XRP is experiencing significant outflows from exchanges like Upbit and Binance, reminiscent of patterns seen before price rallies. These outflows coincide with growing interest in XRP, evidenced by inflows into US-listed spot XRP ETFs and analysts noting its outperformance relative to Bitcoin and Ethereum.

What to Know:

- XRP is experiencing significant outflows from exchanges like Upbit and Binance, reminiscent of patterns seen before price rallies.

- These outflows coincide with growing interest in XRP, evidenced by inflows into US-listed spot XRP ETFs and analysts noting its outperformance relative to Bitcoin and Ethereum.

- Decreasing XRP supply on exchanges, coupled with sustained ETF inflows, could reduce selling pressure and potentially drive price appreciation if key resistance levels are breached.

XRP is once again capturing the attention of crypto investors as substantial amounts of the token are being withdrawn from major exchanges, notably Upbit and Binance. This trend mirrors previous instances where decreased exchange supply preceded notable price increases for XRP. Market participants are closely monitoring whether these outflows will translate into upward price momentum.

Decreasing XRP Supply on Exchanges

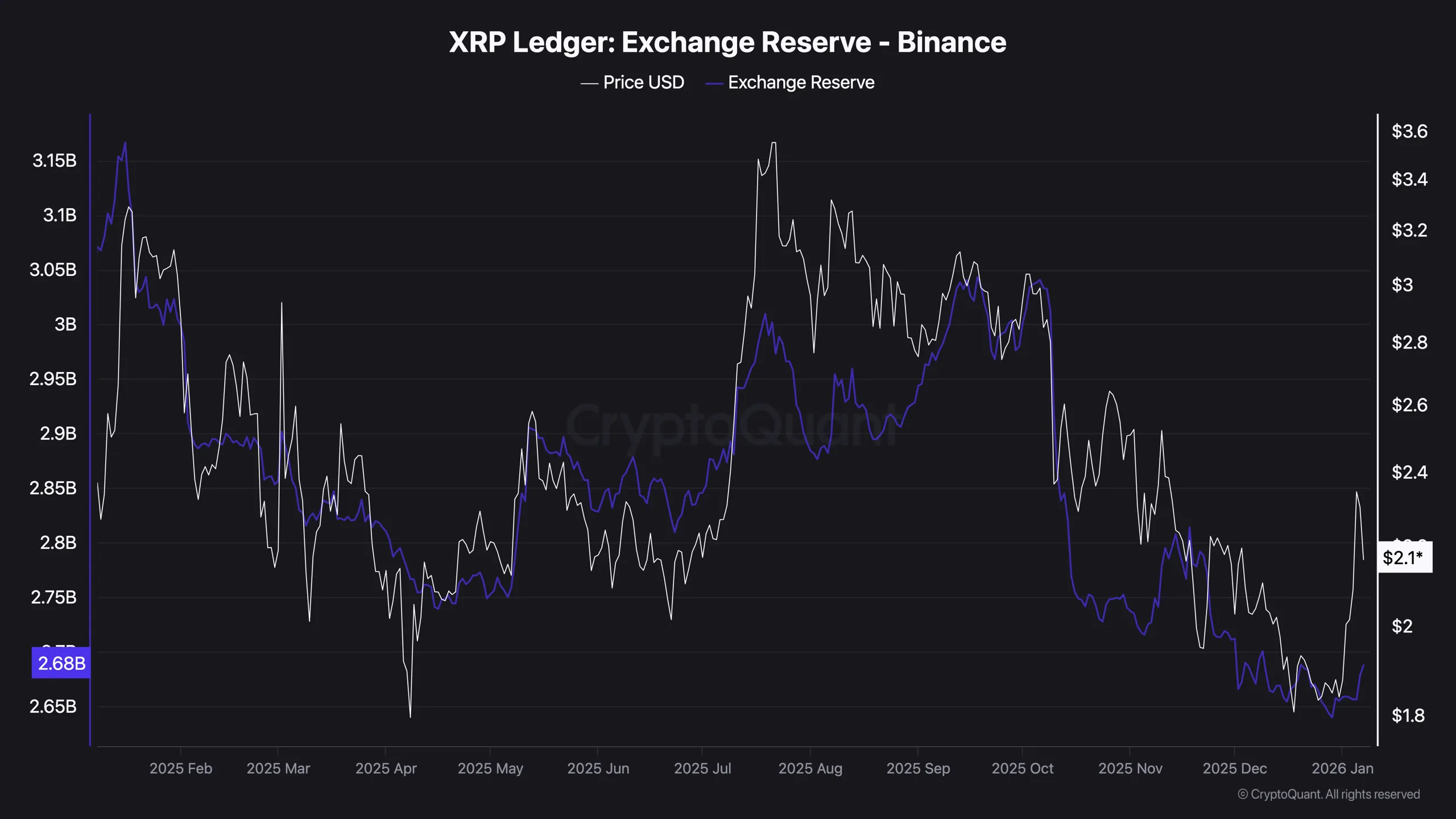

Upbit, a major cryptocurrency exchange, has seen its XRP reserves decline, echoing a pattern observed in late 2024. During that period, a significant drop in XRP supply on Upbit was followed by a substantial price surge. Currently, while the decrease in XRP reserves on Upbit isn’t as steep as in 2024, the trend is familiar, prompting traders to anticipate potential bullish movement. Binance has also recorded a steady decrease in XRP reserves, with over 300 million XRP withdrawn since October 2025. A reduction in tokens available on exchanges typically indicates reduced sell pressure, as holders move their assets to private wallets.

Technical Analysis and Market Sentiment

As of the current market update, XRP is trading around $2.10, reflecting a recent decline but still up over the past week. The $2.28 level is proving to be a resistance point. Some analysts point to potential bearish signals, such as a double top pattern, suggesting possible downside if buyers don’t intervene. Conversely, other analysts maintain a bullish outlook, with some anticipating a new uptrend. Price targets ranging from $5 to as high as $20 have been suggested for this cycle, though a dip to the $1.30–$1.50 range remains a possibility.

XRP Outperforms Bitcoin and Ethereum

In early 2026, XRP’s performance has outpaced both Bitcoin and Ethereum, drawing investor attention. This shift suggests traders are exploring alternative opportunities within the crypto market. Spot XRP ETFs listed in the U.S. have experienced consistent inflows in January, indicating growing interest from institutional investors. This influx of capital, combined with decreasing supply on exchanges, may create a foundation for further price appreciation, contingent on breaking through key resistance levels.

Impact of ETF Inflows on XRP Liquidity

The continuous inflows into US-listed spot XRP ETFs are a notable development. These inflows signify growing institutional interest and can have a positive impact on XRP liquidity. As more XRP is absorbed into these ETFs, the available supply on exchanges decreases, potentially leading to upward price pressure. The ETF inflows reflect a broader trend of traditional financial institutions entering the crypto space, which could further validate XRP as an asset class.

Potential Market Catalysts

Several factors could act as catalysts for XRP’s market performance. A decisive break above the $2.28 resistance level could signal a continuation of the uptrend, attracting further buying interest. Any positive regulatory developments regarding Ripple or XRP could also boost market sentiment. Conversely, negative news or regulatory hurdles could trigger a sell-off. Monitoring these potential catalysts will be crucial for assessing XRP’s future price trajectory.

Conclusion

XRP is currently exhibiting intriguing market dynamics with notable exchange outflows and increasing institutional interest via ETF inflows. While technical analysis presents mixed signals, the overall market sentiment appears cautiously optimistic. Whether these factors will coalesce to propel XRP to new heights remains to be seen, but the current trends warrant close observation by institutional investors.

Related: XRP Price: The Neutral Bridge for Banks?

Source: Original article

Quick Summary

XRP is experiencing significant outflows from exchanges like Upbit and Binance, reminiscent of patterns seen before price rallies. These outflows coincide with growing interest in XRP, evidenced by inflows into US-listed spot XRP ETFs and analysts noting its outperformance relative to Bitcoin and Ethereum.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.