High-net-worth investors are accumulating XRP despite its price remaining in a tight range under $2. XRP’s exchange supply is thinning, potentially setting the stage for sharper upside moves if demand increases. Activity on the XRP Ledger (XRPL) is surging, with DEX transaction counts reaching a 13-month high.

What to Know:

- High-net-worth investors are accumulating XRP despite its price remaining in a tight range under $2.

- XRP’s exchange supply is thinning, potentially setting the stage for sharper upside moves if demand increases.

- Activity on the XRP Ledger (XRPL) is surging, with DEX transaction counts reaching a 13-month high.

XRP has been trading within a narrow range below $2 to start 2026, but on-chain data reveals significant accumulation by large holders. Despite the sideways price action, “millionaire” wallets on the XRP network have increased, signaling a potential shift in market dynamics. This accumulation trend, coupled with other factors, suggests a possible bullish outlook for XRP.

The increase in “millionaire” wallets, defined as addresses holding at least 1 million XRP, indicates strong confidence among high-net-worth investors. This accumulation, occurring even as XRP’s price remains subdued, suggests that large holders are strategically building positions during this period of weakness. Such behavior can often foreshadow a potential uptrend as these holders anticipate future gains.

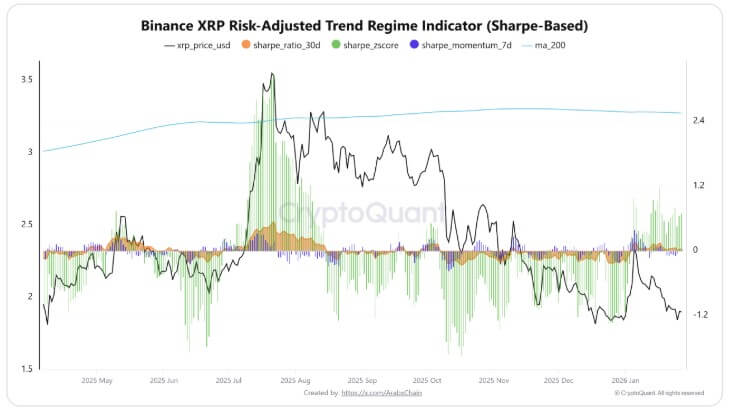

Despite the positive on-chain signals, XRP’s technical indicators present a mixed picture. The cryptocurrency is currently trading below its 200-day moving average, which typically keeps momentum traders cautious. However, this technical fragility may be overshadowed if the accumulation by large holders continues, potentially leading to a breakout.

The risk-adjusted performance metrics, such as the Sharpe Ratio, reflect the current cautious environment. The Sharpe Ratio is close to zero, indicating that recent returns have barely compensated investors for the volatility they have endured. This reinforces the view of a market in equilibrium, awaiting a fresh impulse to drive a clear trend.

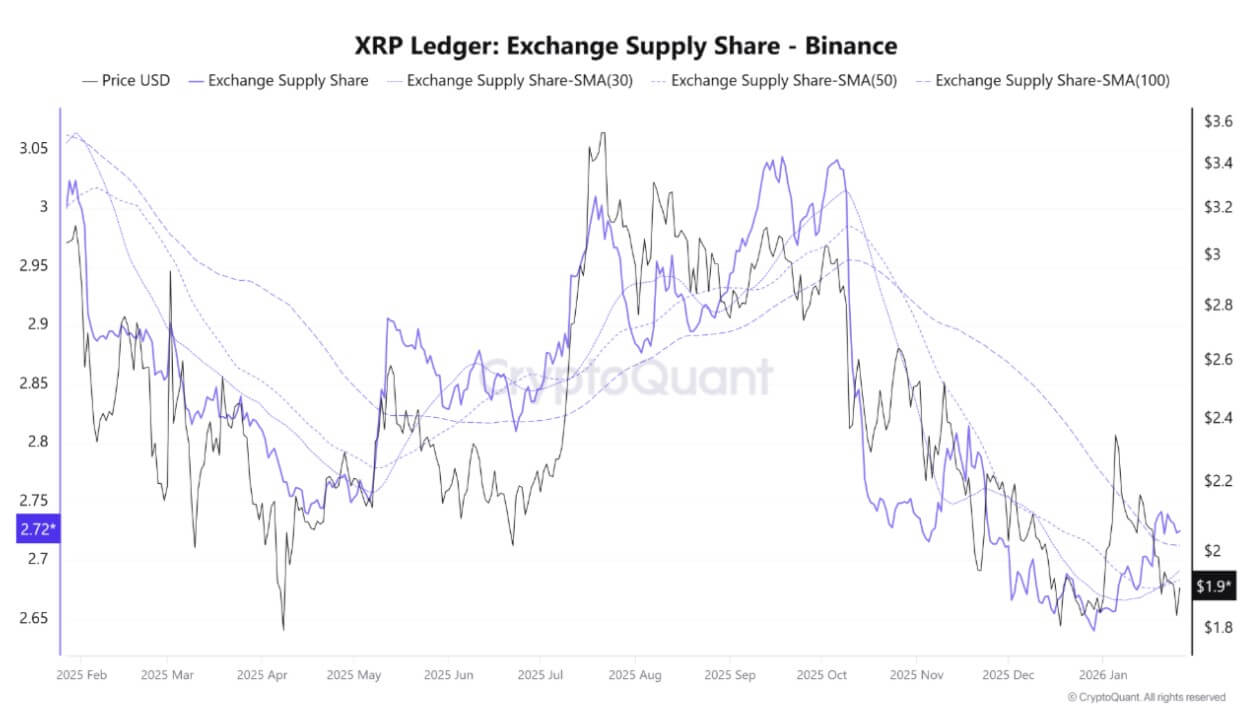

Another critical factor supporting a potential price increase is the tightening supply of XRP on exchanges. Data indicates that the proportion of XRP held on exchanges is in a “bottom zone,” suggesting that selling pressure has stabilized. A decline in exchange-held supply can set the stage for sharper upside moves, as fewer assets are readily available for sale during a rally.

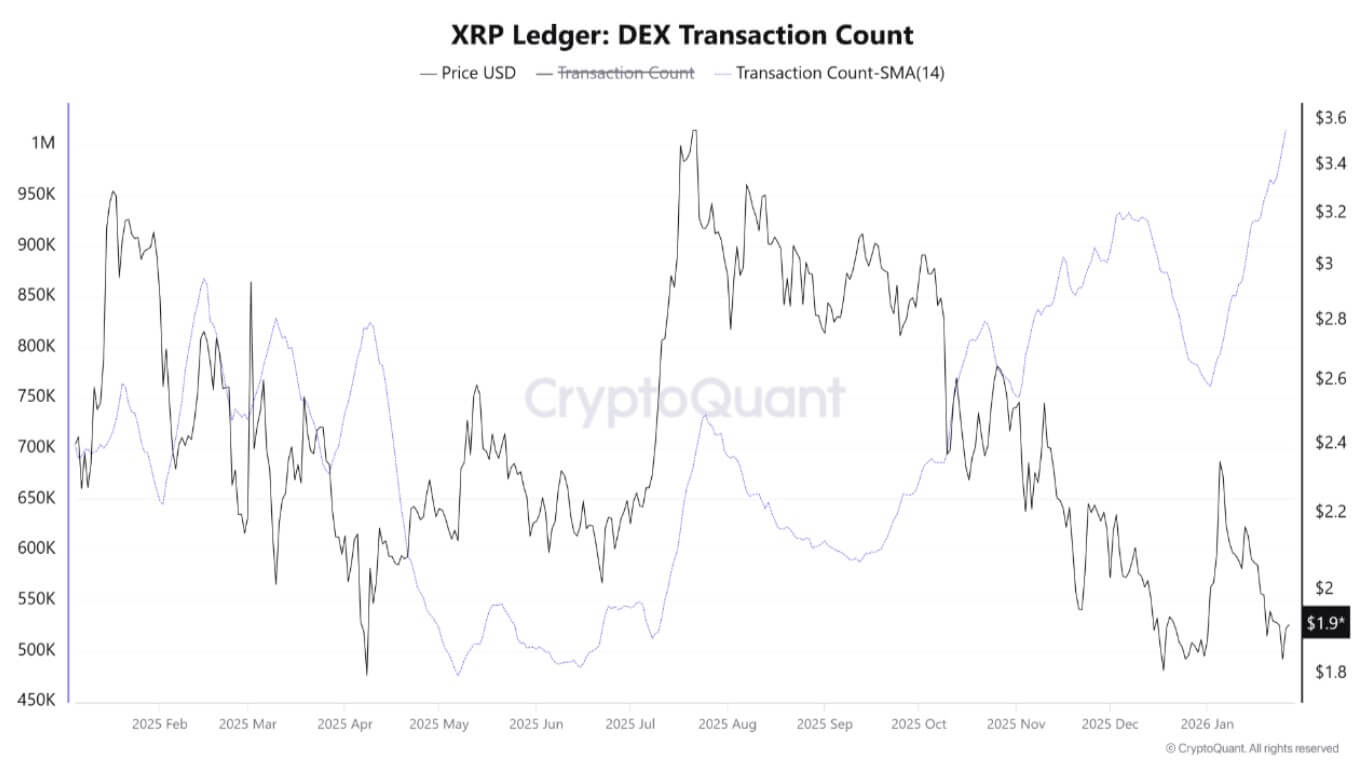

In addition to supply dynamics, activity on the XRP Ledger (XRPL) is showing positive signs. Decentralized exchange (DEX) usage on the XRPL has surged, with the 14-day moving average of DEX transaction counts reaching a 13-month high. This sustained increase in DEX activity indicates growing utility and liquidity within the XRPL ecosystem.

Overall, while XRP’s price has remained relatively stable, underlying data suggests a potential for future growth. The accumulation by large holders, thinning exchange supply, and increased activity on the XRPL point to a strengthening foundation for XRP. Investors should monitor these trends closely as they could signal a shift towards a more bullish phase.

Related: XRP Consolidation Signals Next Move

Source: Original article

Quick Summary

High-net-worth investors are accumulating XRP despite its price remaining in a tight range under $2. XRP’s exchange supply is thinning, potentially setting the stage for sharper upside moves if demand increases. Activity on the XRP Ledger (XRPL) is surging, with DEX transaction counts reaching a 13-month high.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.