An Elliott Wave analyst suggests XRP could rally to $20 this cycle based on unique price behavior. The analysis hinges on XRP establishing a firm price floor and completing a specific corrective pattern. The potential rally could attract more institutional interest, especially if XRP ETF products emerge.

What to Know:

- An Elliott Wave analyst suggests XRP could rally to $20 this cycle based on unique price behavior.

- The analysis hinges on XRP establishing a firm price floor and completing a specific corrective pattern.

- The potential rally could attract more institutional interest, especially if XRP ETF products emerge.

As XRP attempts to sustain its recent recovery, market analysts are weighing the potential for further gains. One Elliott Wave specialist believes a rally to $20 is within reach, citing XRP’s unusual price action and the completion of a specific corrective pattern. This bullish outlook could influence investor sentiment and potentially drive more liquidity into XRP markets.

XRP’s Unprecedented Price Stability

An analyst known as XForceGlobal suggests that XRP’s current trading range is historically tight, establishing a new price floor around $2. Unlike previous cycles where XRP quickly lost ground after rallies, it has maintained relatively strong levels near prior all-time highs for an extended period. This resilience indicates underlying market strength and a potential shift in investor behavior.

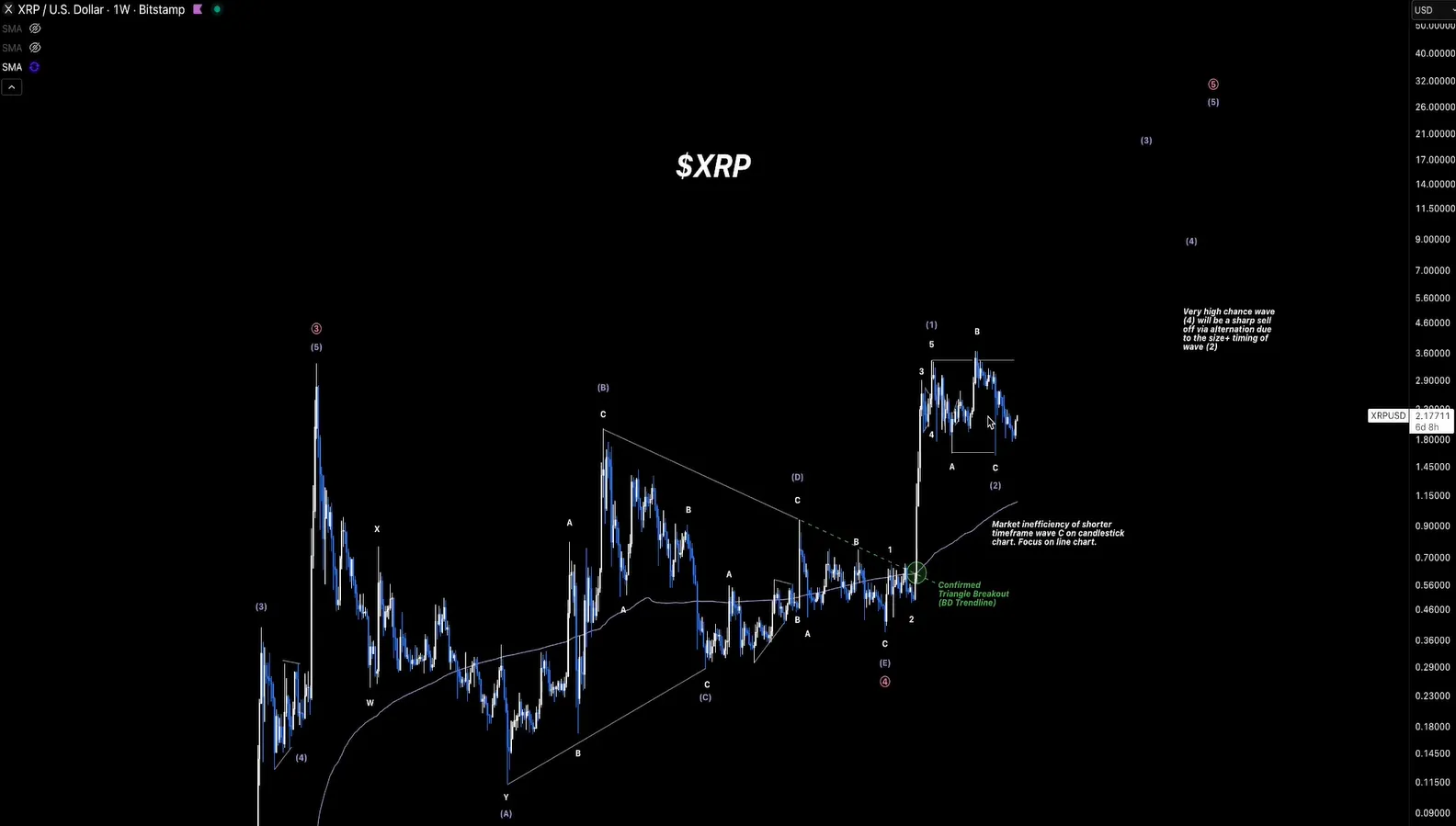

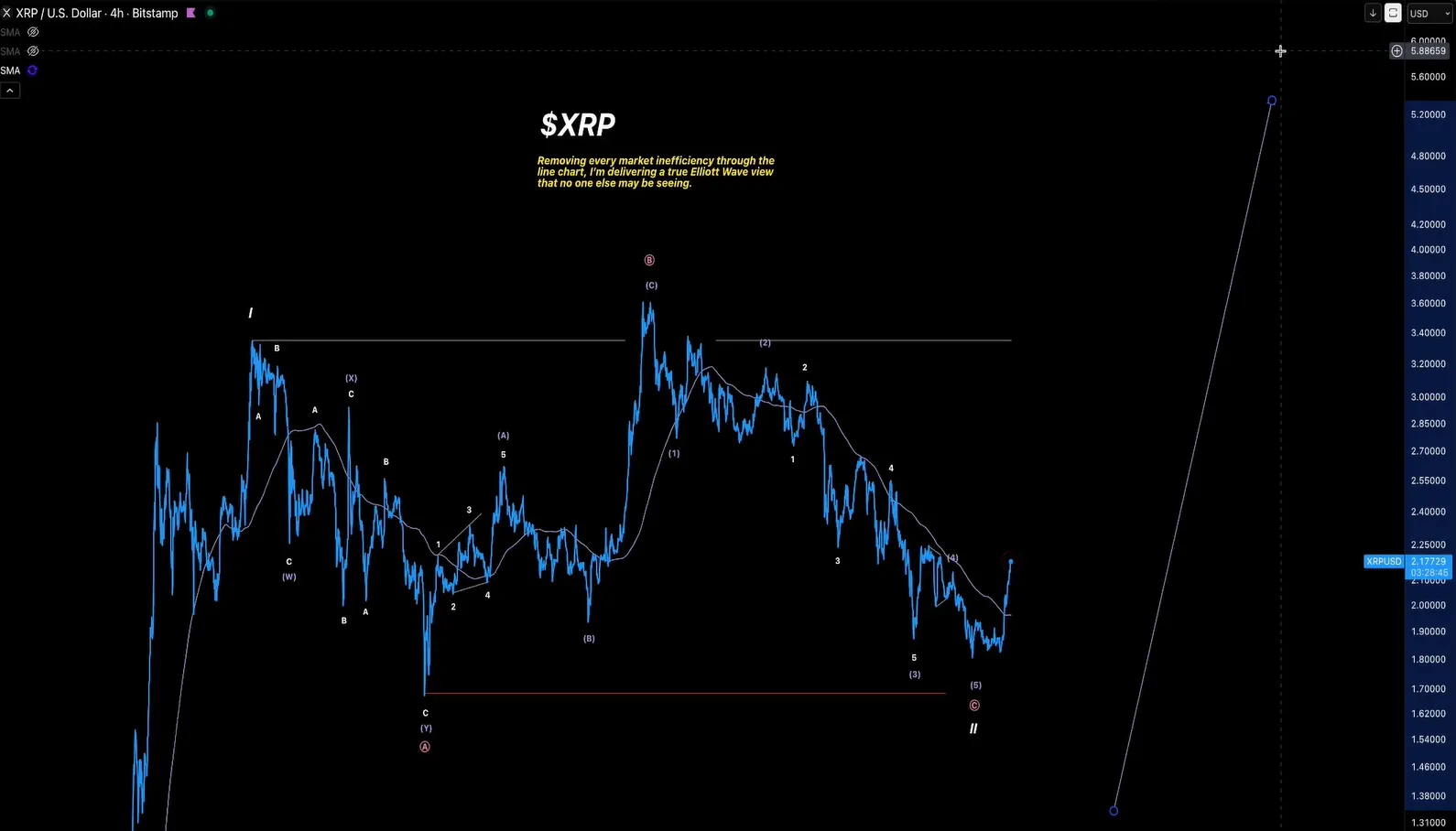

Decoding XRP’s Corrective Structure

According to Elliott Wave theory, markets typically pause within zigzags, flats, or triangles before resuming their primary trend. The analyst believes XRP’s recent correction resembles a “running flat” pattern, characterized by fake-outs that ultimately lead to a strong breakout in the direction of the main trend. This pattern suggests that the recent downtrend may have been a deceptive move before a significant rally.

Targets Based on Wave Completion

XForceGlobal believes XRP has completed the five-wave decline within the running flat pattern, signaling the end of the correction. While acknowledging the possibility of a final dip to the $1.30-$1.50 range, the analyst suggests that the recent upward movement appears impulsive, indicating the start of a new uptrend. If this analysis holds, XRP could be in the early stages of a significant rally.

Potential Price Targets and Institutional Implications

Based on this analysis, the analyst has set a conservative target of $5 for this cycle, with potential for $10, $20, or even $30 if momentum accelerates. Such a rally could attract more institutional attention, particularly as the regulatory landscape for XRP becomes clearer. The emergence of XRP ETF products could further fuel institutional inflows and drive prices higher.

XRP’s Future Outlook

While technical analysis provides valuable insights, market predictions remain uncertain. XRP’s price action will depend on various factors, including regulatory developments, broader market sentiment, and adoption rates. However, if the Elliott Wave analysis proves accurate, XRP could be poised for substantial gains in the coming months, potentially reshaping its market structure and attracting significant institutional investment.

Related: Crypto Rally Stalls

Source: Original article

Quick Summary

An Elliott Wave analyst suggests XRP could rally to $20 this cycle based on unique price behavior. The analysis hinges on XRP establishing a firm price floor and completing a specific corrective pattern. The potential rally could attract more institutional interest, especially if XRP ETF products emerge.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.