Canton (CC), marketed as an institution-friendly RWA token and potential “XRP killer,” has surpassed Shiba Inu (SHIB) in market capitalization rankings, briefly entering the top 25.

What to Know:

- Canton (CC), marketed as an institution-friendly RWA token and potential “XRP killer,” has surpassed Shiba Inu (SHIB) in market capitalization rankings, briefly entering the top 25.

- Cardano’s Charles Hoskinson has criticized Canton’s approach, arguing that established ecosystems like XRP already operate at a much larger scale in the RWA space.

- If Canton sustains its market position and maintains its institutional narrative, it could trigger more serious comparisons with XRP beyond simple meme-based speculation.

The digital asset landscape is constantly evolving, with new projects emerging and challenging established players. Recently, Canton (CC), a token marketed as an institution-friendly real-world asset (RWA) platform and potential competitor to XRP, briefly surpassed Shiba Inu (SHIB) in market capitalization. This development raises questions about the evolving dynamics within the crypto market, the viability of new RWA-focused projects, and the potential impact on established players like XRP.

Canton’s Ascent and Market Positioning

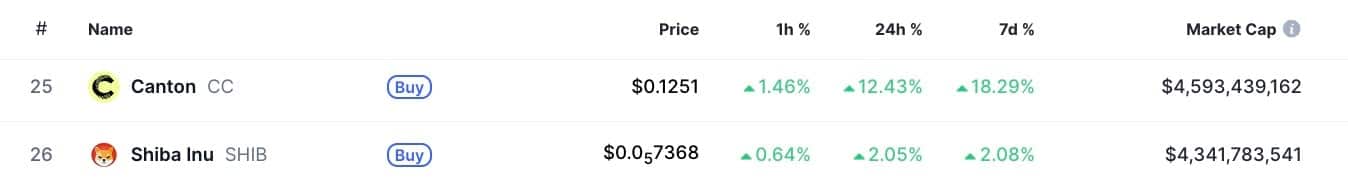

Canton’s recent rise in market capitalization, briefly placing it ahead of Shiba Inu, has turned heads in the digital asset space. According to CoinMarketCap data, Canton reached a market cap of $4.6 billion, ranking it 25th overall, while SHIB slipped to 26th at $4.34 billion. This shift in rankings is significant because Canton is being positioned as an institution-friendly platform focused on real-world asset tokenization, directly challenging XRP’s long-held narrative in that space. Whether this is a temporary blip or a sign of sustained momentum remains to be seen, but it underscores the increasing interest in RWA solutions within the institutional investment community.

Hoskinson’s Critique and RWA Landscape

Cardano’s Charles Hoskinson has publicly criticized Canton’s approach, arguing that established ecosystems like XRP and Midnight are already operating at a scale “100x beyond their ambitions” in the RWA space. Hoskinson’s comments highlight the competitive nature of the RWA landscape and the challenges faced by new entrants attempting to gain traction. His perspective suggests that simply targeting real-world assets is not enough; success requires a robust ecosystem, established infrastructure, and significant scale, areas where existing platforms may have a considerable advantage.

The “XRP Killer” Narrative and Institutional Interest

The “XRP killer” label attached to Canton is largely a marketing narrative, but it underscores the broader interest in finding alternatives to XRP for institutional use cases. XRP has long been associated with cross-border payments and institutional adoption, but regulatory uncertainties and ongoing legal battles have created opportunities for competing platforms. If Canton can continue to demonstrate traction and attract institutional interest, the “XRP killer” narrative may gain more credibility, potentially impacting XRP’s market position and future growth prospects.

Market Dynamics and Speculative Frenzy

The digital asset market is prone to speculative frenzies, where new projects can experience rapid price appreciation based on hype and narratives rather than fundamental value. Canton’s recent surge could be partially attributed to this phenomenon, as investors seek out the next big thing in the RWA space. However, it’s crucial to differentiate between short-term speculative bubbles and sustainable long-term growth. Institutional investors will likely take a more measured approach, carefully evaluating the underlying technology, regulatory compliance, and real-world adoption potential before committing significant capital.

Looking Ahead: Sustaining Momentum

For Canton to truly challenge XRP’s position in the RWA space, it needs to sustain its momentum and demonstrate tangible progress in attracting institutional clients and facilitating real-world asset tokenization. This will require building a robust ecosystem, securing regulatory approvals, and establishing partnerships with traditional financial institutions. If Canton can successfully execute on these fronts, it could become a significant player in the RWA market. If not, it risks fading into obscurity like many other “XRP killer” projects that have come and gone.

In conclusion, Canton’s recent rise in market capitalization and the “XRP killer” narrative highlight the evolving dynamics within the digital asset market and the increasing interest in real-world asset tokenization. While it remains to be seen whether Canton can sustain its momentum and truly challenge XRP’s dominance, this development underscores the importance of innovation, competition, and regulatory clarity in shaping the future of the digital asset landscape.

Related: Crypto Test Reveals Broken Bull Market

Source: Original article

Quick Summary

Canton (CC), marketed as an institution-friendly RWA token and potential “XRP killer,” has surpassed Shiba Inu (SHIB) in market capitalization rankings, briefly entering the top 25. Cardano’s Charles Hoskinson has criticized Canton’s approach, arguing that established ecosystems like XRP already operate at a much larger scale in the RWA space.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.