XRP is experiencing a short-term price pullback after a recent rally, but institutional demand via ETFs remains robust. The broader crypto market is seeing altcoin rotation and increased institutional interest, impacting XRP’s price dynamics.

What to Know:

- XRP is experiencing a short-term price pullback after a recent rally, but institutional demand via ETFs remains robust.

- The broader crypto market is seeing altcoin rotation and increased institutional interest, impacting XRP’s price dynamics.

- Strong ETF inflows suggest continued institutional bullishness on XRP despite technical indicators signaling potential overbought conditions.

XRP is currently navigating a period of price consolidation after a notable rally, trading around $2.26. While short-term momentum appears to be waning, the underlying strength of institutional demand, particularly through XRP ETFs, presents a compelling counter-narrative. Understanding these dynamics is crucial for assessing XRP’s potential trajectory in the coming weeks.

Technical Analysis: Signs of Exhaustion?

The recent XRP chart reveals a strong upward trajectory, marked by a decisive break above the $2.20 resistance. Currently, the price is testing the $2.40 level, a pivotal point that could dictate further bullish continuation. However, the Relative Strength Index (RSI) is showing a reading of 66.35 and trending downward from overbought territory, suggesting the market may be due for a correction if buyers don’t step in.

The RSI Trend indicator, which remains above 75, still signals a bullish trend, reinforcing the positive momentum behind XRP’s price action. Yet, as this indicator also ventures into overbought territory, the bullish trend could decelerate or face a short-term reversal if momentum falters.

Institutional Demand Remains Strong

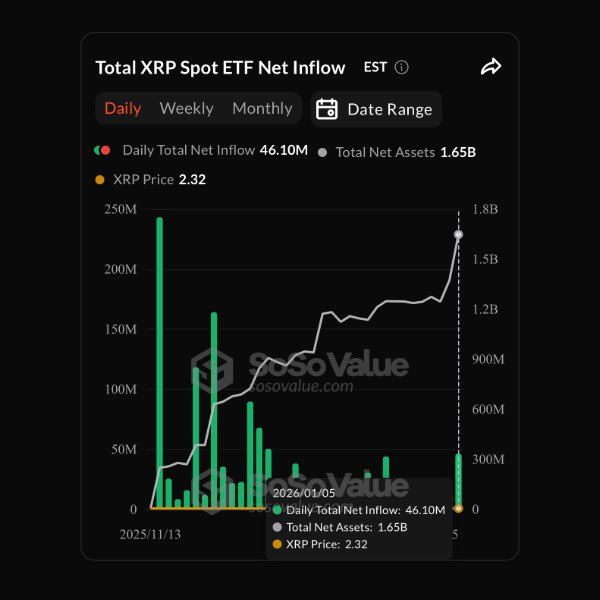

Despite the potential for a technical pullback, institutional interest in XRP remains exceptionally strong. On January 5, XRP ETFs saw inflows of $46.1 million, bringing total net assets to $1.65 billion. This level of investment indicates a strong belief among institutional players in XRP’s long-term prospects, potentially driven by regulatory clarity or anticipated developments within Ripple.

As of January 6, the trend continued with a further $9.22 million flowing into XRP ETFs, pushing the cumulative total net inflow to $1.25 billion. These substantial inflows suggest that institutions are actively accumulating XRP, possibly in anticipation of future price appreciation or as part of a broader digital asset allocation strategy.

ETF Dynamics and Market Impact

The mechanics of XRP ETFs play a crucial role in influencing market dynamics. The persistent inflows effectively reduce the available supply of XRP on exchanges, potentially creating upward price pressure. Furthermore, the presence of ETFs provides a regulated and accessible avenue for traditional investors to gain exposure to XRP, which can broaden the investor base and improve liquidity.

Navigating Market Uncertainty

While the strong ETF inflows paint a bullish picture, it’s essential to acknowledge the inherent volatility of the crypto market. Regulatory developments, macroeconomic factors, and shifts in market sentiment can all impact XRP’s price. Investors should consider these factors and manage their risk accordingly.

Conclusion

XRP’s current market position presents a mixed picture. Technical indicators suggest a potential pullback, while robust institutional demand through ETFs signals underlying strength. The interplay between these factors will likely determine XRP’s short- to mid-term trajectory. Investors should closely monitor ETF flows, regulatory news, and broader market trends to make informed decisions.

Related: XRP ETF Hopes Rise as Ripple Exec Reacts

Source: Original article

Quick Summary

XRP is experiencing a short-term price pullback after a recent rally, but institutional demand via ETFs remains robust. The broader crypto market is seeing altcoin rotation and increased institutional interest, impacting XRP’s price dynamics. Strong ETF inflows suggest continued institutional bullishness on XRP despite technical indicators signaling potential overbought conditions.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.