XRP is consolidating under key resistance levels, indicating a critical decision point for its price trajectory. Technical analysis of XRP’s USDT and BTC pairs suggests potential downside risks and upside targets based on specific price movements.

What to Know:

- XRP is consolidating under key resistance levels, indicating a critical decision point for its price trajectory.

- Technical analysis of XRP’s USDT and BTC pairs suggests potential downside risks and upside targets based on specific price movements.

- Breaking above or below certain price thresholds could significantly impact XRP’s value in the near term.

XRP is currently consolidating under key resistance levels, suggesting a pivotal moment for its price. Analysis of both USDT and BTC trading pairs indicates that the token is at a critical juncture. While selling pressure persists, the potential for further downside seems limited unless broader market conditions weaken.

The XRPUSDT pair is navigating within a descending channel on the daily chart. The asset has reached the lower boundary of a wedge pattern while testing the $2.10–$2.20 support zone, a region that previously acted as a demand area. A breakdown below this level could lead to a rapid decline toward the $1.80 zone.

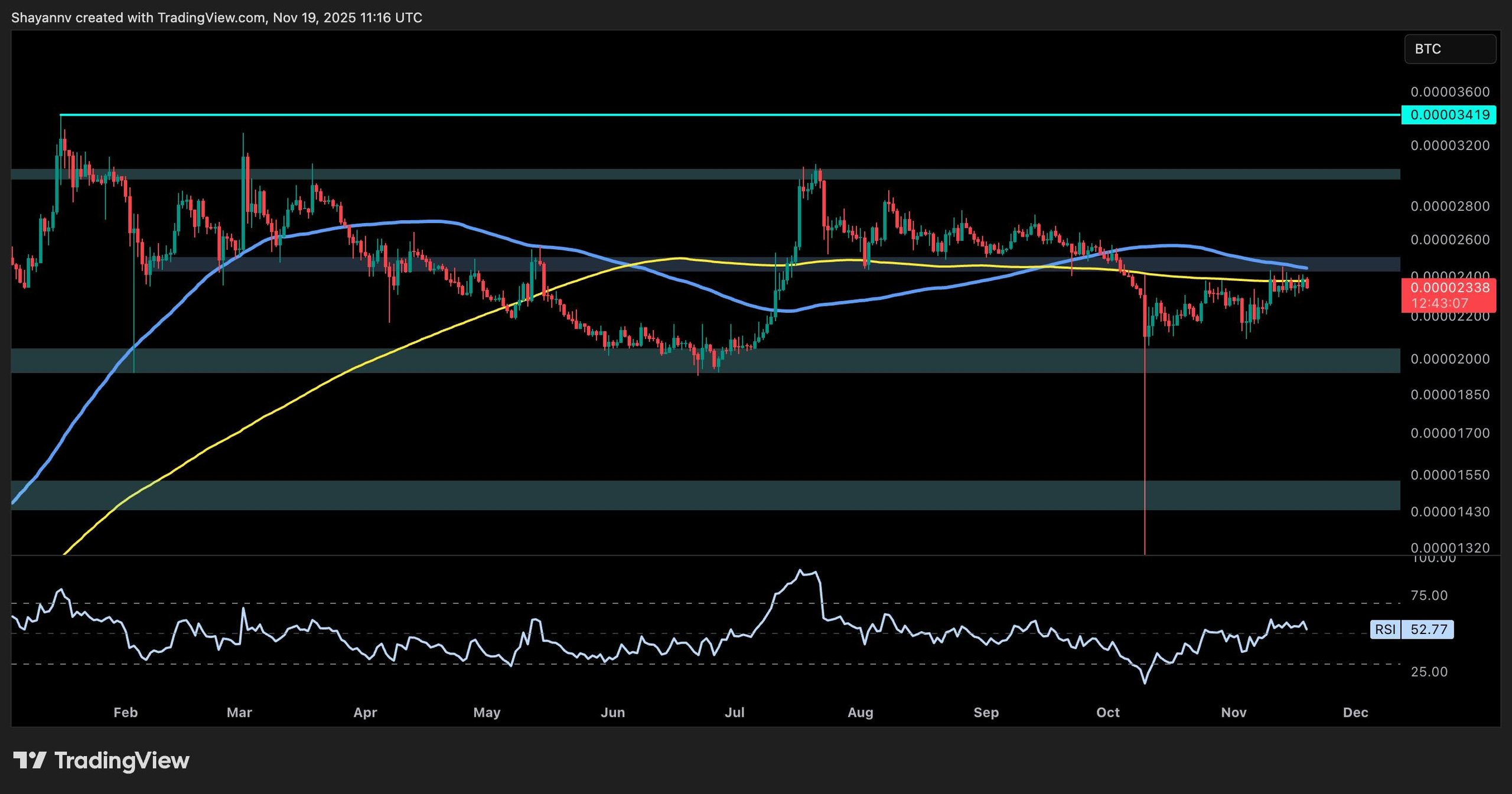

Conversely, the XRPBTC pair is testing the 2,400 SAT resistance zone, aligning with the 100-day and 200-day moving averages. Buyers have faced challenges in surpassing this area, and momentum remains neutral, suggesting a potential rejection if Bitcoin dominance increases. Successfully breaking and closing above this supply zone could propel XRP toward the 3,000 SAT mark.

Overall, XRP’s price action suggests a market in anticipation, influenced by both internal technical factors and external market dynamics. Investors and traders should closely monitor these key levels and potential catalysts to anticipate XRP’s next significant move.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

XRP is consolidating under key resistance levels, indicating a critical decision point for its price trajectory. Technical analysis of XRP’s USDT and BTC pairs suggests potential downside risks and upside targets based on specific price movements.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.