XRP’s Institutional Era Has Finally Arrived: ETFs, Regulation, and Global Infrastructure Align at Once Brad Garlinghouse doesn’t post celebratory messages lightly. So when he wrote, “It’s (finally!) happening.” — he meant it.

XRP’s Institutional Era Has Finally Arrived: ETFs, Regulation, and Global Infrastructure Align at Once

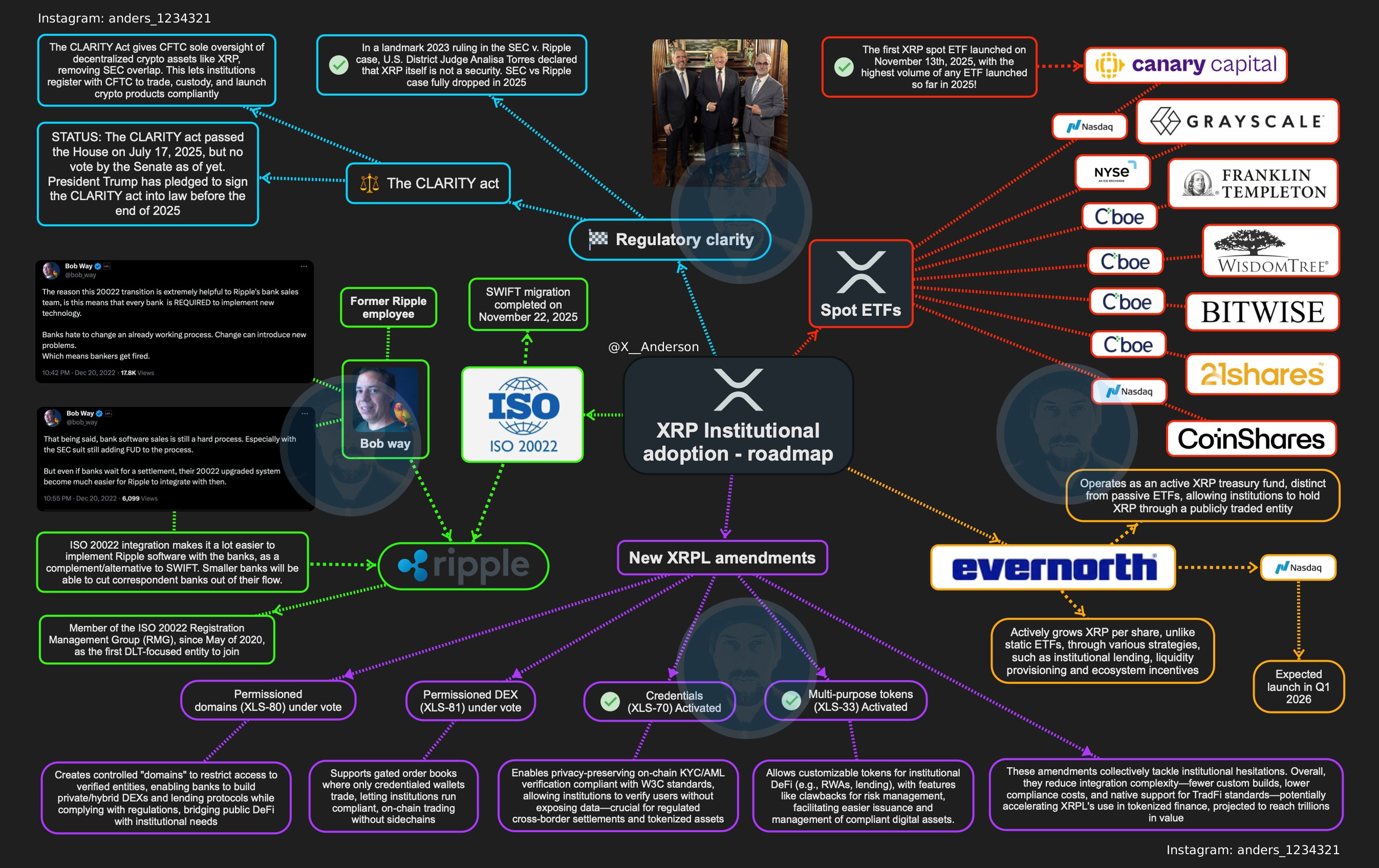

Brad Garlinghouse doesn’t post celebratory messages lightly. So when he wrote, “It’s (finally!) happening.” — he meant it. The timing lined up perfectly with the launch of the first pure spot XRP ETF, which instantly became the highest-volume ETF debut of all 900 ETFs in 2025.

This isn’t random hype. This is what a coordinated institutional rollout looks like.

Massive Facts You Can Actually Verify

Everything below is factual, documented, and unfolding within the same window — which is why analysts are calling this the biggest structural shift in XRP’s history.

1. The First Spot XRP ETF Broke 2025 Volume Records

- Launch Date: November 13, 2025

- Issuer: Canary Capital (Ticker: XRPC)

- Milestone: Highest-volume ETF debut of any U.S. ETF launched in 2025

This wasn’t a slow, quiet launch — institutional demand showed up instantly.

2. Multiple Additional XRP ETFs Are Already in the Pipeline

Public filings confirm:

- Franklin Templeton has filed for an XRP ETF

- Bitwise has filed for an XRP ETF

- Grayscale is preparing conversion for its XRP Trust

- Two additional issuers are expected to file in December

This is not speculation — these filings are public and active.

3. ISO 20022 Migration Is Complete

- SWIFT completed its mandatory ISO 20022 migration on November 22, 2025.

- This standard forms the messaging backbone for CBDCs, tokenized assets, and interbank settlement.

- XRP, along with XLM, HBAR, QNT, XDC, and ALGO, is referenced as ISO-compliant in industry documents.

This unlocks global interoperability that banks needed before touching blockchain settlement at scale.

4. The CLARITY Act Could Pass Before Year-End

The bipartisan CLARITY Act is progressing and includes:

- Commodity vs. security differentiation

- Stablecoin regulatory framework

- Rules for blockchain settlement networks

This is exactly the regulatory foundation institutions have been waiting for.

5. XRPL Upgrades Are Now Enterprise-Ready

Recent XRPL amendments enable:

- Decentralized identity and credentialing

- Multi-purpose and programmable tokens

- Permissioned domains and enterprise controls

- Regulated asset issuance

- Granular access rules for financial institutions

These are approved, voted on, and actively rolling out — not theoretical roadmaps.

6. Evernorth Built a $1B Regulated XRP Treasury

Evernorth has established a $1 billion regulated XRP treasury designed for:

- Institutional yield strategies

- High-liquidity operations

- Enterprise-grade custody and compliance

This is the first treasury of its size specifically designed around XRP.

This Alignment Is Not Random — It’s Synchronized

When you zoom out, the timing speaks for itself:

- ETF launches

- ISO 20022 completion

- Regulatory clarity approaching

- XRPL institutional upgrades

- Major treasury deployment

All converging in the same 90-day window.

For the first time ever:

- The rails are ready.

- The regulation is ready.

- The liquidity is ready.

- The ETFs are ready.

XRP’s institutional era isn’t coming — it’s happening right now.

Related: XRP Price: $12M Max Pain for Bears

Quick Summary

XRP’s Institutional Era Has Finally Arrived: ETFs, Regulation, and Global Infrastructure Align at Once Brad Garlinghouse doesn’t post celebratory messages lightly. So when he wrote, “It’s (finally!) happening.” — he meant it.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.