An analyst’s bold prediction suggests XRP could surpass Ethereum’s market cap by 2026, stirring debate amid current market weakness. Dogecoin’s liquidation data shows a peculiar absence of short liquidations, hinting at potential exhaustion among bearish traders.

What to Know:

- An analyst’s bold prediction suggests XRP could surpass Ethereum’s market cap by 2026, stirring debate amid current market weakness.

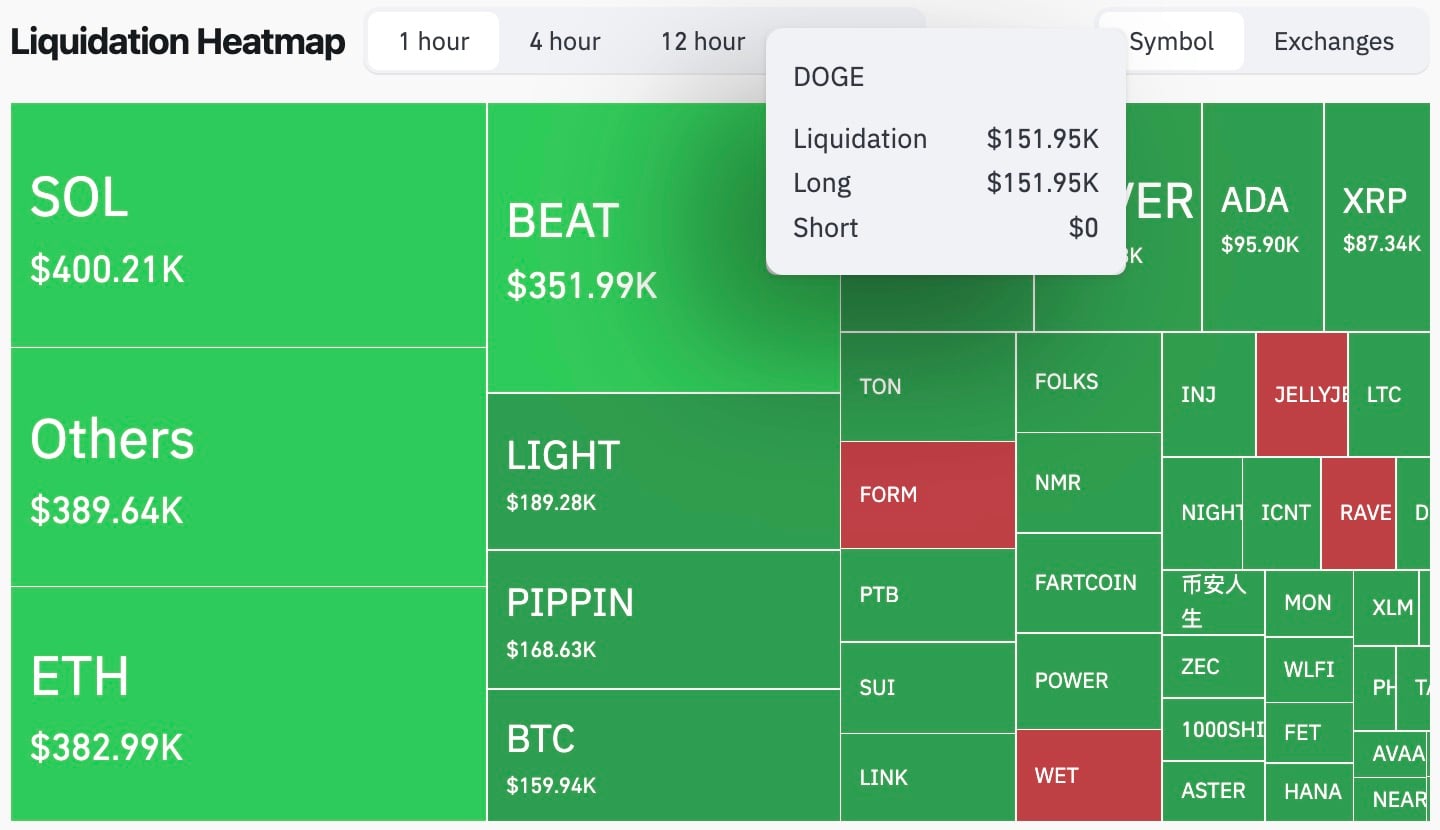

- Dogecoin’s liquidation data shows a peculiar absence of short liquidations, hinting at potential exhaustion among bearish traders.

- Cardano’s NIGHT token experiences a surge in trading activity, contrasting with ADA’s subdued performance and highlighting speculative interest in the Cardano ecosystem.

XRP’s potential to overtake Ethereum in market capitalization has become a talking point, particularly as regulatory clarity around XRP continues to evolve. While ambitious price targets often circulate in crypto, this one carries weight due to the bold timeline. Such a shift would represent a significant reordering of the digital asset landscape, influencing institutional portfolio allocations and risk assessments.

XRP’s Ambitious Target

YoungHoon Kim’s projection that XRP could eclipse Ethereum by 2026 has injected fresh debate into the market. To achieve this, XRP would need to close a substantial valuation gap, requiring a price surge to the $5.80-$6 range, assuming the circulating supply remains constant. This claim arrives amidst a broader market downturn, where both XRP and Ethereum have experienced weekly declines, underscoring the challenge ahead.

For institutional investors, this target necessitates a careful evaluation of XRP’s growth potential, technological advancements, and regulatory tailwinds. While the prediction may seem far-fetched, the very discussion of XRP as a potential market leader signals a shift in sentiment. The conversation has evolved from questioning XRP’s viability to considering its potential for market dominance, a factor that influences how traders and funds assess risk and opportunity.

Dogecoin’s Curious Liquidation Data

Intriguingly, Dogecoin’s derivatives data reveals an absence of short liquidations, a situation that typically indicates a lack of bearish conviction. With Dogecoin trading near $0.13 after months of downward price action, this anomaly suggests that sellers may be losing interest in shorting the asset. This shift in sentiment does not guarantee an immediate rally, but it does imply a change in market dynamics, where further downside pressure may be more challenging to achieve.

The absence of short liquidations can be interpreted as a sign of potential seller exhaustion. It suggests that the market may have reached a point where the risk-reward ratio for shorting Dogecoin is no longer attractive. This could lead to a stabilization of the price or even a potential reversal, as any remaining selling pressure would need to come from spot selling, rather than the unwinding of leveraged short positions.

Cardano’s Ecosystem Buzz

While major cryptocurrencies grapple with market headwinds, Cardano’s ecosystem is witnessing notable activity, particularly with the NIGHT token. NIGHT, associated with Cardano’s privacy-focused narrative, has exhibited a remarkable volume-to-market-cap ratio, indicating strong speculative demand. This surge in trading activity contrasts with ADA’s muted performance, suggesting that investors are exploring alternative opportunities within the Cardano ecosystem.

The NIGHT token’s price action, characterized by an initial spike, a pullback, and sustained trading above the midrange, reflects the speculative interest surrounding the project. While ADA remains subdued, the movement of capital into NIGHT suggests that investors are not necessarily exiting the Cardano ecosystem altogether. Instead, they are seeking out new opportunities and narratives within the network, which could eventually benefit ADA as well.

Navigating a Volatile Market

The current crypto market is characterized by a tug-of-war between weak price structures and compelling narratives. Prices are under pressure, leverage is diminishing, and attention is shifting towards individual stories rather than overarching trends. In this environment, volatility remains a significant risk, and investors must exercise caution.

The market’s current state of uncertainty underscores the importance of disciplined risk management and careful analysis. Investors should avoid chasing short-term gains and instead focus on identifying assets with strong fundamentals and long-term growth potential. While narratives can drive short-term price movements, ultimately, it is the underlying value and utility of an asset that will determine its long-term success.

In conclusion, the crypto market is currently navigating a complex landscape of competing forces. XRP’s ambitious target, Dogecoin’s unusual liquidation data, and Cardano’s ecosystem activity all point to a market in flux, where narratives and sentiment play a significant role in shaping price action. As the market continues to evolve, investors must remain vigilant and adapt their strategies to navigate the inherent volatility and uncertainty.

Related: XRP Volume Spike Signals Market Turn

Source: Original article

Quick Summary

An analyst’s bold prediction suggests XRP could surpass Ethereum’s market cap by 2026, stirring debate amid current market weakness. Dogecoin’s liquidation data shows a peculiar absence of short liquidations, hinting at potential exhaustion among bearish traders.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.