An analyst suggests holding 10,000 XRP tokens could lead to financial freedom. This perspective indicates the ongoing debate about XRP’s valuation and future potential within the broader crypto market.

What to Know:

- An analyst suggests holding 10,000 XRP tokens could lead to financial freedom.

- This perspective highlights the ongoing debate about XRP’s valuation and future potential within the broader crypto market.

- The discussion is relevant for institutional investors tracking XRP’s market dynamics, Ripple’s regulatory progress, and potential shifts in investment strategies.

The future valuation of XRP continues to be a hot topic among crypto analysts and investors. One market commentator has suggested that accumulating 10,000 XRP tokens could be a game-changing move toward financial independence. This bold claim underscores the speculative nature of the crypto market, while also drawing attention to XRP’s potential upside amid regulatory developments and increasing institutional interest.

The Case for 10,000 XRP

Edoardo Farina, a figure in the XRP community, has expressed strong conviction that holding 10,000 XRP tokens could lead to significant financial benefits. Farina’s bullish outlook is rooted in the belief that XRP is currently undervalued and poised for substantial growth. While such predictions should be taken with caution, they reflect the optimism that persists among certain XRP proponents.

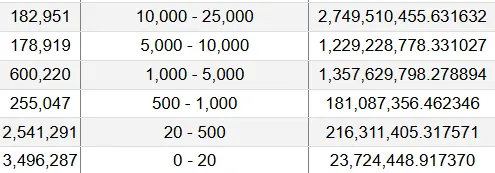

Data from the XRP Rich List reveals that only a small percentage of XRP holders possess this quantity of tokens, suggesting that such a holding could indeed be considered a premium position. This scarcity, combined with potential future demand, could theoretically drive up the value of XRP, rewarding those who hold a significant amount.

Discounted Buying Opportunity

Since the initial bullish comments, XRP’s price has experienced a notable decline, presenting a possible opportunity for investors to accumulate more tokens at a discount. Some analysts have pointed to this price dip as a “Black Friday” moment, suggesting that the current levels offer an attractive entry point for long-term investors. The argument is that acquiring XRP at lower prices could amplify potential returns if the digital asset appreciates in the future.

Analyst Sentiment and Market Catalysts

Despite the inherent volatility and uncertainty, numerous analysts maintain a bullish stance on XRP. Factors contributing to this optimism include the potential launch of XRP ETFs and Ripple’s recent conditional approval for a U.S. bank charter. The introduction of XRP ETFs could drive significant institutional inflows, while regulatory clarity surrounding Ripple’s operations could further legitimize XRP as an investment asset.

XRP’s Trajectory and ETF Impact

The performance of XRP ETFs, which have already attracted substantial inflows, highlights the growing institutional interest in the digital asset. These inflows suggest a belief among institutional investors that XRP has long-term value and growth potential. As the regulatory landscape evolves and traditional financial institutions become more involved in the crypto space, XRP could benefit from increased adoption and liquidity.

Navigating Uncertainty

While the potential for XRP to reach ambitious price targets exists, investors should exercise caution and conduct thorough research before making any investment decisions. The crypto market is inherently volatile, and unforeseen events can significantly impact asset prices. A balanced approach that considers both the potential upside and downside risks is essential for navigating the uncertainties of the digital asset market.

In conclusion, the discussion around XRP’s future valuation and the potential benefits of holding a significant amount of the token reflects the ongoing evolution of the crypto market. While the claims of financial freedom may be speculative, the underlying factors driving optimism, such as regulatory progress and institutional interest, warrant attention from investors seeking exposure to this unique digital asset.

Related: XRP Price Fights, Signals No Major Gains

Source: Original article

Quick Summary

An analyst suggests holding 10,000 XRP tokens could lead to financial freedom. This perspective highlights the ongoing debate about XRP’s valuation and future potential within the broader crypto market. The discussion is relevant for institutional investors tracking XRP’s market dynamics, Ripple’s regulatory progress, and potential shifts in investment strategies.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.