XRP utility within the Ripple ecosystem and its impact on the XRP Ledger has become a focal point for crypto investors seeking long-term relevance.

XRP utility within the Ripple ecosystem and its impact on the XRP Ledger has become a focal point for crypto investors seeking long-term relevance. Recently, Bitwise Investments, a respected digital asset management firm, addressed critical questions surrounding XRP’s intrinsic value and practical roles within the broader Ripple-driven financial infrastructure.

An influencer in the XRP community, known as WrathofKahneman (WOK), highlighted an insightful report from Bitwise. Described as clear and informative, the analysis dissects XRP’s unique value proposition by distinguishing its separate, yet interconnected roles as a cryptocurrency, a utility token for the XRP Ledger (XRPL), and a strategic asset leveraged by Ripple.

XRP, XRP Ledger, and Ripple: Clarifying the Ecosystem

Bitwise begins by distinguishing between XRP (the token), the XRP Ledger (the blockchain protocol), and Ripple (the company). XRPL is a high-throughput blockchain using a proof-of-authority consensus algorithm to facilitate rapid global transactions. Meanwhile, XRP serves as the native currency of XRPL, and Ripple is a private technology firm that utilizes the ledger—and by extension XRP—as part of its international payment solutions.

Three Primary Drivers of XRP’s Value

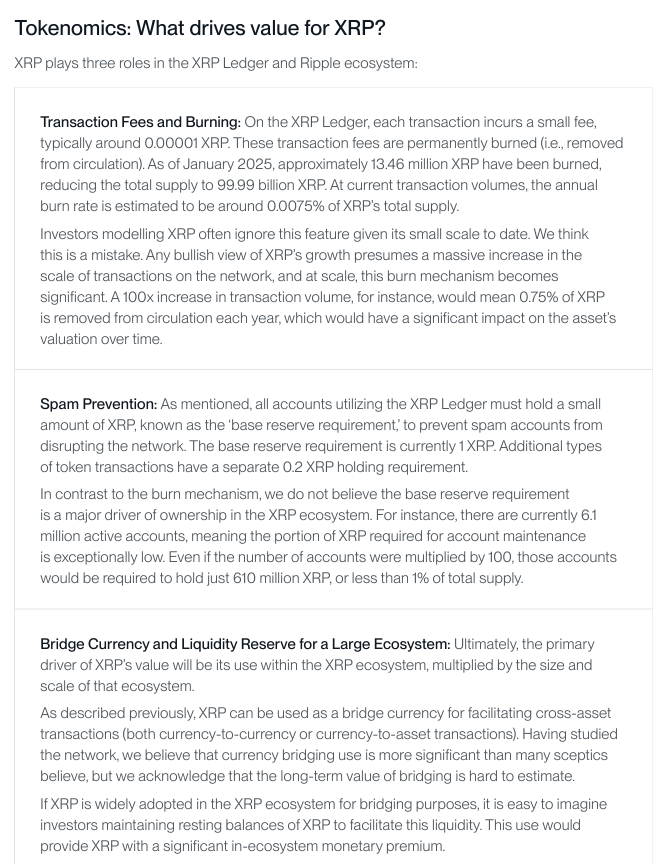

According to Bitwise, the value that XRP accumulates within the ecosystem stems from three key areas: transaction fees, spam mitigation, and bridging capabilities.

Firstly, XRP’s utility as a transaction fee token plays a foundational role. Fees incurred during each XRPL transaction are paid in XRP, and these fees are permanently burned, reducing the circulating supply over time. So far, this mechanism has destroyed 13.85 million XRP, shaving down the supply to approximately 99.986 billion XRP. With a current average of 1.17 million daily transactions on XRPL in Q1 2025, a rise in transaction activity could accelerate the burn rate. Bitwise suggests that a 100-fold increase could push the annual burn rate to 0.75% of total supply, thereby introducing long-term deflationary pressure that enhances value.

Spam Deterrence through Base Reserve

The second function involves security. XRP acts as an anti-spam feature by enforcing a minimum reserve requirement per account on the ledger. Currently set at 1 XRP following a major change in December 2024, this measure prevents mass account creation that could disrupt network stability. Previously, the cost was 10 XRP. While useful for network reliability, Bitwise argues this reserve mechanism doesn’t significantly influence demand, especially with 6.1 million active addresses on record. Even with a 100-times growth in active wallets, the effect on token supply remains negligible.

Bridge Currency: The Core Catalyst

Arguably XRP’s most crucial functionality lies in its role as a bridge asset. Ripple’s core business leverages XRP to facilitate cross-border currency and asset transfers via the XRP Ledger. As institutions begin to adopt XRPL for seamless, real-time liquidity solutions, their need to hold XRP as a bridging currency is expected to increase. This uptick in institutional adoption could significantly affect XRP’s supply and demand balance, contributing to long-term value appreciation.

Ripple’s Competitive Play Against SWIFT

Looking ahead, Ripple is boldly aiming to challenge SWIFT, the dominant global messaging network for financial transactions. Industry analysts have speculated that capturing even 15% of SWIFT’s daily volume could catapult XRP to a valuation level as high as $25.68, showcasing its massive market potential if adoption ramps up at scale.

That said, there are variables to monitor. One growing consideration among analysts is the impact of Ripple’s new USD stablecoin, which debuted in December. Although Ripple has assured stakeholders that this stablecoin won’t displace XRP’s role, its usage could dilute transaction volumes previously reserved for the XRP token. The degree to which this affects XRP utility remains to be seen as both assets coexist on XRPL.

Related: Expert Advice: Sell XRP If You’re Confused

In summary, XRP’s value narrative rests on its multifunctional use within a thriving ledger infrastructure. Whether it’s transaction utility, network integrity, or bridging global finance, XRP continues to evolve as a cornerstone in Ripple’s vision for decentralized, real-time payments.

Quick Summary

XRP utility within the Ripple ecosystem and its impact on the XRP Ledger has become a focal point for crypto investors seeking long-term relevance. Recently, Bitwise Investments, a respected digital asset management firm, addressed critical questions surrounding XRP’s intrinsic value and practical roles within the broader Ripple-driven financial infrastructure.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.