XRP’s struggle below $1.60 indicates persistent bearish pressure, with potential for a relief rally if buyers can establish support and volume. Shiba Inu is tracing a path to recovery, but it needs to overcome key moving averages and the $0.0000078 resistance to confirm a trend reversal.

What to Know:

- XRP’s struggle below $1.60 highlights persistent bearish pressure, with potential for a relief rally if buyers can establish support and volume.

- Shiba Inu is tracing a path to recovery, but it needs to overcome key moving averages and the $0.0000078 resistance to confirm a trend reversal.

- Ethereum’s oversold conditions, reminiscent of April 2025, present a potential bounce opportunity, contingent on stabilizing market sentiment and regaining key levels.

The cryptocurrency market is showing tentative signs of recovery after a period of sustained selling pressure. XRP, Shiba Inu, and Ethereum are each at critical junctures that could determine their short- to medium-term trajectories. Institutional investors are closely watching these assets for signs of sustainable momentum, as oversold conditions and potential breakouts offer tactical opportunities.

XRP’s Bearish Trap

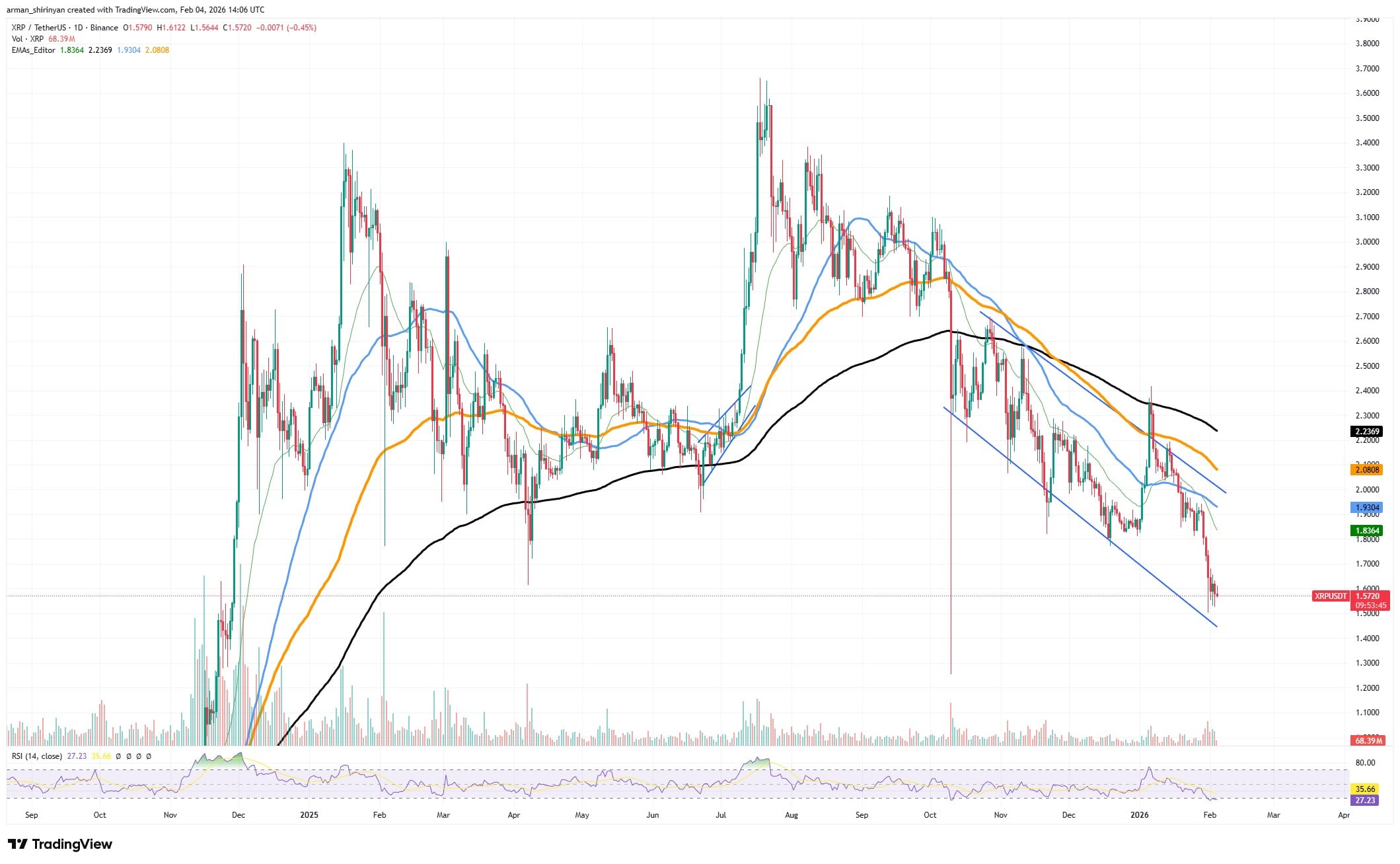

XRP is currently ensnared in a bearish pattern, struggling to break above the $1.60 level, which now acts as a significant resistance. The repeated failures to sustain upward momentum suggest underlying weakness and persistent selling interest. This level is not just a technical barrier but also a psychological one for traders.

The inability to breach this threshold raises concerns about XRP’s ability to attract substantial capital inflows. Similar patterns have been observed in other assets, where prolonged consolidation below a key level leads to investor fatigue and further downward pressure. A decisive move above $1.60, supported by strong volume, would signal a potential shift in market sentiment. Absent that, XRP may continue to languish.

Shiba Inu’s Recovery Roadmap

Shiba Inu is attempting to carve out a recovery structure after a sharp decline, with buyers showing tentative interest. However, the momentum remains weak, and a full trend reversal is not yet confirmed. The path to recovery is becoming clearer, but execution is key.

The immediate challenge for SHIB is to reclaim its short-term moving averages, particularly the 26 and 50 EMAs, which have acted as dynamic resistance. Overcoming these hurdles could attract short-term traders and signal a structural improvement in price action. The ultimate test lies at $0.0000078, a level that must be surpassed to invalidate the current bearish structure.

Ethereum’s Oversold Bounce

Ethereum is currently navigating one of its most oversold conditions in nearly a year, with the daily RSI reaching levels not seen since April 2025. This extreme condition often precedes a relief rally or a period of consolidation as the market absorbs excess supply. Given the upcoming ETH ETF approvals, many analysts and investors are closely watching this asset for a bounce.

The aggressive downside momentum and high trading volume suggest significant market participants have been reducing exposure, potentially through liquidations. However, oversold conditions alone do not guarantee an immediate reversal, especially if overall market sentiment remains negative. ETH needs to stabilize above key moving averages to regain investor confidence.

Macroeconomic Considerations

The broader macroeconomic environment plays a crucial role in the potential for recovery across these assets. Factors such as interest rate policies, inflation data, and overall risk appetite influence capital flows into the cryptocurrency market. A more dovish stance from central banks could provide a tailwind, while continued hawkishness may dampen enthusiasm.

Regulatory Developments

Regulatory clarity remains a key driver for institutional adoption. Positive developments, such as the approval of spot Bitcoin ETFs, have historically spurred market rallies. Conversely, increased regulatory scrutiny or enforcement actions can trigger sell-offs. Investors should closely monitor regulatory announcements and their potential impact on market sentiment.

Derivatives Positioning

The positioning of derivatives, such as futures and options, can amplify price movements. High levels of leverage and concentrated positions can lead to cascading liquidations during periods of market stress. Monitoring open interest and funding rates can provide insights into potential vulnerabilities and inform risk management strategies.

Conclusion

XRP, Shiba Inu, and Ethereum are each at critical junctures, presenting both opportunities and risks for investors. XRP needs to overcome its bearish trap, Shiba Inu must execute its recovery roadmap, and Ethereum is poised for a potential oversold bounce. The broader market context, including macroeconomic factors, regulatory developments, and derivatives positioning, will ultimately determine their trajectories.

Related: XRP Targets $4.9 After Wyckoff Buy Signal

Source: Original article

Quick Summary

XRP’s struggle below $1.60 highlights persistent bearish pressure, with potential for a relief rally if buyers can establish support and volume. Shiba Inu is tracing a path to recovery, but it needs to overcome key moving averages and the $0.0000078 resistance to confirm a trend reversal.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.