takeaway #3 explaining trader confidence and potential for a 32.5% price increase.

XRP is showing strong potential for a bullish breakout, with multiple technical indicators suggesting a significant rally. Technical analysis and on-chain data point to a possible price target of $2.80 by the end of the month. The convergence of these signals indicates growing confidence among traders and the potential for substantial gains.

XRP Falling Wedge Breakout Targets $2.70

The XRP/USD pair broke out of a falling wedge pattern on Jan. 1, as shown on the two-day chart. A falling wedge is a classic bullish setup characterized by two downward-sloping, converging trendlines, showing decreasing selling momentum and volume. It often leads to an upside breakout as sellers get exhausted and buyers take control.

The altcoin needs to hold above the support at $2 to increase its chances of a return toward $2.40. Overcoming this resistance would open the way for a run toward the bullish target of the prevailing chart pattern at $2.70. Trader CryptoWIZRD noted that the last time this happened was in Q4/2025 when the price “exploded” 486%.

XRP Bull Flag Targets $2.80

The eight-hour chart shows XRP price trading with a bull flag, with the price facing resistance from the pattern’s upper trendline at $2.15. A bull flag is a continuation pattern that forms after a strong upward move. It suggests that the price will likely continue to rise after a brief consolidation period.

An eight-hour candlestick close above this area will clear the path for XRP’s rise toward the top of the flag’s post at $2.41 and later to the measured target of the prevailing chart pattern at $2.80. Such a move would represent a 32.5% increase from the current price. The relative strength index has increased, suggesting growing bullish momentum.

What Is the Significance of Spot Taker CVD?

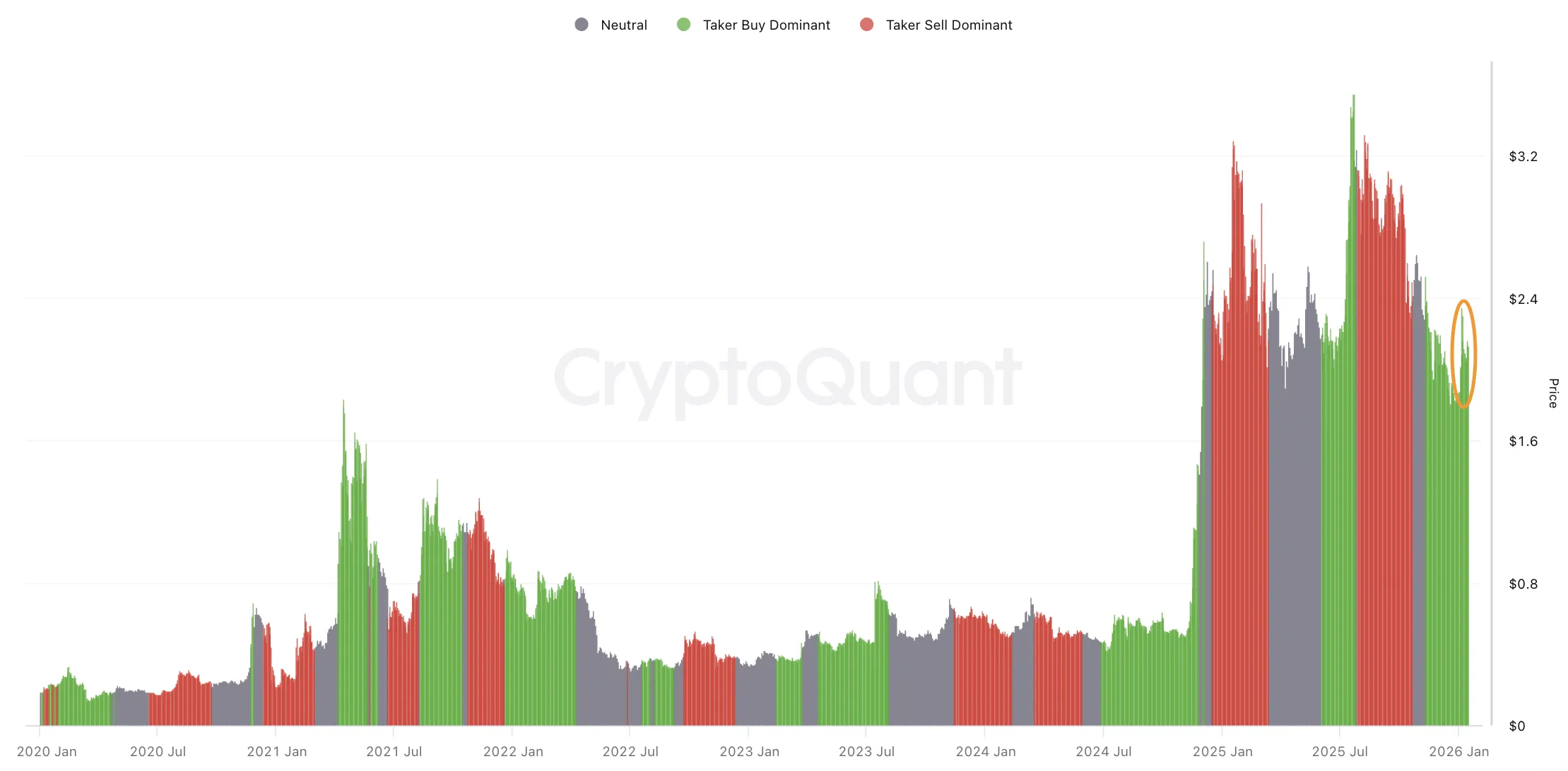

The 90-day Spot Taker Cumulative Volume Delta (CVD), a metric showing the balance of buyers and sellers, reveals that buy-orders (taker buy) have become dominant again. Spot taker CVD is an on-chain metric that reflects the eagerness of buyers to acquire an asset at the current market price. A rising CVD indicates strong buying pressure.

CryptoQuant data shows that the demand-side pressure has dominated the order book since November 2025, with the XRP/USD pair rising 16% in 2026 so far. This indicates that more traders are buying XRP at the market price, rather than waiting for cheaper bids, demonstrating growing confidence in higher prices ahead. The last time XRP saw a similar surge in spot CVD was in July 2025, preceding a 65% price rally within weeks.

How Do Derivatives Data and Funding Rates Influence XRP?

Derivatives data, including funding rates and open interest, can provide insights into market sentiment and potential price movements for XRP. Positive funding rates suggest that long positions are dominant, indicating bullish sentiment. High open interest can amplify price volatility, as large positions may lead to significant liquidations during market swings.

Monitoring these metrics helps traders gauge the overall market positioning and potential risks associated with XRP. Institutional sentiment, as reflected in derivatives data, can influence market liquidity and price stability. Analyzing these factors in conjunction with technical and on-chain data offers a comprehensive view of XRP’s market dynamics.

What Role Does the XRP Ledger Play?

The XRP Ledger is a decentralized cryptographic ledger powered by a network of peer-to-peer servers. It underpins XRP and facilitates fast, low-cost transactions. Its efficiency and scalability make it attractive for various applications, including cross-border payments and tokenization. The XRP Ledger’s technological capabilities influence the utility and adoption of XRP.

Developments and upgrades to the XRP Ledger can enhance its performance and attract more users and developers, potentially driving demand for XRP. Monitoring the activity and innovations within the XRP Ledger ecosystem provides insights into the long-term prospects and value proposition of XRP. Increased institutional interest in leveraging the XRP Ledger can also positively impact XRP’s market performance.

Technical and on-chain signals suggest a bullish outlook for XRP, potentially driving its price toward $2.80. The convergence of falling wedge breakouts, bull flag patterns, and positive spot taker CVD indicates strong buyer confidence and upward momentum for XRP.

Related: XRP ETF Flows Show Largest Volume Increase

Source: Original article

Quick Summary

Key takeaway #1 — XRP’s technical and onchain signals hint at a bullish breakout, with analysts eyeing a rally toward $2.80 by the month’s end. Key takeaway #2 summarizing major data from spot taker CVD and bull flag patterns.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.