The XRP market continues to react to fresh developments following Ripple’s recent legal triumph, a pivotal moment that has shifted the landscape for Ripple and the broader crypto sector.

The XRP market continues to react to fresh developments following Ripple’s recent legal triumph, a pivotal moment that has shifted the landscape for Ripple and the broader crypto sector. The SEC’s decision to withdraw its appeal against Ripple marks a crucial milestone, potentially paving the way for improved regulatory clarity and broader institutional acceptance.

On August 11, a formal statement confirmed the SEC’s withdrawal of its case against Ripple. Commissioner Hester Peirce emphasized that now is the time to focus on crafting a robust legal framework for the crypto industry. SEC Chair Paul Atkins echoed this sentiment, suggesting the closure of the Ripple litigation opens up new possibilities for policy building to support both innovation and investor protection.

Legal representatives from Ripple expressed optimism about the agency’s shift in approach. Ripple’s Chief Legal Officer welcomed this move, framing it as a stepping stone toward improved crypto regulation in the U.S. The SEC also confirmed that, while the lawsuit has ended, the injunction barring Ripple from violating securities laws remains in place. However, the specifics of how each commissioner voted remain undisclosed.

Critically, the SEC approved a waiver preventing Ripple from being categorized as a “bad actor,” a designation that could have negatively impacted its ability to raise capital. Legal experts noted this exemption boosts Ripple’s prospects in pursuing broader objectives, including its ongoing attempt to secure a U.S. banking license. Former SEC officials clarified that if future legislation changes the requirements around crypto sales, the current injunction may lose effect altogether.

The next phase for XRP’s market progress appears closely linked to external triggers. Most notably, potential approval of XRP-specific spot ETFs remains top of mind for investors. Other factors include progress on Ripple’s U.S. bank charter application and developments on cross-border transaction networks like SWIFT.

After a brief rally to $3.3826 on August 8, XRP’s value fell to $3.1326, marking a 1.74% decrease and underperforming the broader crypto market. Without substantial movement on the ETF front, XRP struggled while the overall market ended a five-session gain streak. Should XRP manage to break through $3.2, it may challenge prior highs near $3.3830, with a potential upward move toward its July peak of $3.6606. Conversely, dipping below the $3.1 mark might drive the price closer to the August 5 low of $2.9184.

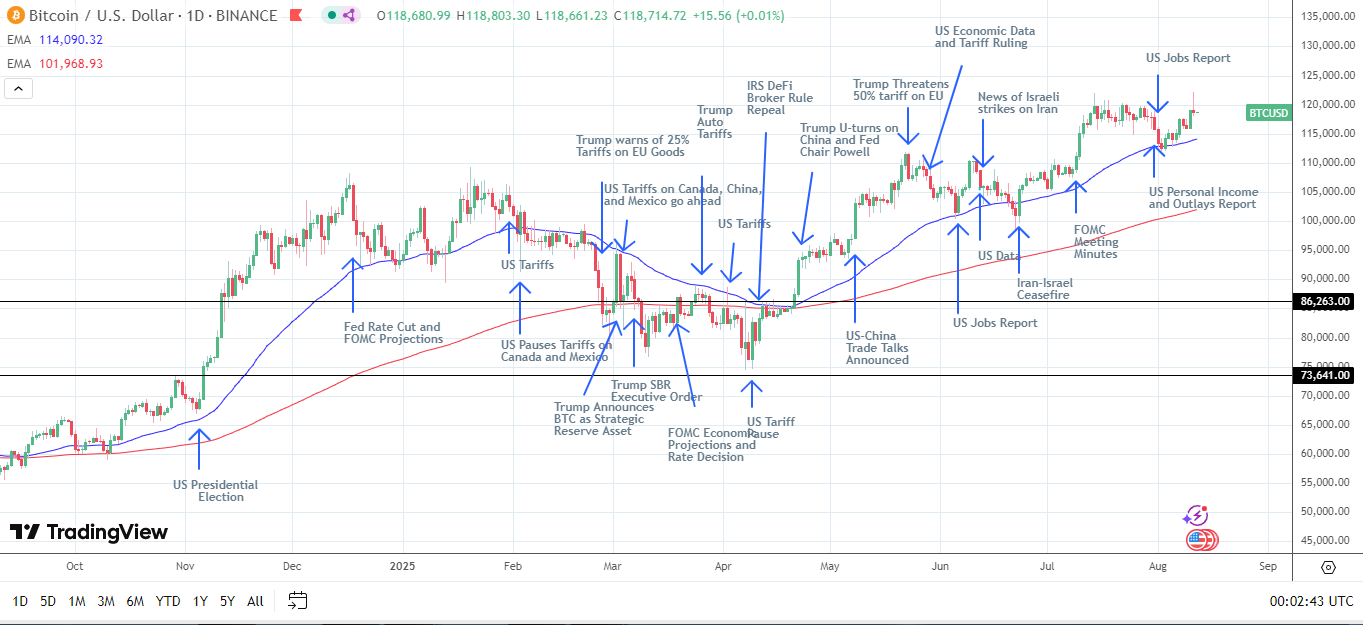

Meanwhile, Bitcoin’s contrasting rally adds another layer to the market narrative. BTC recently reached a record high of $122,190 before pulling back. Institutional interest, especially in spot ETFs, appears to be the driving force behind this surge. Companies such as Strategy celebrated the fifth anniversary of adopting Bitcoin as a reserve asset. As of August 11, the company had accumulated over 628,000 BTC, showcasing a long-term commitment to cryptocurrency as financial infrastructure.

Weekly data highlighted strong inflows into U.S.-based Bitcoin ETFs, totaling $253.2 million. These inflows included $13 million into the Fidelity Wise Origin Bitcoin Fund and $14.2 million into the Grayscale Bitcoin Mini Trust. Although data from top providers like BlackRock is still awaited, the positive capital flow trend enhances the market’s overall momentum.

However, investor enthusiasm could face a test with the upcoming U.S. Consumer Price Index (CPI) report. Expectations suggest inflation may see a modest uptick. If the data supports a tighter Federal Reserve stance, risk assets like BTC and XRP may face short-term headwinds. Still, a softer inflation print could boost expectations for looser monetary policy and bolster crypto prices further.

Related: XRP Price: $12M Max Pain for Bears

Both XRP and BTC are moving in response to macroeconomic data, legal decisions, and evolving regulatory frameworks. For XRP, clarity on ETF approvals, legislative direction, and continued expansion in the financial services space will be critical to its momentum and adoption.

Quick Summary

The XRP market continues to react to fresh developments following Ripple’s recent legal triumph, a pivotal moment that has shifted the landscape for Ripple and the broader crypto sector. The SEC’s decision to withdraw its appeal against Ripple marks a crucial milestone, potentially paving the way for improved regulatory clarity and broader institutional acceptance.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.