XRP bucked the trend of crypto outflows, posting significant inflows while Bitcoin saw heavy withdrawals. Overall crypto outflows slowed, suggesting a potential stabilization in investor sentiment despite recent market downturns.

What to Know:

- XRP bucked the trend of crypto outflows, posting significant inflows while Bitcoin saw heavy withdrawals.

- Overall crypto outflows slowed, suggesting a potential stabilization in investor sentiment despite recent market downturns.

- XRP’s strong performance highlights institutional interest and relative resilience, contrasting with the broader market’s struggles and making it a standout asset.

Last week’s crypto markets presented a mixed bag for institutional investors. While Bitcoin and other crypto assets experienced substantial outflows, XRP emerged as a notable exception, attracting fresh capital even amid broader market pressures. This divergence underscores the nuanced dynamics at play and warrants a closer look at the factors driving XRP’s outperformance.

Outflows Decelerate, Market Stabilizing?

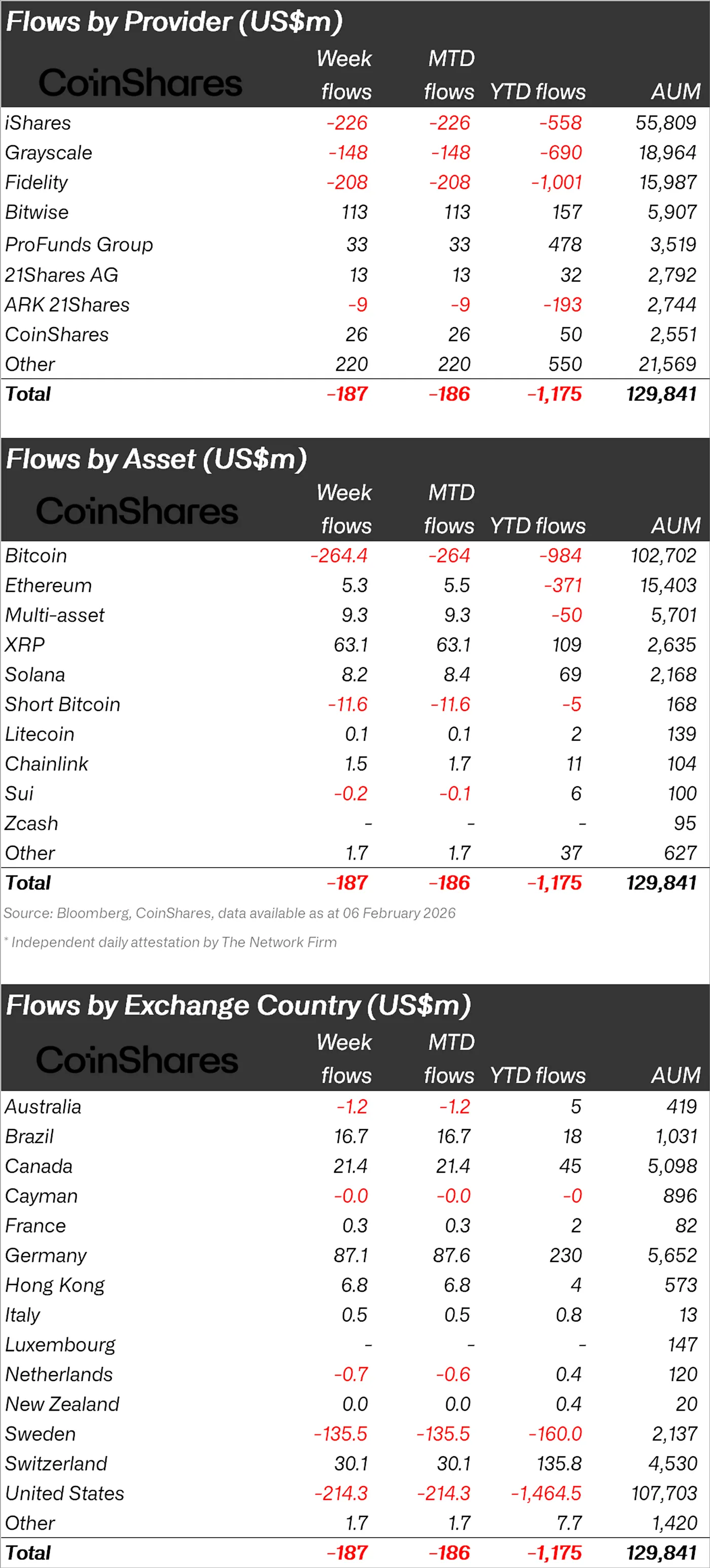

The headline figure of $187 million in cumulative outflows reflects a market grappling with uncertainty, particularly after the recent spot market downturn that pushed Bitcoin to around $60,000 and XRP to $1.11. However, the slowing pace of these outflows, as highlighted in CoinShares’ latest weekly report, offers a glimmer of hope. Typically, fund flows mirror price movements, but the deceleration in outflows suggests a stabilizing investor sentiment, potentially indicating a short-term bottom.

The recent market correction has impacted total assets under management (AuM), which fell to $129.8 billion, a level not seen since February. Despite lower prices, trading activity surged, with crypto ETP volumes reaching a record $63.1 billion for the week, surpassing October’s previous high. This suggests continued engagement from institutional players, even as they navigate the choppy waters.

Bitcoin Bears the Brunt

Bitcoin bore the brunt of the negative sentiment, with $264 million in weekly outflows. This made BTC the only major asset to see significant withdrawals during the period. Year-to-date, Bitcoin products now show $984 million in outflows, although their AuM remains substantial at $102 billion. The outflows may reflect profit-taking after the initial ETF-driven rally, or concerns about regulatory headwinds and macroeconomic uncertainty.

XRP Shines as Top Performer

In stark contrast to Bitcoin, XRP recorded $63.1 million in inflows, outperforming other major altcoins. Solana followed with $8.2 million, while Ethereum attracted $5.3 million in new investments. This influx of capital into XRP underscores its relative strength and appeal amid market volatility. XRP now leads year-to-date inflows with a total of $109 million, demonstrating sustained institutional interest even during periods of market weakness. The positive flows may be related to anticipation of further clarity in the ongoing SEC case, or perhaps due to its utility in cross-border payments.

Regional Disparities: Europe vs. Americas

Regionally, the picture is also mixed. Europe, particularly Germany ($87.1 million) and Switzerland ($30.1 million), along with Canada ($21.4 million) and Brazil ($16.7 million), recorded solid inflows, indicating a more constructive sentiment towards crypto assets in these regions. However, the United States continued to experience outflows, with $214 million exiting U.S.-based crypto asset products year-to-date, reaching a total of $1.464 billion. Despite these outflows, AuM in the U.S. remains strong at $107.7 billion, dwarfing its closest regional competitor, Canada, which has $5.1 billion.

While overall crypto investment products remain under pressure, XRP’s resilience stands out amid the slowdown in outflows. Whether this trend continues will depend on a variety of factors, including regulatory developments, macroeconomic conditions, and overall investor sentiment.

Related: Bitcoin Wobbles: Derivatives Data Signals Correction

Source: Original article

Quick Summary

XRP bucked the trend of crypto outflows, posting significant inflows while Bitcoin saw heavy withdrawals. Overall crypto outflows slowed, suggesting a potential stabilization in investor sentiment despite recent market downturns. XRP’s strong performance highlights institutional interest and relative resilience, contrasting with the broader market’s struggles and making it a standout asset.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.