XRP experienced a dramatic shift in market dynamics over the past 12 hours, driven by an extraordinary spike in long position liquidations.

XRP experienced a dramatic shift in market dynamics over the past 12 hours, driven by an extraordinary spike in long position liquidations. This sudden imbalance, reaching as high as 2,475%, has captured the attention of traders across the cryptocurrency sector, especially as it unfolded during a broader market upheaval.

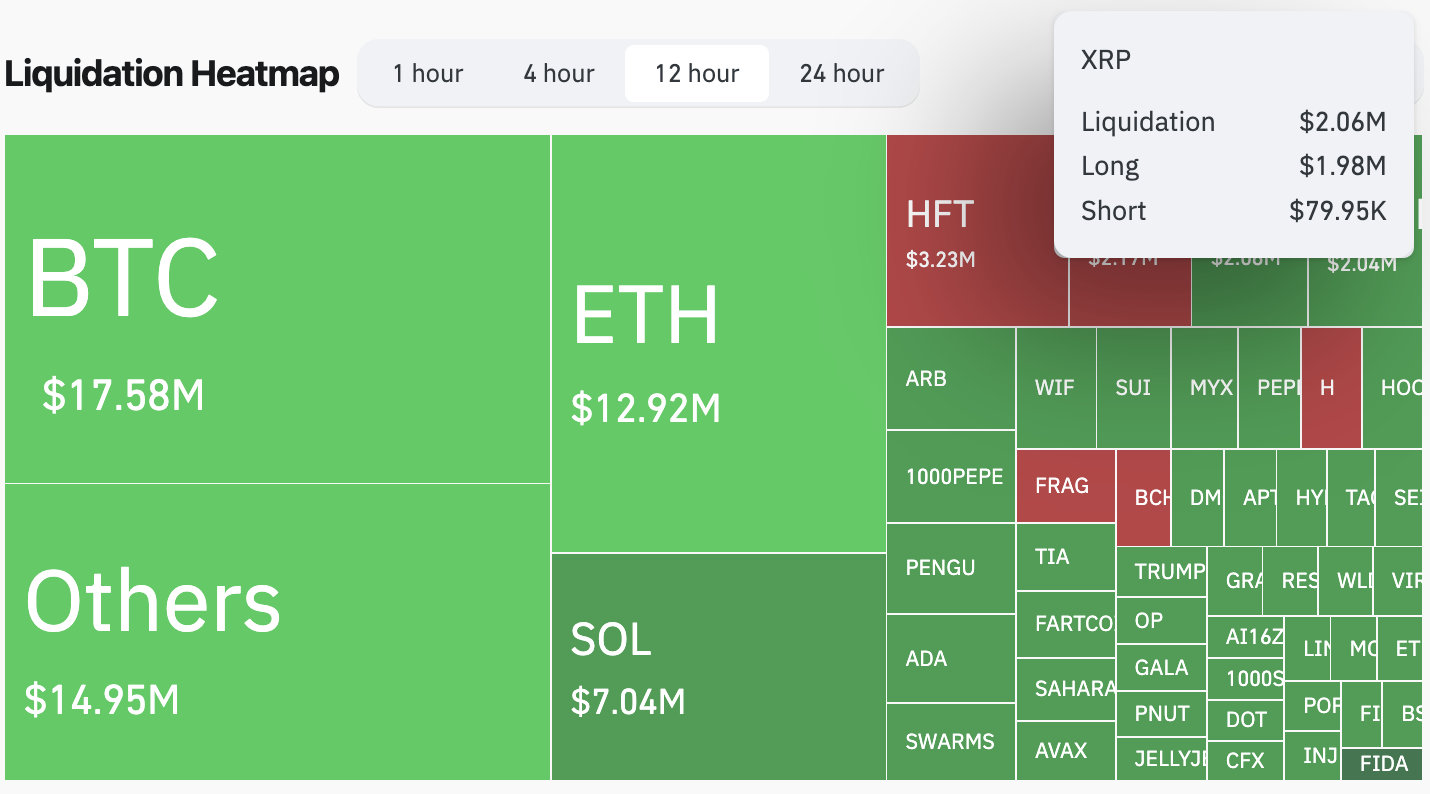

The major trigger behind this disruption in XRP trading was an intense liquidation event. According to data from CoinGlass, long positions on XRP recorded liquidations amounting to $1.98 million. In comparison, short positions faced only $79,950 in liquidations. This significant discrepancy highlights a one-sided market reaction, causing ripple effects across trading platforms and investor sentiment.

The rally began with XRP breaking through a key resistance level and reaching upward of $2.33. This move, although bullish at the outset, sparked a wave of fear of missing out (FOMO) activity among long traders. However, the excitement was short-lived. Almost as quickly as the surge began, XRP reversed direction, triggering a fierce cascade of liquidations among overleveraged long positions.

This unexpected reversal not only wiped out gains but also highlighted a critical imbalance in the market structure. When such sell-offs occur, especially after heavy long exposure, liquidation flows tend to concentrate on one side — in this case, the longs — creating vulnerabilities and exacerbating sell pressure.

The timing of XRP’s price action coincided with widespread liquidations across the broader crypto ecosystem. Over the past 24 hours, more than $208 million in open positions were forcefully closed, affecting around 88,000 traders. While Bitcoin and Ethereum saw liquidations totaling $17.58 million and $12.92 million respectively, XRP emerged with the most extreme long exposure imbalance.

This incident underscores a critical lesson for XRP traders: High-leverage bullish positions can become a liability during sudden downturns. The thin liquidity and sharp fluctuations contributed to amplified losses, forcing traders to rethink risk management strategies.

Currently, XRP is navigating a shaky path, stabilizing around the $2.18 mark. The aftermath of the liquidation spree has left many market participants cautious, with order books showing less depth and more hesitancy from buyers. This environment often leads to slower recoveries and smaller trading volumes as participants await clearer signals before re-entering the market.

The recent volatility also reflects a broader pattern where bullish momentum can spiral into abrupt corrections due to emotional trading behavior and overconfidence. As always in crypto markets, risk mitigation and diversified positioning are essential to withstand these sudden shifts, especially when trading an asset as prominent and widely speculated on as XRP.

Related: Expert Advice: Sell XRP If You’re Confused

As investors reassess positions and markets search for equilibrium, it remains to be seen how XRP and the broader crypto landscape will stabilize in the short term. However, the recent events serve as a stark reminder that speculative bubbles can burst as quickly as they form, particularly in markets driven by leverage and sentiment.

Quick Summary

XRP experienced a dramatic shift in market dynamics over the past 12 hours, driven by an extraordinary spike in long position liquidations. This sudden imbalance, reaching as high as 2,475%, has captured the attention of traders across the cryptocurrency sector, especially as it unfolded during a broader market upheaval.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.