Speculation arose regarding XRP’s true value being linked to Ripple’s potential IPO, based on an SBI Holdings report. SBI, holding a 9% stake in Ripple, clarified that it would only include the value of its stake after Ripple’s public valuation.

What to Know:

- Speculation arose regarding XRP’s true value being linked to Ripple’s potential IPO, based on an SBI Holdings report.

- SBI, holding a 9% stake in Ripple, clarified that it would only include the value of its stake after Ripple’s public valuation.

- Despite the IPO speculation, optimism surrounds Ripple’s commitment to XRP, reinforced by recent partnerships and acquisitions.

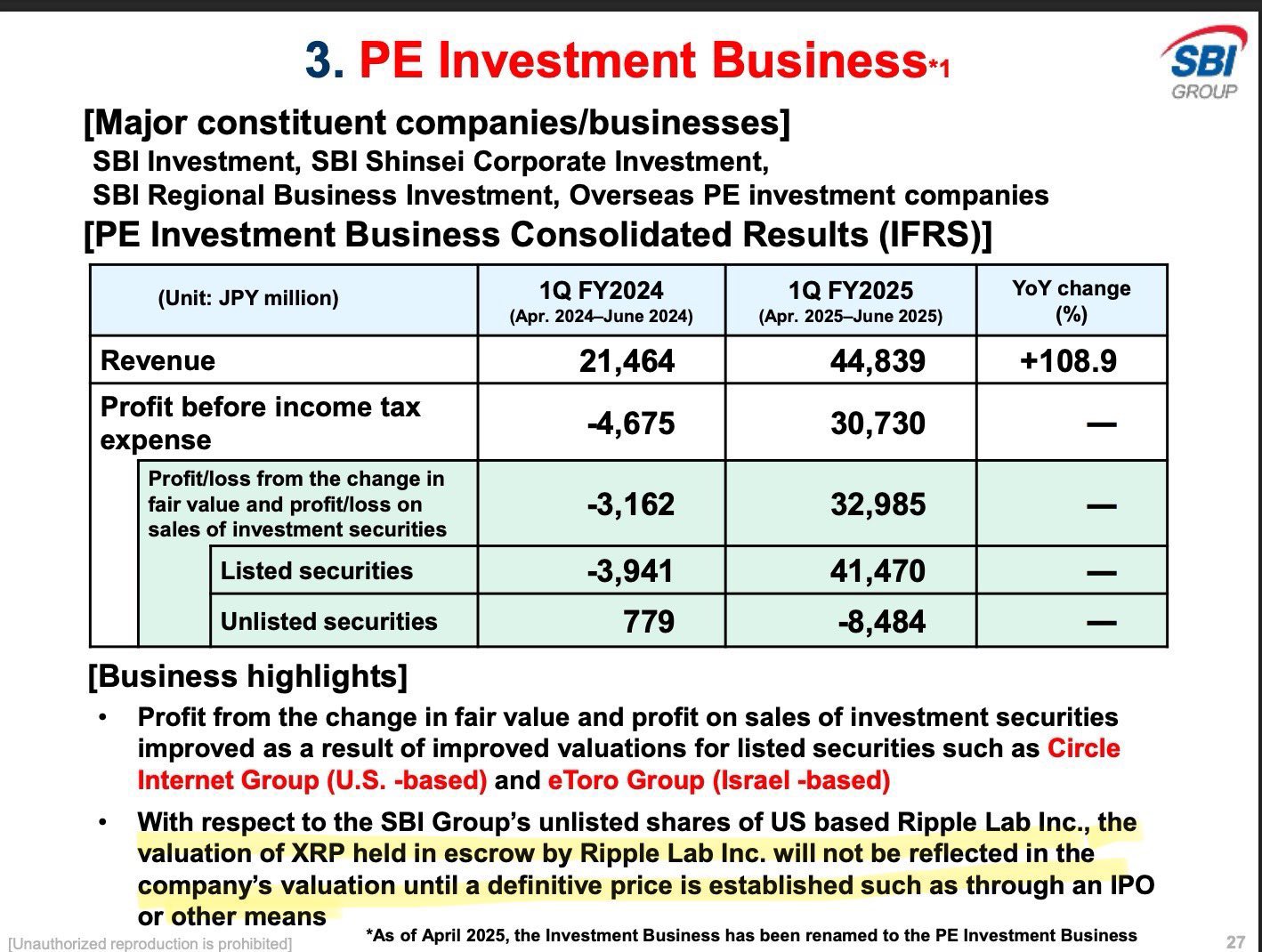

The crypto community is buzzing over speculation that the true value of XRP will only be revealed after Ripple goes public, fueled by interpretations of a recent SBI Holdings financial report. Crypto researcher SMQKE analyzed the report, suggesting that SBI hinted at this connection. However, SBI’s statements specifically address valuing their equity stake in Ripple, not necessarily XRP’s market price.

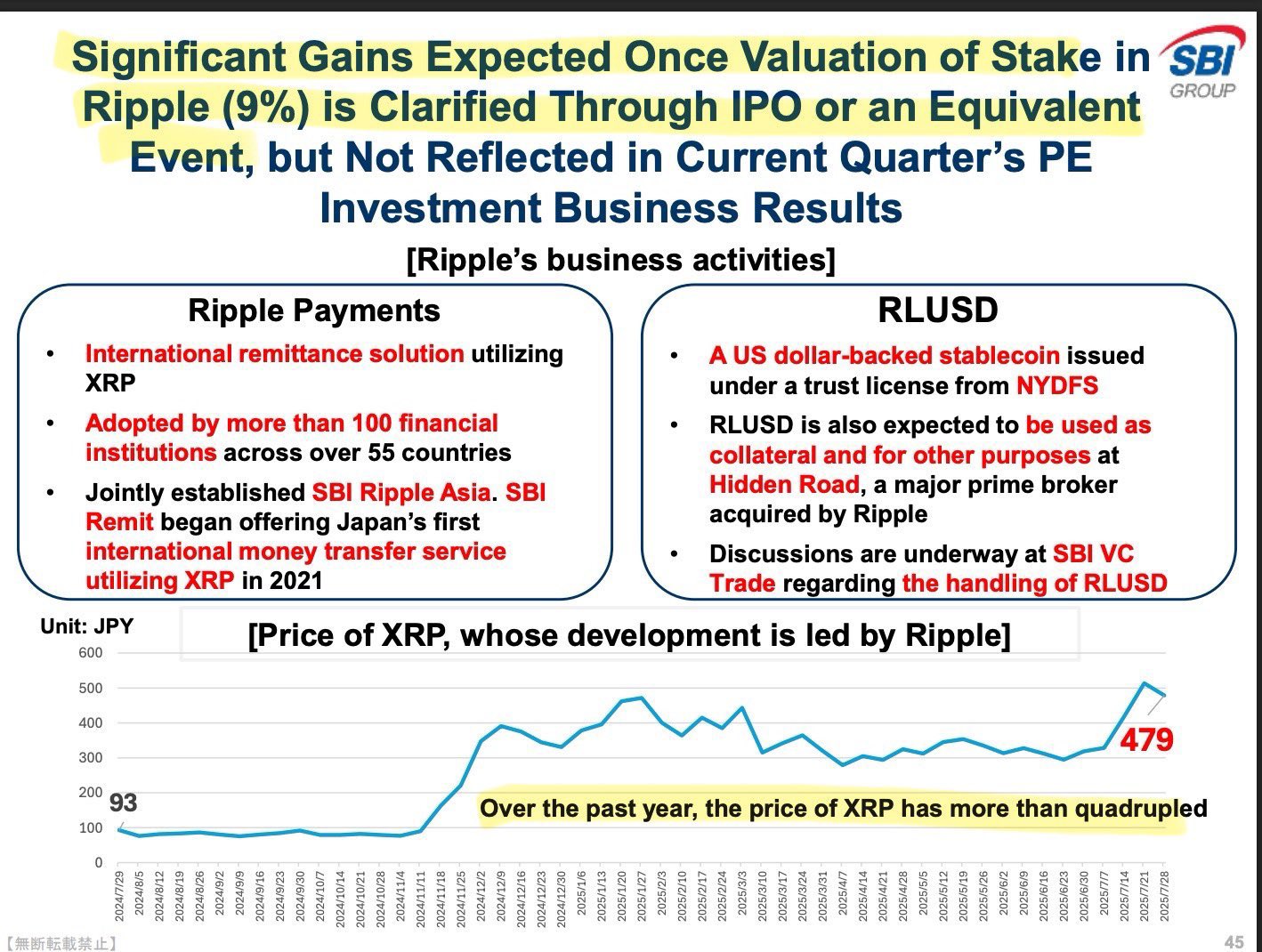

SBI’s report highlighted potential gains from its 9% ownership in Ripple, contingent on a defined valuation through an IPO or similar event. The report also mentioned that the value of Ripple’s unlisted shares and XRP in escrow would not be included in their valuation until a concrete market price is established. This clarification aimed to provide transparency regarding SBI’s investment strategy.

Despite SMQKE’s interpretation, optimism around Ripple’s commitment to XRP is growing, reassuring investors of its ongoing utility. Ripple’s recent acquisition of Hidden Road, along with CEO Brad Garlinghouse’s reaffirmation, underscores XRP’s central role in Ripple’s operations. The partnership with Gemini to launch an XRP credit card further demonstrates Ripple’s dedication to expanding XRP’s ecosystem.

Recent moves by Ripple support this positive outlook. The launch of Ripple Prime, offering spot brokerage in the U.S., includes both RLUSD and XRP as tradeable assets. This integration highlights Ripple’s continued focus on XRP, addressing earlier concerns about a potential shift in strategy.

While Ripple has stated that there are no immediate plans for an IPO, its strong financial position allows for strategic partnerships and acquisitions. This approach enables Ripple to expand its market presence and enhance the utility of XRP within its ecosystem, contributing to its long-term value proposition amid evolving crypto regulations and the rise of Bitcoin ETFs.

In conclusion, while speculations about XRP’s value being tied to a Ripple IPO have circulated, SBI’s statements primarily concern the valuation of its equity stake. The underlying sentiment remains bullish, driven by Ripple’s strategic initiatives and reaffirmation of XRP’s importance.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Speculation arose regarding XRP’s true value being linked to Ripple’s potential IPO, based on an SBI Holdings report. SBI, holding a 9% stake in Ripple, clarified that it would only include the value of its stake after Ripple’s public valuation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.