XRP is facing renewed market pressure, with profitability metrics nearing levels last seen in late 2024. Derivatives activity shows cautious sentiment, with open interest in XRP futures declining significantly from earlier in the year.

What to Know:

- XRP is facing renewed market pressure, with profitability metrics nearing levels last seen in late 2024.

- Derivatives activity shows cautious sentiment, with open interest in XRP futures declining significantly from earlier in the year.

- Despite short-term weakness, long-term fundamentals remain strong, supported by Ripple’s developments and growing institutional interest through new XRP ETFs.

XRP is experiencing headwinds as a broader market downturn impacts its profitability. Data indicates that only 58.5% of XRP’s circulating supply is currently in profit, a level not seen since late 2024. This situation highlights the challenges XRP faces in maintaining upward momentum amid shifting market dynamics.

The derivatives market reflects a cautious outlook on XRP, with open interest in XRP futures contracts having fallen sharply from nearly $10 billion earlier in the year to around $3.8 billion. This decline suggests that speculative demand is waning, and traders are reducing their directional bets on XRP. The stall in XRP’s price growth since its post-election spike can be attributed to this reduced speculative activity.

Profit-taking by long-term holders who acquired XRP below $1 before the late-2024 surge has also contributed to the price pressure. The rate of profit realization among this cohort has increased by 240% since September, with daily profit-taking climbing from approximately $65 million to nearly $220 million. This activity is adding to the selling pressure on XRP.

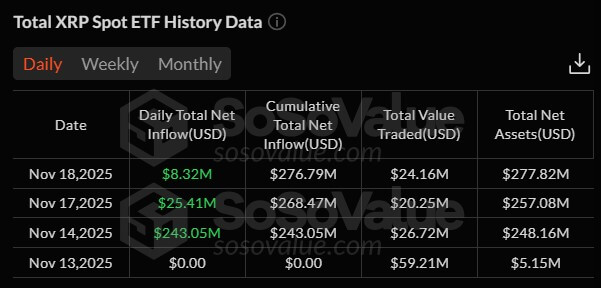

Despite the current challenges, XRP’s underlying fundamentals remain strong. Ripple’s resolution with the SEC, coupled with strategic acquisitions and partnerships, is fortifying the company’s ecosystem. The launch of several spot XRP ETFs by firms like Franklin Templeton and Bitwise indicates growing institutional interest in XRP, further supporting the long-term outlook.

While XRP faces short-term market pressures, its strong fundamentals, growing institutional adoption through ETFs, and Ripple’s strategic advancements suggest potential for future growth. Investors should monitor market trends and regulatory developments to assess XRP’s long-term positioning.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is facing renewed market pressure, with profitability metrics nearing levels last seen in late 2024. Derivatives activity shows cautious sentiment, with open interest in XRP futures declining significantly from earlier in the year.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.