XRP spot trading volumes on Upbit and Binance have recently surged, sparking a competition for the top spot in XRP trading volume. This increase in volume occurs within a broader context of fluctuating interest in XRP, following a period of decline after reaching a two-month high.

What to Know:

- XRP spot trading volumes on Upbit and Binance have recently surged, sparking a competition for the top spot in XRP trading volume.

- This increase in volume occurs within a broader context of fluctuating interest in XRP, following a period of decline after reaching a two-month high.

- The renewed interest and volume spikes could signal a potential recovery for XRP, impacting institutional and high net worth investors looking for opportunities in the digital asset space.

Recent data indicates a heated competition between Upbit and Binance to secure the highest XRP spot trading volume. This surge in activity suggests renewed interest in XRP, potentially signaling a shift in market sentiment after a period of relative apathy. For institutional and high net worth investors, these volume spikes can offer insights into short-term trading opportunities and broader market trends.

Upbit and Binance Volume Surge

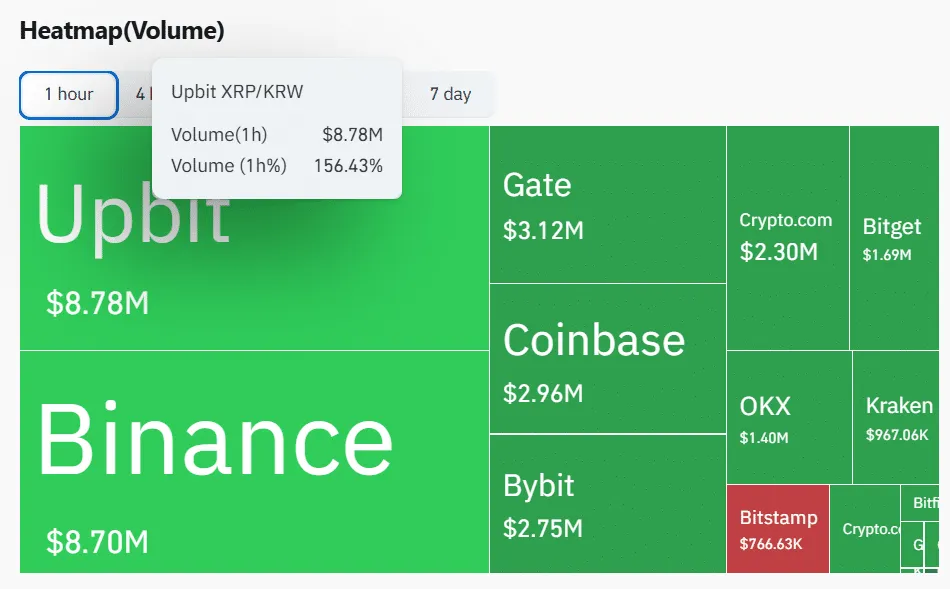

Coinglass data reveals a significant spike in XRP trading volume on both Upbit and Binance. Specifically, the XRP/KRW pair on Upbit, South Korea’s leading exchange, experienced a 156% surge in the past hour, reaching $8.78 million. Concurrently, the XRP/USDT pair on Binance, the world’s largest exchange by trade volume, saw a 69% increase, hitting $8.7 million. This competition highlights the concentration of XRP trading activity on these major exchanges and the potential for arbitrage opportunities.

Broader Market Participation

The increase in trading volume extends beyond Upbit and Binance, with exchanges like Gate.io, Coinbase, and Bybit also reporting spikes in XRP volumes. This broader participation suggests a wider resurgence of interest in XRP among retail and potentially institutional investors. Monitoring these volume trends across multiple exchanges can provide a more comprehensive view of market sentiment and potential price movements.

Fluctuations in XRP Interest

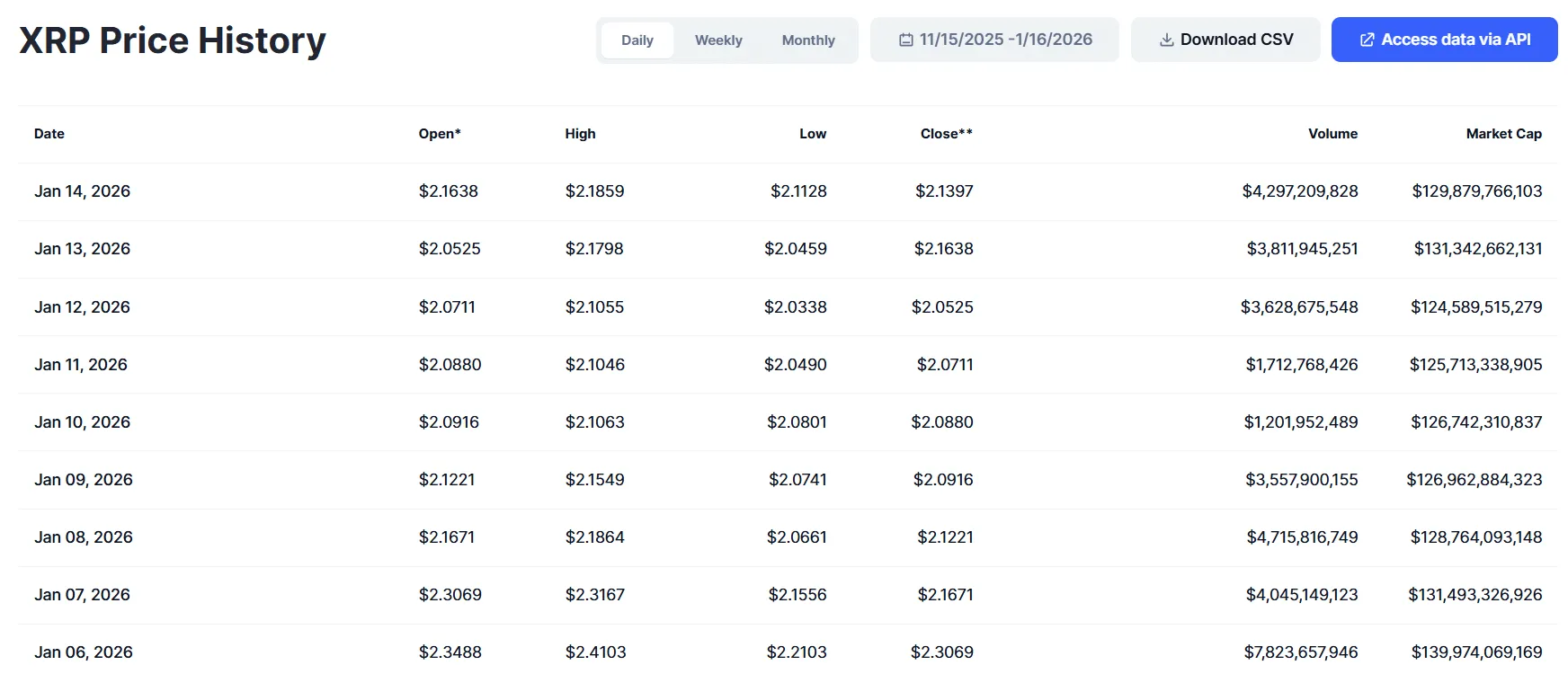

After reaching a 24-hour volume peak of $7.8 billion on January 6, coinciding with a two-month high of $2.41, XRP experienced a gradual decline in trading interest. The 24-hour volume decreased to $4 billion within two days, eventually dropping to $1 billion by January 10 and 11. However, recent data indicates a recovery in investor interest, with volumes rebounding to $3.6 billion on January 12, $3.8 billion on January 13, and $4.297 billion yesterday. These fluctuations underscore the volatility inherent in the XRP market and the importance of monitoring volume trends.

Interpreting Volume Spikes

While a surge in trading volume during a rebound can provide the necessary momentum for a sustained recovery, it’s crucial to interpret these spikes with caution. Increased volume does not always equate to increased buying pressure, as selloffs can also contribute to higher volumes. For instance, despite the recent volume spike, XRP has struggled to maintain the $2.2 price level from January 14, currently trading at $2.12. Analyzing order book depth and trade direction can provide additional insights into the nature of these volume spikes.

Market Dynamics and Future Outlook

The competition between Upbit and Binance for XRP trading volume, coupled with the broader resurgence in market participation, highlights the dynamic nature of the digital asset market. For institutional investors, these trends underscore the importance of monitoring exchange-specific activity and overall market sentiment to identify potential trading opportunities and manage risk. While the recent volume spikes are encouraging, sustained price appreciation will depend on continued buying pressure and positive developments in the regulatory landscape surrounding XRP and Ripple.

In conclusion, the observed increase in XRP trading volumes on major exchanges like Upbit and Binance suggests a potential shift in market sentiment. However, investors should remain cautious and consider broader market dynamics, including order book analysis and regulatory developments, before making investment decisions. These short-term volume trends provide valuable data points for assessing the overall health and potential of XRP in the digital asset market.

Related: XRP Signals Bottom Per Bollinger Bands

Source: Original article

Quick Summary

XRP spot trading volumes on Upbit and Binance have recently surged, sparking a competition for the top spot in XRP trading volume. This increase in volume occurs within a broader context of fluctuating interest in XRP, following a period of decline after reaching a two-month high.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.