XRP downtrend appears to be losing steam, hinting at a potential stabilization phase. Shiba Inu remains under bearish pressure, with limited signs of a trend reversal. Bitcoin is testing a critical support level around $80,000, which will determine its short-term trajectory.

What to Know:

- XRP downtrend appears to be losing steam, hinting at a potential stabilization phase.

- Shiba Inu remains under bearish pressure, with limited signs of a trend reversal.

- Bitcoin is testing a critical support level around $80,000, which will determine its short-term trajectory.

Digital asset markets are currently at an inflection point, with several leading cryptocurrencies displaying signs of transition. XRP, Shiba Inu, and Bitcoin each face unique technical challenges and opportunities that warrant close inspection by institutional investors. Understanding these nuances is critical for navigating the current market environment and positioning portfolios for potential shifts in momentum.

XRP Downtrend Exhaustion

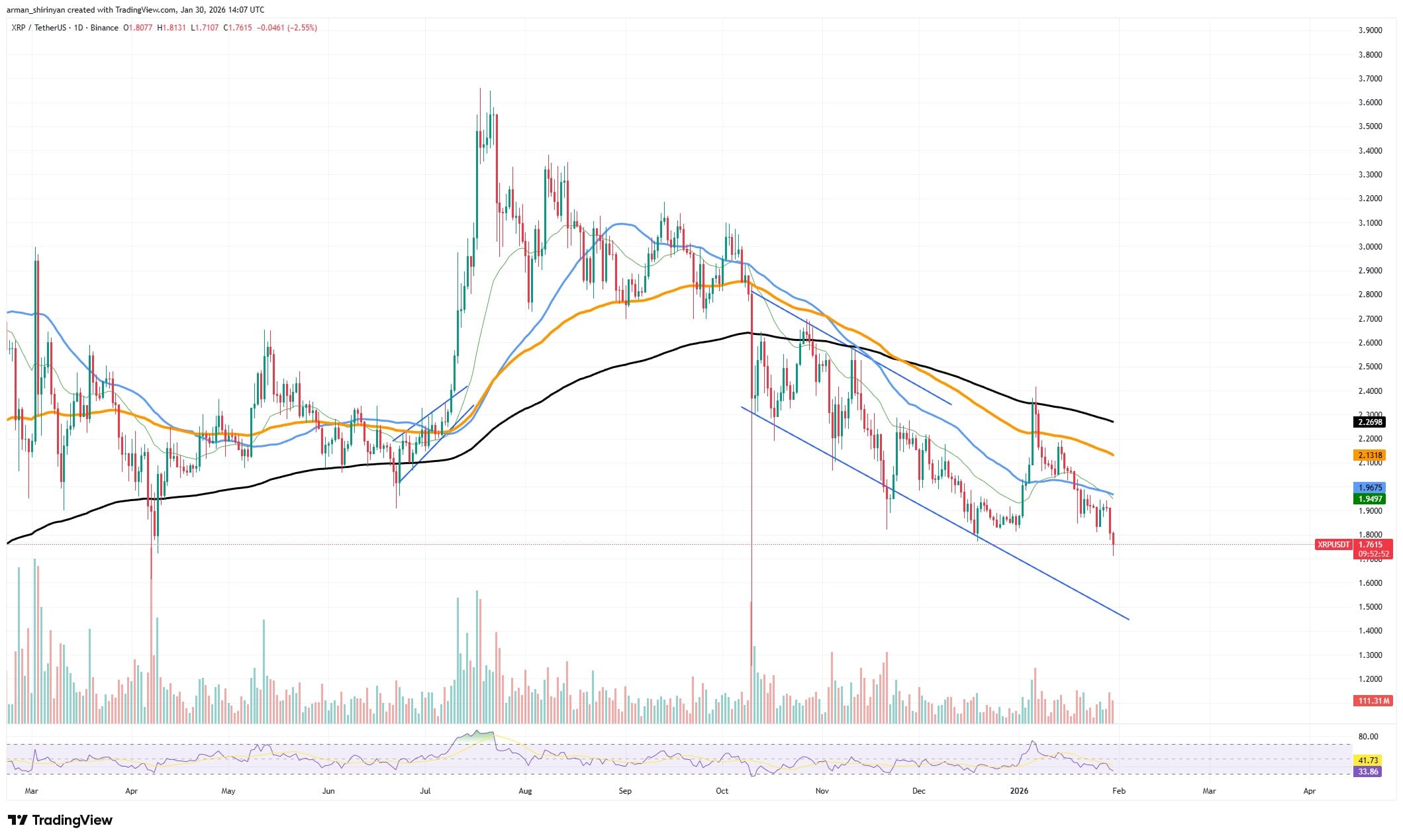

XRP’s multi-month downtrend appears to be reaching exhaustion, suggesting a possible shift in market dynamics. The descending channel that has defined its price action is showing signs of compression, with diminishing selling pressure and lighter volume on recent downside attempts. This behavior often precedes a period of stabilization or a relief rally, offering a potential entry point for astute investors.

From an institutional perspective, the risk-reward ratio for new short positions in XRP is becoming less attractive. The majority of the obvious selling has likely already occurred, and late entrants may find themselves caught in a potential bounce. While a full-blown bull trend may not materialize immediately, the waning downward momentum suggests that XRP is entering an accumulation phase, reminiscent of previous crypto market bottoms.

This doesn’t guarantee a vertical recovery, but rather a period of stabilization followed by a relief recovery that resets positioning. Institutional investors should anticipate recovery attempts, or at minimum, a halt in persistent downside pressure. The most important takeaway is that the aggressive downward trend is waning.

Shiba Inu’s Bearish Pressure

Shiba Inu (SHIB) continues to face persistent bearish pressure, with its price action trapped beneath major moving averages. The formation of a tightening triangle near local lows suggests indecision rather than accumulation, as each bounce remains shallow and lacks convincing volume expansion. This indicates that demand is reactive, not aggressive, signaling continued weakness.

The broader structure of SHIB’s chart reveals a stair-stepping decline since its previous peak, with no clear reversal signals in sight. Rallies remain corrective by definition until a higher high or a break above key resistance zones is achieved. The moving averages stacked above the price form a formidable ceiling that would require significant momentum to overcome, similar to the resistance faced by many altcoins during the 2018 crypto winter.

While a brief volatility spike is possible as the triangle resolves, the dominant trend still favors sellers. Institutional investors should remain cautious and avoid chasing short-term rallies, as upside moves are likely to be capped and temporary without a decisive shift in market structure and volume. A period of consolidation or sideways action would be constructive.

Bitcoin’s Critical Support

Bitcoin (BTC) is currently testing a critical support level around $80,000, which will determine its short-term trajectory. The recent price drop has pushed BTC towards the lower boundary of its multiweek range, but a failure to break below this level would suggest relative stability and a continuation of the consolidation phase. For now, this appears to be a correction within a larger consolidation rather than a confirmed breakdown.

The $80,000 area acts as a psychological and technical support level, reinforced by previous reaction lows and heavy historical volume. Such zones are typically defended vigorously by markets, particularly following protracted declines. A firm hold on this area could promote range trading and eventual stabilization, allowing buyers to regain their confidence.

However, a breakdown below $80,000 would shift the narrative towards deeper downside exploration, potentially triggering a cascade of stop-loss orders and liquidations. Institutional investors should closely monitor this level and prepare for a potential increase in volatility if it is breached. Given the current macro environment, such a breakdown could accelerate.

Market Transition

The developments across XRP, Shiba Inu, and Bitcoin suggest that the broader cryptocurrency market is entering a transition phase. While each asset faces unique challenges, the common thread is a shift in momentum and a potential for stabilization or reversal. Institutional investors should carefully analyze these signals and adjust their strategies accordingly.

A key factor to consider is the regulatory landscape, which continues to evolve and impact market sentiment. Clarity on issues such as ETF approvals, custody requirements, and taxation could provide a significant boost to institutional adoption and drive fresh capital inflows. Monitoring regulatory developments and engaging with policymakers is crucial for navigating the evolving digital asset ecosystem.

Ultimately, the long-term success of digital assets will depend on their ability to demonstrate real-world utility and generate sustainable value. Institutional investors should focus on projects with strong fundamentals, innovative use cases, and experienced management teams. By adopting a research-driven approach and staying informed about market trends, investors can position themselves to capitalize on the opportunities presented by this emerging asset class.

Related: Bitcoin Negative Funding Signals Leverage Unwind

Source: Original article

Quick Summary

XRP downtrend appears to be losing steam, hinting at a potential stabilization phase. Shiba Inu remains under bearish pressure, with limited signs of a trend reversal. Bitcoin is testing a critical support level around $80,000, which will determine its short-term trajectory.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.