The stablecoin market has hit an impressive $300 billion capitalization. Ethereum remains the primary host for stablecoins, with $177 billion in natively minted assets. Institutional adoption of stablecoins is predicted to drive the market cap to $1.2 trillion by 2028.

What to Know:

- The stablecoin market has hit an impressive $300 billion capitalization.

- Ethereum remains the primary host for stablecoins, with $177 billion in natively minted assets.

- Institutional adoption of stablecoins is predicted to drive the market cap to $1.2 trillion by 2028.

The stablecoin market has triumphantly soared past a monumental $300 billion cap, underscoring its pivotal role as the linchpin between traditional finance and the blossoming crypto sphere.

This remarkable milestone is a testament to increased investor interest and the proliferation of diverse stablecoin models, which span from established fiat-pegged titans to newcomers offering enticing yields.

USDT from Tether continues its reign, boasting over half the market share with a valuation at $176 billion. Circle’s USDC trails behind at $74 billion, while Ethena’s rapidly growing USDe shows a market appetite for yield-bearing alternatives, with a cap of $14.8 billion.

Other noteworthy issuers making their mark include Sky and WLFI, both positioning themselves as formidable contenders to the established players.

With nearly $177 billion in native assets, Ethereum proves to be the favored playground for stablecoins. Tron secures the second spot with $76.9 billion, followed by Solana and Arbitrum with $13.7 billion and $9.6 billion respectively.

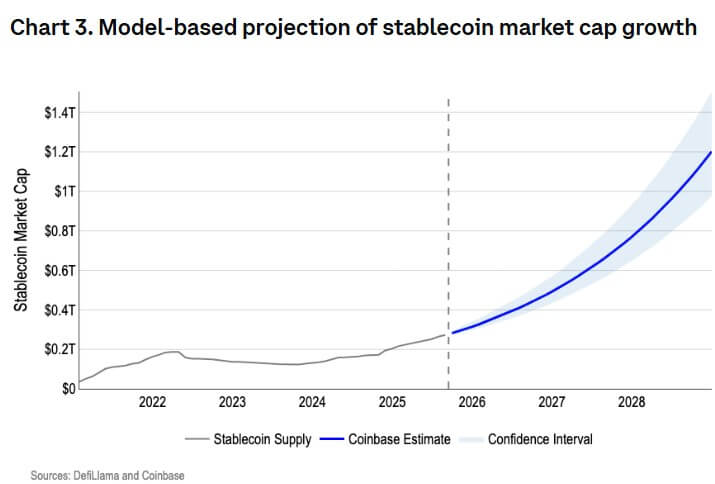

The meteoric rise of stablecoins this year has prompted serious attention from major institutions, leading Coinbase to forecast a near $1.2 trillion market capitalization by 2028.

Coinbase based this projection on the gradual adoption spurred by favorable regulation and the widespread acceptance of tokenized assets.

What is the effect on Bitcoin and Ethereum?

A study from 2021 revealed that the creation of new stablecoins contributes to price discovery and enhances efficiency in the crypto markets.

Notably, the issuance of Tether tends to fuel higher trading volumes without directly impacting Bitcoin or Ethereum returns. Interestingly, increased Tether activity often coincides with Bitcoin price drops, reinforcing its role as a temporary safe haven.

This research also linked issuances to arbitrage opportunities, allowing traders to profit when market prices diverge from parity.

A fresh surge in stablecoins signals the inflow of capital back into digital assets, bolstering liquidity across the board. For Bitcoin, these inflows generate demand that indirectly bolsters its role as the industry’s reserve asset.

The 2021 study suggested that large Bitcoin purchases often follow stablecoin issuances, hinting at a feedback loop where liquidity inflows stabilize the market.

“Demand for stablecoins is driven by demand for cryptocurrencies – be it regular investments or arbitrage opportunities – and/or the market regards the issuance of stablecoins as a positive signal regarding the demand for cryptocurrency.”

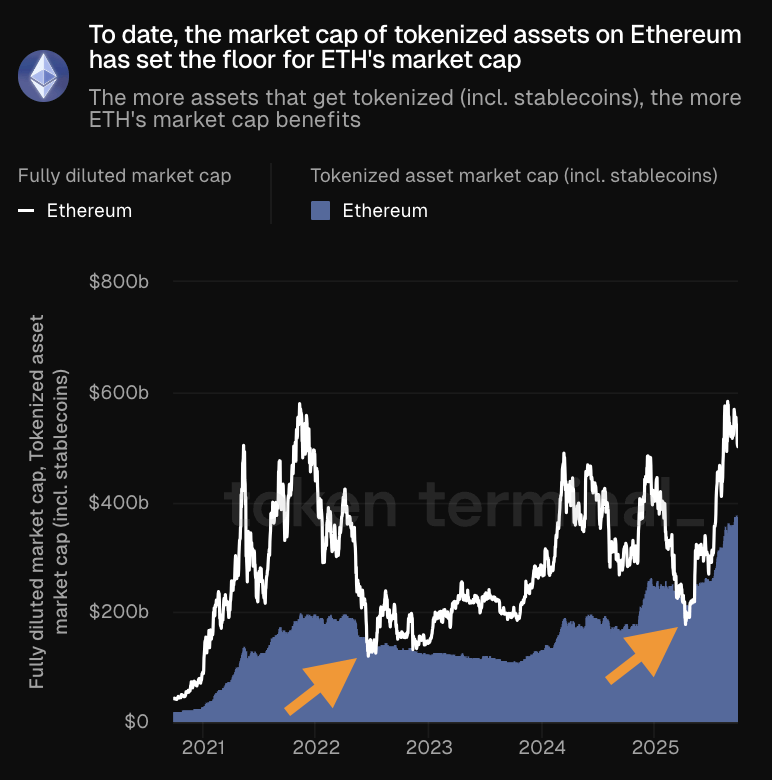

Ethereum, on the other hand, has reaped the benefits from the structural demand created by tokenized assets. Data from Token Terminal indicates that tokenized holdings, including stablecoins, form a sturdy base for Ethereum’s valuation.

Even during downturns like in 2022, the value of tokenized assets on-chain remained resilient, preventing Ethereum’s fully diluted market cap from plunging further.

As more real-world assets transition to blockchain networks, this floor expands, assuring Ethereum’s long-term resilience despite price volatility.

Related: Cardano Bull Setup Points to December Rally

In conclusion, the stablecoin boom is not a standalone phenomenon. It is propelling capital efficiency, strengthening ties between crypto and mainstream finance, and reinforcing the pillars of both Bitcoin and Ethereum.

Quick Summary

The stablecoin market has hit an impressive $300 billion capitalization. Ethereum remains the primary host for stablecoins, with $177 billion in natively minted assets. Institutional adoption of stablecoins is predicted to drive the market cap to $1.2 trillion by 2028.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.