Bitcoin’s resilience above $67,000 has kept a significant portion of its supply in profit, signaling strong holder conviction despite recent market volatility. XRP’s profitability has seen a notable boost, indicating growing investor confidence and potential for further price appreciation.

What to Know:

- Bitcoin’s resilience above $67,000 has kept a significant portion of its supply in profit, signaling strong holder conviction despite recent market volatility.

- XRP’s profitability has seen a notable boost, indicating growing investor confidence and potential for further price appreciation.

- Solana’s high percentage of supply in loss highlights the risks associated with altcoin investments, particularly during market downturns, and underscores the importance of risk management.

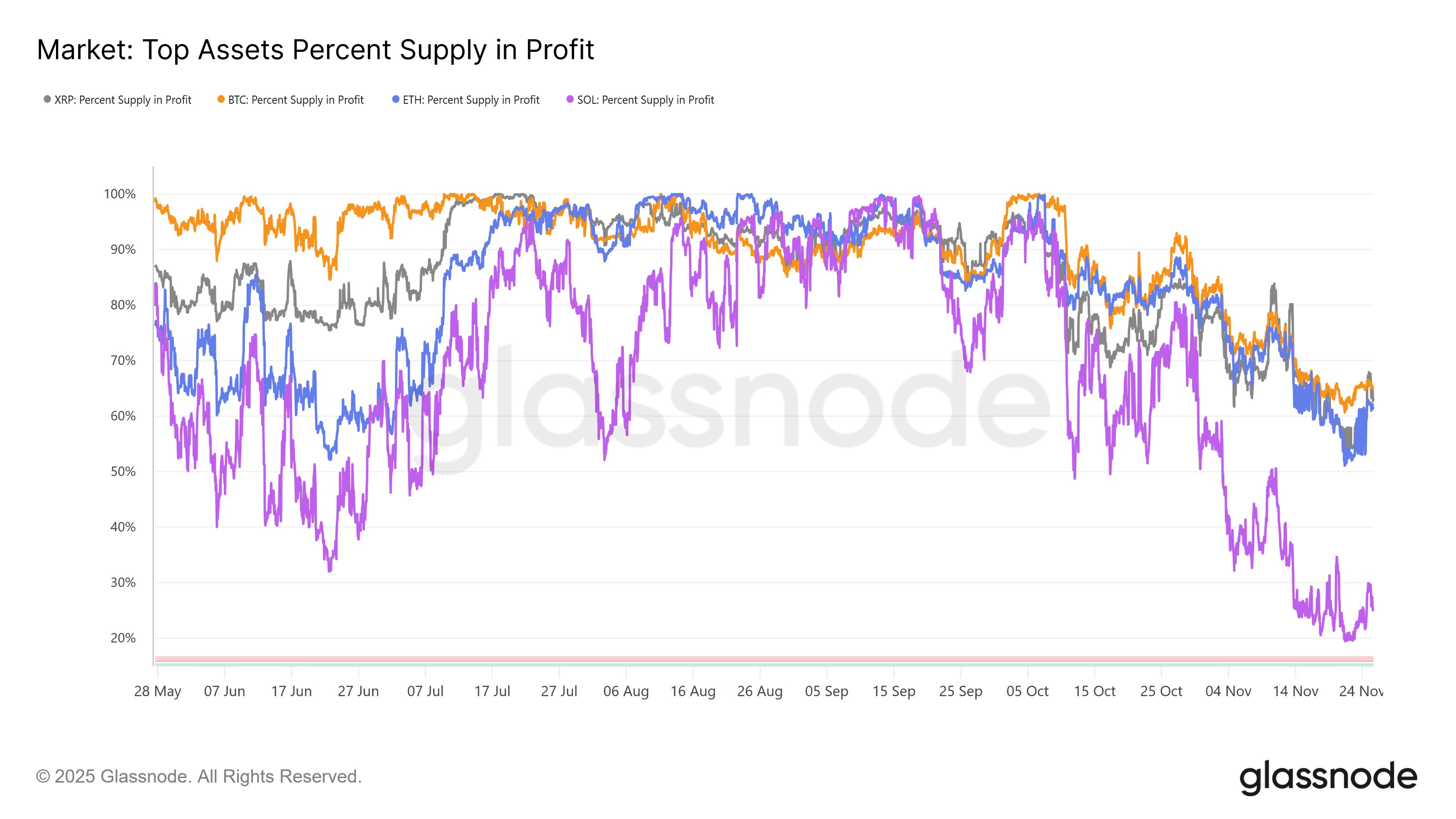

Recent on-chain data from Glassnode offers a snapshot into the profitability of major crypto assets, including XRP and Bitcoin, providing valuable insights for institutional investors navigating this dynamic market. As Bitcoin stabilizes above $67,000 and altcoins experience varied price action, understanding the distribution of profit and loss across different crypto assets is crucial for informed decision-making. This analysis delves into the implications of these profitability metrics, offering a nuanced perspective on market sentiment and potential future movements.

Glassnode’s analysis reveals that approximately 34.91% of Bitcoin’s circulating supply is currently held at a loss. While this figure might raise concerns, it’s important to consider that the remaining 65.09% is in profit, representing a substantial portion of the market. This suggests that a majority of Bitcoin holders entered their positions at lower prices and are therefore less likely to sell during market dips. The resilience of these holders contributes to Bitcoin’s overall stability and supports its role as a store of value.

XRP, on the other hand, presents a more nuanced picture. According to Glassnode, about 36.70% of XRP’s supply is in the red. However, a recent improvement in XRP’s price has led to a decrease in the percentage of supply held at a loss, indicating growing investor confidence. This shift in profitability could attract further institutional interest, particularly if XRP can sustain its upward momentum. The history of XRP has been volatile, and this metric offers a window into the current risk/reward balance.

Solana stands out with a significant 74.84% of its circulating supply currently held at a loss. This high percentage suggests that a large number of investors bought Solana near its peak or during its subsequent decline, possibly during the FTX implosion. Such a large proportion of holders in the red can create significant selling pressure if market conditions worsen, as these investors may be eager to exit their positions at the first sign of recovery. Institutional investors should be wary of this overhang, as it could limit Solana’s upside potential in the near term.

Ethereum’s profitability metrics fall somewhere in between Bitcoin and Solana. Glassnode’s data indicates that 38.37% of Ethereum’s supply is in the red, while the remaining 61.63% is in profit. This distribution suggests a relatively healthy balance between holders who are likely to hold through market volatility and those who may be more inclined to sell. Ethereum’s diverse ecosystem and ongoing development efforts contribute to its attractiveness as a long-term investment.

The percentage of supply in loss can serve as a useful indicator of holder sentiment and potential market behavior. Assets with a higher percentage of holders in loss are more susceptible to sell-offs during periods of market stress, as these investors may seek to cut their losses. Conversely, assets with a higher percentage of holders in profit tend to exhibit greater stability, as these investors are more likely to hold onto their positions and even add to them during dips. Savvy institutional investors can use these insights to better anticipate market movements and manage their risk exposure.

Ultimately, on-chain analysis of supply profitability provides valuable context for understanding the underlying dynamics of the crypto market. While Bitcoin’s resilience and XRP’s improving profitability offer encouraging signs, Solana’s high percentage of supply in loss serves as a reminder of the risks associated with altcoin investments. By carefully monitoring these metrics and considering their implications for market sentiment, institutional investors can make more informed decisions and navigate the crypto landscape with greater confidence.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Bitcoin’s resilience above $67,000 has kept a significant portion of its supply in profit, signaling strong holder conviction despite recent market volatility. XRP’s profitability has seen a notable boost, indicating growing investor confidence and potential for further price appreciation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.