XRP is outperforming major cryptocurrencies, attracting significant institutional investment while Bitcoin and Ethereum see outflows. New infrastructure developments, like permissioned domains and a credential-gated DEX on the XRPL, are attracting regulated financial institutions.

What to Know:

- XRP is outperforming major cryptocurrencies, attracting significant institutional investment while Bitcoin and Ethereum see outflows.

- New infrastructure developments, like permissioned domains and a credential-gated DEX on the XRPL, are attracting regulated financial institutions.

- Ripple is expanding its ecosystem to include custody, brokerage, and a stablecoin, positioning XRP for broader institutional adoption and utility.

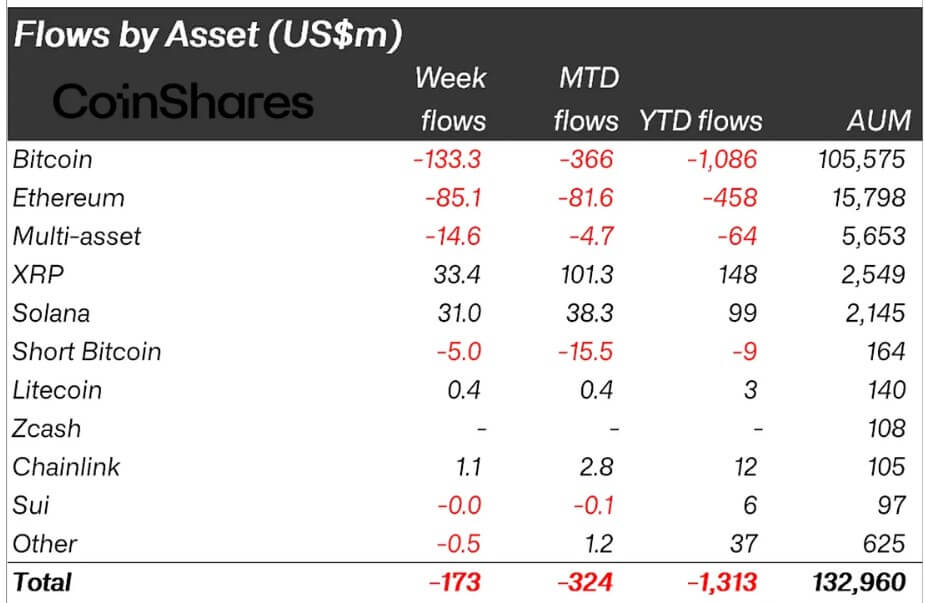

XRP is emerging as a standout performer in the crypto market, drawing substantial institutional capital amid a generally risk-averse environment. While Bitcoin and Ethereum have experienced significant outflows, XRP has attracted approximately $150 million in fresh capital this year alone. This divergence suggests a strategic rotation into alternative assets, signaling a potential shift in investor sentiment.

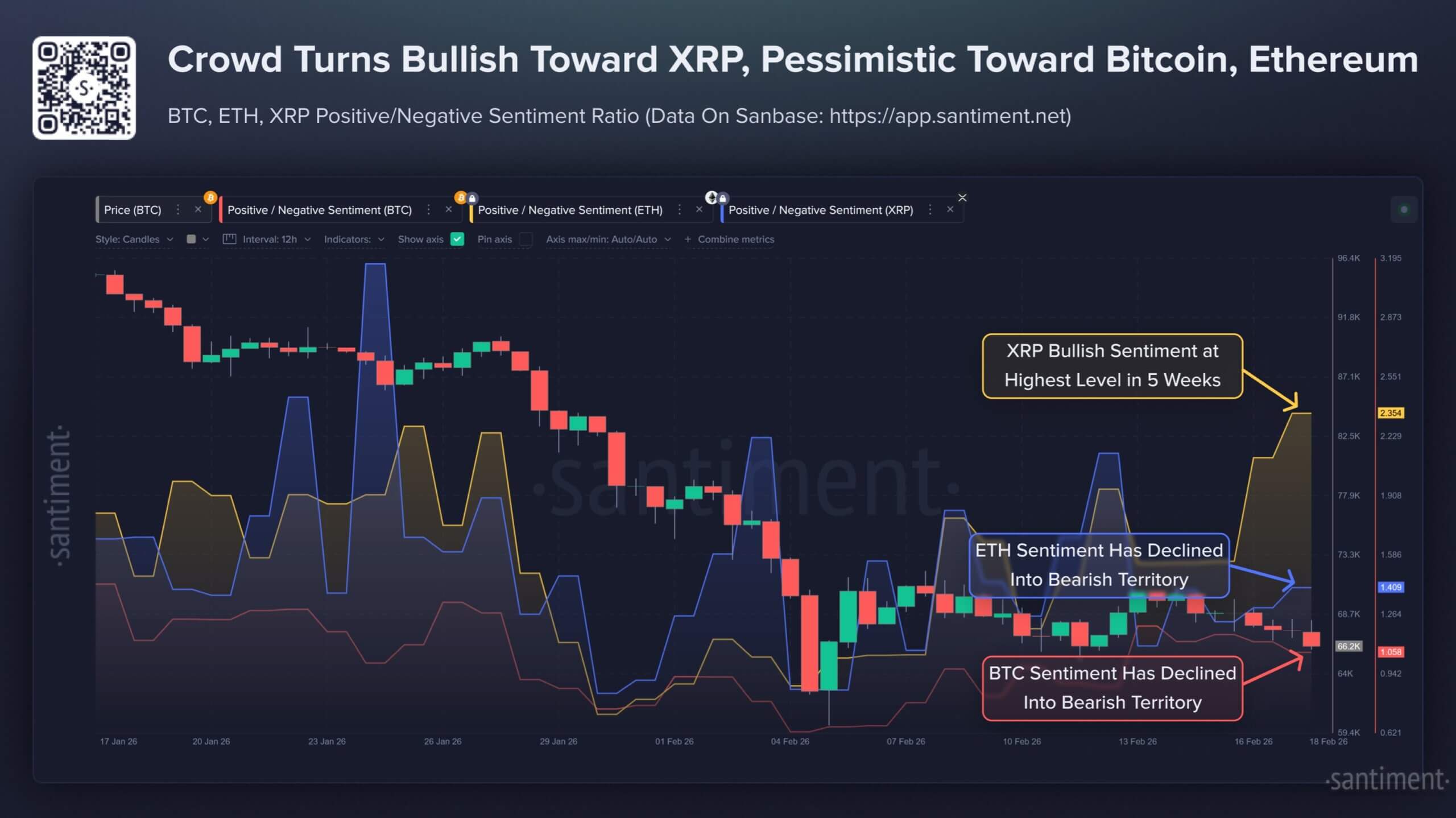

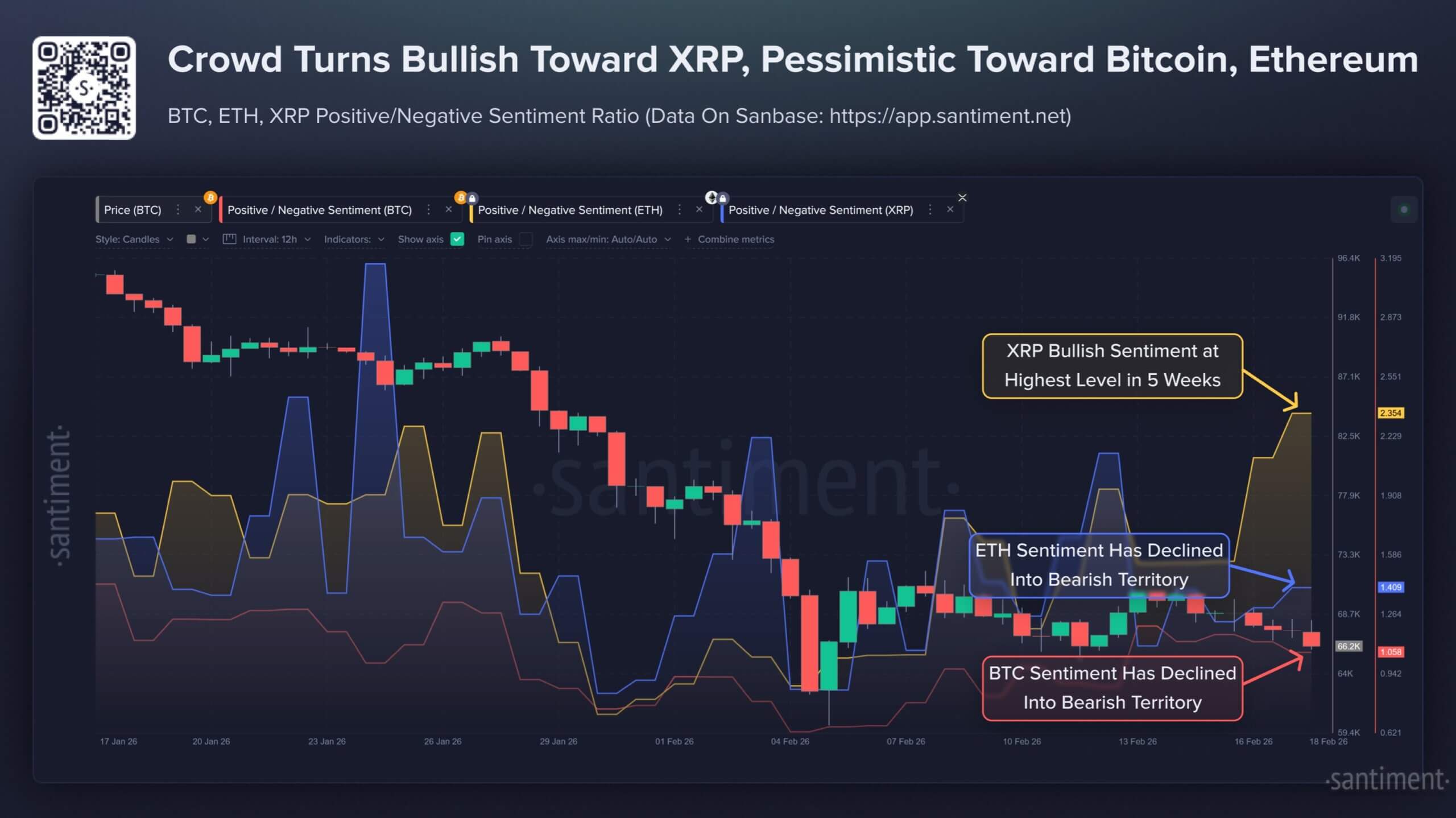

Market sentiment also reflects this trend, with XRP experiencing a surge in bullish commentary, reaching a five-week high. Meanwhile, discussion around Bitcoin and Ethereum has cooled, indicating a possible change in investor focus.

Coinbase’s recent decision to include XRP as collateral for USDC loans marks a significant catalyst for the digital asset. This move expands XRP’s utility beyond simple trading, establishing a longer-term demand as holders can now borrow against their XRP holdings without selling.

Developments within the XRPL infrastructure are also positioning XRP for broader institutional adoption. Features like Permissioned Domains and a credential-gated DEX aim to provide regulated firms with the necessary tools to transact on-chain within defined compliance boundaries. This approach differs from the open-access model of networks like Ethereum, catering to institutions that require real-world compliance and internal controls.

Ripple’s strategic expansion into a comprehensive digital asset platform is also noteworthy. By offering a suite of services, including payments, custody, and brokerage, Ripple aims to keep more of the transaction lifecycle within its ecosystem, benefiting XRP as liquidity moves across corridors.

In conclusion, XRP’s recent performance and strategic developments suggest a positive outlook for the digital asset. Its increasing utility, coupled with Ripple’s institutional-focused approach, positions XRP for sustained growth and adoption in the evolving crypto landscape.

Related: Crypto Retreat: XRP, Ethereum Show Slide

Source: Original article

Quick Summary

XRP is outperforming major cryptocurrencies, attracting significant institutional investment while Bitcoin and Ethereum see outflows. New infrastructure developments, like permissioned domains and a credential-gated DEX on the XRPL, are attracting regulated financial institutions.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.