A prominent Bitcoin trader suggests XRP’s evolution is designed to exclude retail investors over time. This perspective aligns with the broader narrative that XRP’s primary utility lies within institutional finance rather than retail speculation.

What to Know:

- A prominent Bitcoin trader suggests XRP’s evolution is designed to exclude retail investors over time.

- This perspective aligns with the broader narrative that XRP’s primary utility lies within institutional finance rather than retail speculation.

- The shift towards institutional adoption could significantly impact XRP’s accessibility and price dynamics for individual investors.

The narrative around XRP’s role in the cryptocurrency ecosystem is evolving, with some analysts suggesting the asset is increasingly geared towards institutional finance. A seasoned Bitcoin trader known as AltcoinFox recently voiced concerns that XRP’s trajectory may lead to retail investors being priced out. This perspective adds to the ongoing debate about XRP’s utility and its potential impact on individual investors versus large financial institutions. Is XRP destined for institutional dominance, or will retail speculation continue to play a significant role?

The ‘Priced Out’ Argument

The idea that XRP could become inaccessible to retail investors isn’t new. For years, observers have suggested that XRP’s long-term value lies in its adoption by banks, corporations, and central institutions. The argument is that as institutional demand grows, the influence of retail investors will diminish. This shift could lead to a scenario where XRP’s price becomes driven by large-scale financial flows, making it difficult for individual investors to accumulate meaningful positions.

Wallet Data and Accumulation Trends

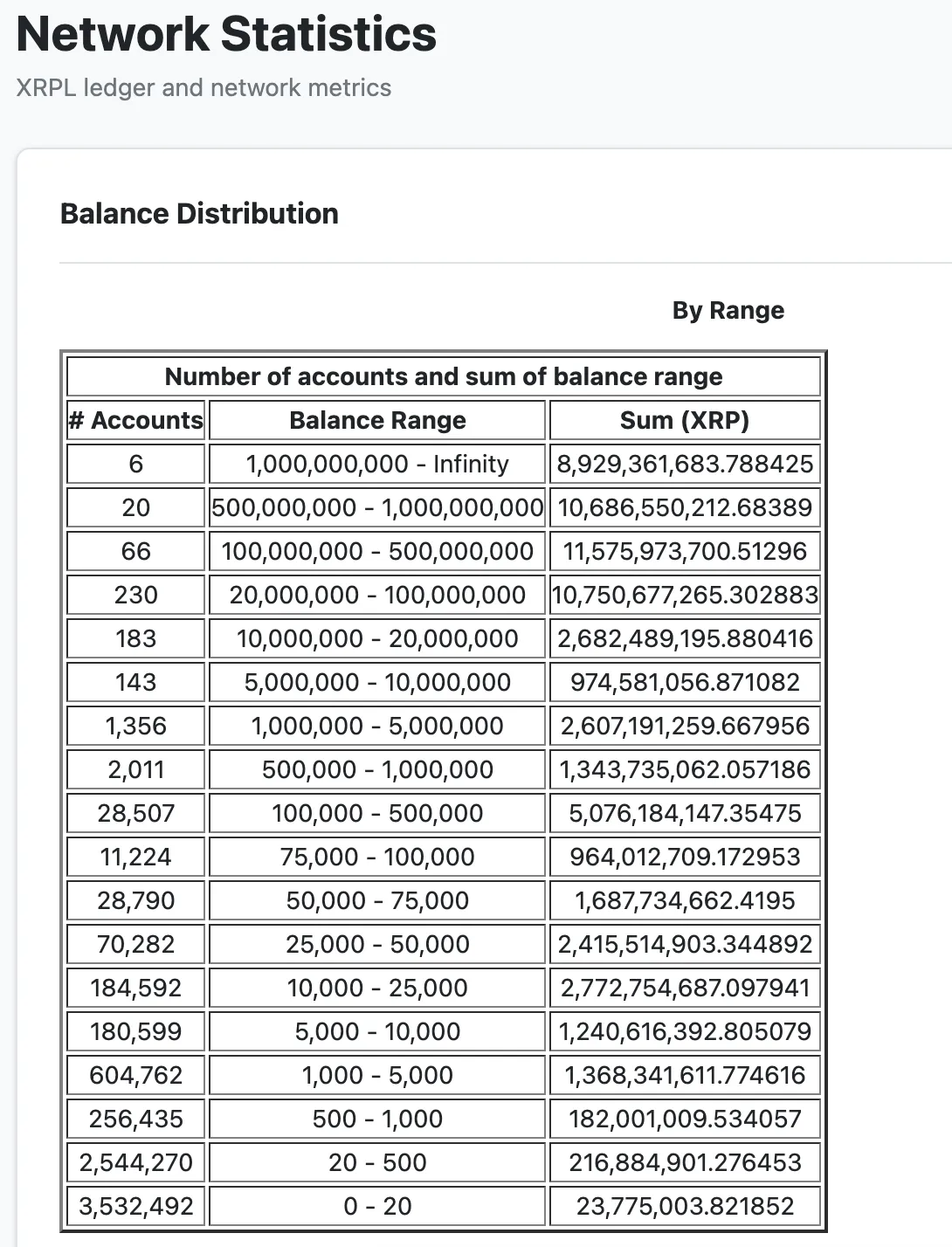

Current data from the XRP Rich List appears to support the “priced out” thesis. The data indicates that a significant portion of XRP wallets hold relatively small balances. Over six million wallets contain 500 XRP or fewer. As the price of XRP increases, acquiring even a modest amount becomes more challenging for the average investor. This trend suggests that meaningful exposure to XRP may become financially prohibitive for many as prices rise.

XRP’s Role in Financial Infrastructure

Proponents of the “priced out” thesis believe that XRP’s evolution is intentional, positioning it as a key component of future financial infrastructure. Ripple’s focus on providing global payment systems, custody services, and settlement tools based on the XRP Ledger signals a shift away from retail speculation towards institutional utility. In this view, XRP’s value is tied to its role in facilitating large liquidity flows rather than short-term price fluctuations driven by market hype.

Liquidity, Utility, and Market Cap

Some analysts argue that comparing XRP’s market capitalization to other cryptocurrencies is irrelevant due to its unique role in global settlements, tokenized real-world assets, and cross-border finance. According to this perspective, XRP’s price will be determined by its accessibility as a liquidity tool for institutions rather than by speculative trading activity. The key question is whether retail investors will have the opportunity to participate as institutional demand takes over.

Counterarguments and Market Dynamics

Of course, not everyone agrees with the “priced out” thesis. Skeptics contend that XRP’s price will continue to be influenced by broader market speculation, regardless of institutional adoption. They argue that the cryptocurrency market is inherently volatile and that retail investors will continue to play a significant role in driving price movements. The future of XRP’s price dynamics remains uncertain, with both institutional utility and retail speculation likely to play a part.

The debate surrounding XRP’s future highlights the evolving dynamics of the cryptocurrency market. While some believe XRP is destined for institutional dominance, others maintain that retail speculation will continue to be a significant factor. Ultimately, the interplay between these forces will determine XRP’s accessibility and price trajectory in the years to come.

Related: Bitcoin Rejected: Crypto Weekend Watch

Source: Original article

Quick Summary

A prominent Bitcoin trader suggests XRP’s evolution is designed to exclude retail investors over time. This perspective aligns with the broader narrative that XRP’s primary utility lies within institutional finance rather than retail speculation. The shift towards institutional adoption could significantly impact XRP’s accessibility and price dynamics for individual investors.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.