XRP is showing signs of strength against both USDT and BTC after a period of consolidation. Key resistance levels to watch are $2.50 against USDT and 2,500 SAT against BTC. A successful breakout could signal a bullish trend, while failure to hold may lead to retests of support levels.

What to Know:

- XRP is showing signs of strength against both USDT and BTC after a period of consolidation.

- Key resistance levels to watch are $2.50 against USDT and 2,500 SAT against BTC.

- A successful breakout could signal a bullish trend, while failure to hold may lead to retests of support levels.

XRP is exhibiting renewed vigor against both USDT and Bitcoin, signaling a potential shift in market dynamics. After weeks of consolidation, the cryptocurrency is attempting to break free from key resistance areas, presenting an opportunity for traders and investors. The sustainability of this momentum will be crucial in the coming sessions.

On the USDT pair, XRP is testing a significant bearish order block around $2.50 after rebounding from the $2 demand area, indicating a potential breakout from the descending channel pattern. The Relative Strength Index (RSI) is recovering, suggesting increasing bullish momentum, though buyers have yet to fully dominate. A successful break above the $2.50 resistance could pave the way for the 100-day and 200-day moving averages near the $2.70 mark.

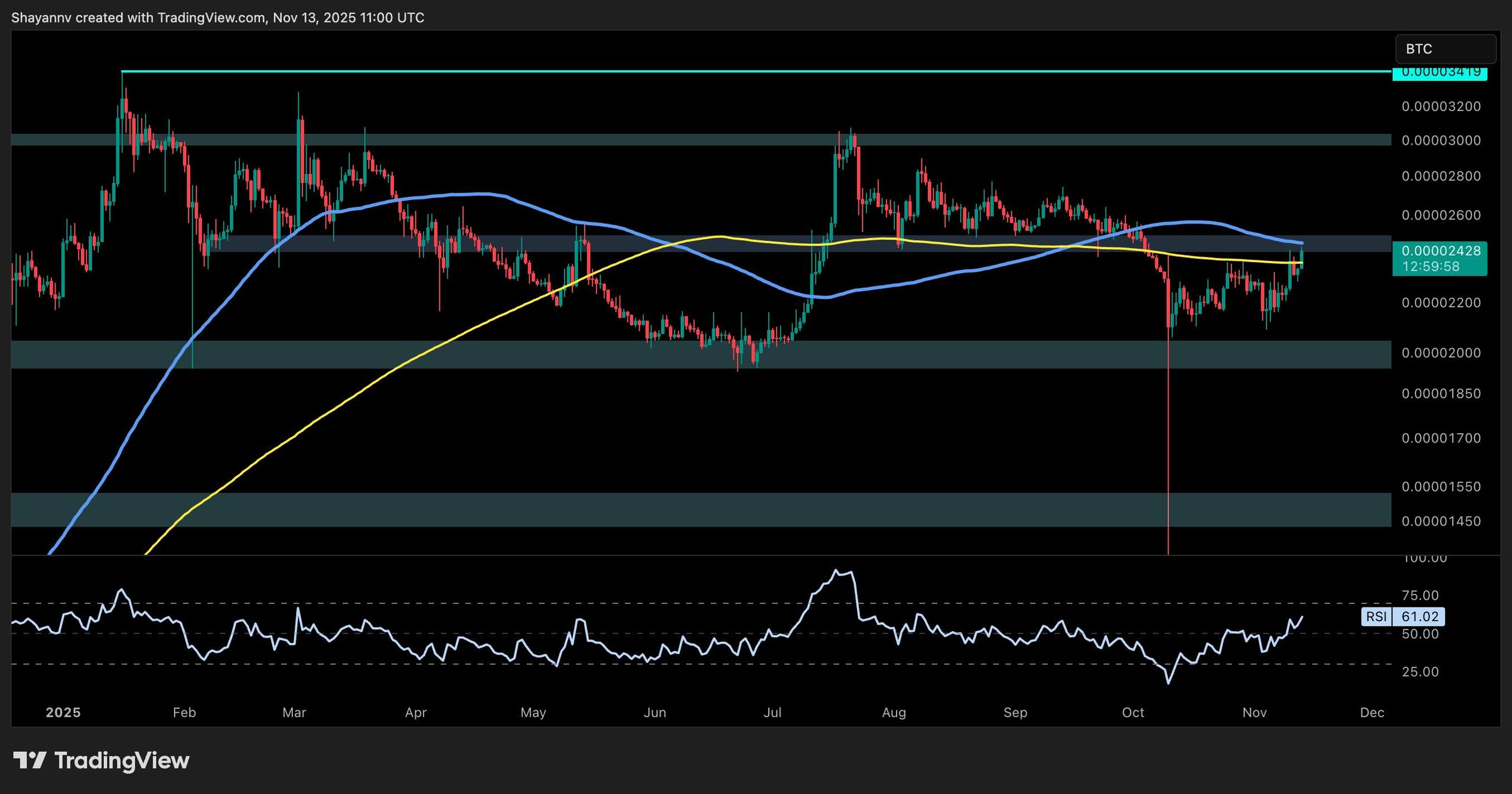

Against Bitcoin, XRP is demonstrating relative strength, currently testing the confluence of the 100-day and 200-day moving averages near the 2,500 SAT supply zone. With the RSI above 61, bullish momentum is evident, potentially driving the asset toward the 3,000 SAT region. Bitcoin’s price action will also influence this pair, with potential rotation into altcoins benefiting XRP/BTC if BTC remains under pressure.

As XRP navigates these critical levels, traders should closely monitor volume and momentum indicators to gauge the strength and sustainability of any breakout attempts. The convergence of moving averages and key resistance zones suggests a pivotal moment for XRP, with potential for significant price movement in either direction. Keeping an eye on broader market trends and Bitcoin’s performance will also be essential in assessing XRP’s trajectory.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is showing signs of strength against both USDT and BTC after a period of consolidation. Key resistance levels to watch are $2.50 against USDT and 2,500 SAT against BTC. A successful breakout could signal a bullish trend, while failure to hold may lead to retests of support levels.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.