An XRP influencer teases the community with a cryptic message referencing a long-term price target of $589, sparking renewed speculation. Significant Shiba Inu (SHIB) deposits on a major Korean exchange raise concerns about potential sell-offs.

What to Know:

- An XRP influencer teases the community with a cryptic message referencing a long-term price target of $589, sparking renewed speculation.

- Significant Shiba Inu (SHIB) deposits on a major Korean exchange raise concerns about potential sell-offs.

- Bitcoin’s monthly chart hints at a possible correction towards $52,000 if it fails to reclaim a key moving average.

The crypto markets are showing signs of life as the year winds down, but underneath the surface, crosscurrents abound. XRP is experiencing a social media driven speculative push, while Shiba Inu faces potential headwinds from exchange inflows, and Bitcoin struggles to maintain its bullish momentum. These developments offer traders and investors clear levels to watch as they position for 2024.

XRP’s $589 Target Resurfaces

The XRP community is buzzing once again after a prominent insider, BearableGuy123, posted a cryptic message on X featuring the number “589.” This number has long been associated with a meme-driven price target of $589 per XRP token, a figure considered highly ambitious. The timing of the post, right before 2026, has ignited speculation about a potential rally.

While such targets should be taken with a grain of salt, the renewed attention could inject speculative liquidity into XRP. Social media narratives often play a significant role in crypto markets, and a resurgence of the $589 meme could translate into increased trading volume and potentially drive short-term price appreciation. However, it’s crucial to remember that these narratives are often detached from fundamental value, and corrections can be swift and painful.

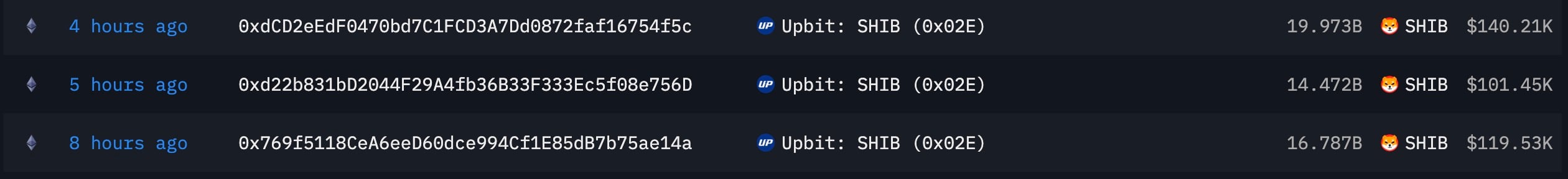

Shiba Inu Faces Supply Concerns

Shiba Inu (SHIB), the popular meme coin, is facing potential headwinds after a substantial influx of tokens onto the Upbit exchange in Korea. A total of 51.23 billion SHIB tokens were deposited in three large transfers within a short period. This has raised concerns among investors that holders may be preparing to offload their positions, potentially putting downward pressure on the price.

Exchange inflows are always a critical metric to watch, especially for meme coins like SHIB that are prone to volatility. While deposits don’t automatically equate to selling pressure – they could be for custody rotation, market-making, or other purposes – the increased supply on Upbit creates optionality for holders to sell. Given SHIB’s already precarious technical position on the SHIB/KRW chart, this development warrants caution.

Bitcoin’s Bollinger Band Warning

Bitcoin is currently trading near $87,042, below its monthly Bollinger Band midband of $88,871. According to technical analysis, this could signal a potential correction towards the lower Bollinger Band, which currently sits around $52,187. This represents a potential downside of approximately 39% from current levels.

The Bollinger Band is a widely used volatility indicator, and the midband often acts as a key level of support or resistance. A break below the midband can signal a shift in momentum, with the lower band becoming a potential price target. While this doesn’t guarantee a crash to $52,000, it does highlight the risk of a significant correction if Bitcoin fails to reclaim the $88,871 level. Investors should monitor price action closely and be prepared for potential volatility.

Navigating the Crypto Landscape

The current crypto market presents a mixed bag of opportunities and risks. XRP is experiencing a social media-driven speculative push, Shiba Inu faces potential supply headwinds, and Bitcoin is grappling with technical resistance. These developments underscore the importance of careful analysis and risk management.

As we approach the end of the year, market liquidity tends to thin out, which can amplify price swings. Traders should be aware of this and adjust their positions accordingly. The key is to focus on objective price levels and technical indicators, rather than getting caught up in the hype or fear that often dominates crypto markets.

Looking Ahead

The crypto market is entering a crucial phase as it transitions into the new year. The developments surrounding XRP, Shiba Inu, and Bitcoin highlight the diverse forces at play. While speculative narratives can drive short-term price movements, fundamental factors and technical analysis ultimately determine the long-term trajectory. By staying informed and disciplined, investors can navigate the crypto landscape and capitalize on emerging opportunities.

Related: XRP Signals; Crypto News: Cross-Chain Bridge

Source: Original article

Quick Summary

An XRP influencer teases the community with a cryptic message referencing a long-term price target of $589, sparking renewed speculation. Significant Shiba Inu (SHIB) deposits on a major Korean exchange raise concerns about potential sell-offs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.