XRP is facing downward pressure, prompting long-term bulls to consider aggressive accumulation strategies. The discussion occurs amid broader market uncertainty and historical price volatility in the crypto space.

What to Know:

- XRP is facing downward pressure, prompting long-term bulls to consider aggressive accumulation strategies.

- The discussion occurs amid broader market uncertainty and historical price volatility in the crypto space.

- Potential accumulation strategies by high-conviction XRP investors could signal future demand and price stabilization.

XRP is currently experiencing renewed selling pressure, testing the resolve of long-term investors. As the token trades below key psychological levels, prominent voices in the XRP community are discussing potential accumulation strategies should the price decline significantly. This highlights a divergence in sentiment, with some bracing for a deeper correction while others view it as a strategic buying opportunity. The conversation underscores the speculative nature of digital asset markets and the importance of understanding market cycles.

Contrasting Price Expectations

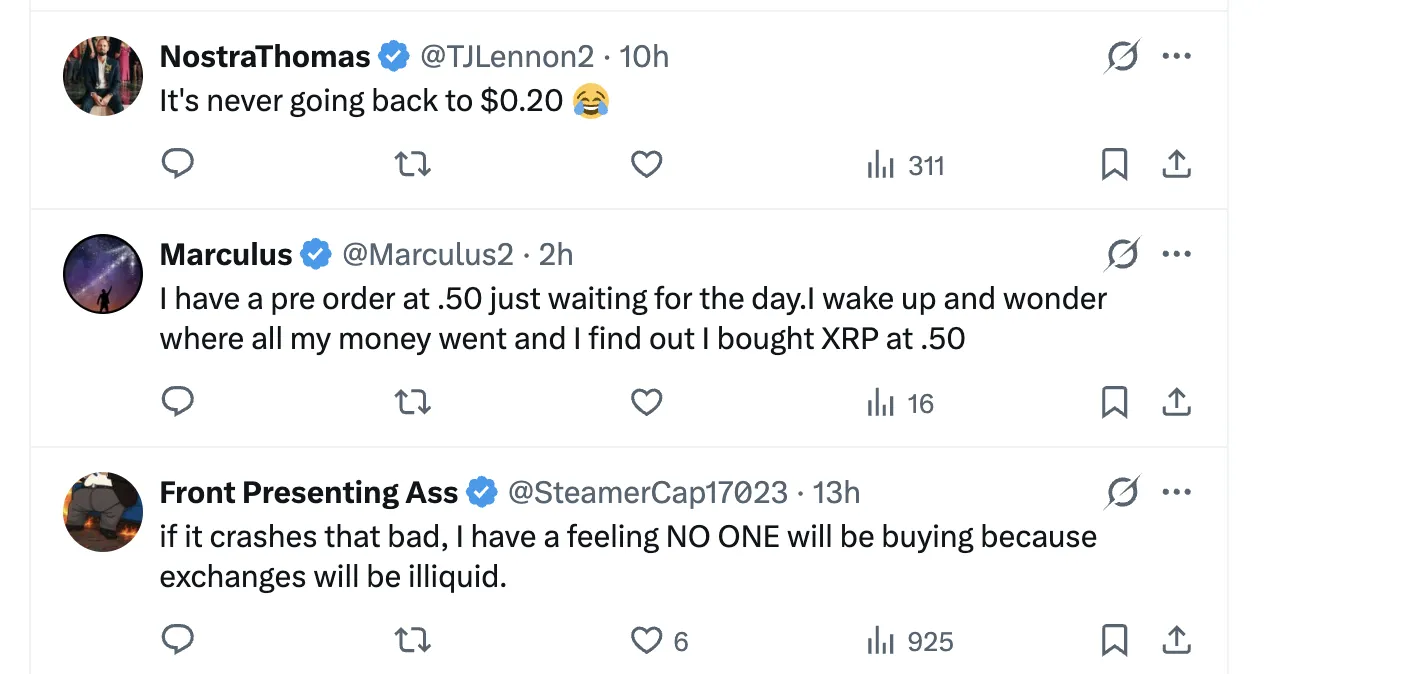

The debate was sparked by a call for an extreme price drop from XRPee, who expressed willingness to aggressively buy XRP should it crash to $0.20. This view is not universally shared, with many dismissing such a steep decline as unrealistic. The contrasting opinions reflect the inherent uncertainty in forecasting digital asset prices, influenced by factors ranging from regulatory developments to broader market sentiment.

Exchange Liquidity Concerns

Steamer Cap cautioned that a severe price crash could lead to illiquidity on exchanges, potentially hindering traders’ ability to capitalize on the dip. This concern highlights the importance of market structure and liquidity in digital asset trading. Institutional investors closely monitor liquidity conditions to ensure efficient execution of large orders and to mitigate the risk of slippage.

Million-Dollar Buy Orders

The discussion around buying XRP at extreme levels aligns with a trend of high-conviction investors positioning themselves to capitalize on potential market downturns. Earlier in the month, veteran investor Pumpius revealed plans to deploy $1 million to buy 1 million XRP if the price reaches $1. Such strategies indicate a long-term bullish outlook among some market participants, despite short-term volatility and uncertainty.

Bear Market Considerations

The overall theme in these discussions suggests that expectations for a major XRP bull run in the immediate future are tempered. Many investors are anticipating a bear market phase after the highs seen in 2025, prompting them to consider downside risks and potential accumulation levels. This cautious approach reflects a broader understanding of historical market cycles and the need for risk management in digital asset investing.

Downside Risk Scenarios

In July, analyst EGRAG outlined potential downside scenarios for XRP in the next bear market, suggesting possible crashes to $0.80 or $1.30 depending on previous peak prices. While acknowledging the possibility of a sub-$0.30 price as extreme but not impossible, EGRAG anticipates a final bullish surge above $3 before such scenarios play out. This analysis underscores the importance of considering multiple potential outcomes and developing strategies to navigate different market conditions.

In conclusion, the discussions surrounding XRP’s potential price movements highlight the speculative nature of digital asset markets and the diverse range of opinions among investors. While some anticipate further downside and are preparing to accumulate aggressively, others remain skeptical of extreme price predictions. Understanding these dynamics and considering various risk scenarios is crucial for institutional and high net worth investors navigating the digital asset landscape.

Related: Bitcoin Liquidation Signals Macro Catalyst

Source: Original article

Quick Summary

XRP is facing downward pressure, prompting long-term bulls to consider aggressive accumulation strategies. The discussion occurs amid broader market uncertainty and historical price volatility in the crypto space. Potential accumulation strategies by high-conviction XRP investors could signal future demand and price stabilization.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.