Binance’s XRP reserves have decreased by 310 million in less than two months, signaling a potential supply squeeze. The launch of spot Bitcoin ETFs introduces new demand for XRP, exacerbating the impact of declining exchange reserves.

What to Know:

- Binance’s XRP reserves have decreased by 310 million in less than two months, signaling a potential supply squeeze.

- The launch of spot Bitcoin ETFs introduces new demand for XRP, exacerbating the impact of declining exchange reserves.

- If Binance’s XRP holdings fall below 2.6 billion, even moderate buying pressure could trigger a significant price increase.

The digital asset XRP is garnering increased attention from institutional investors amid shifting exchange dynamics and the advent of spot Bitcoin ETFs. Recent data indicates a substantial decline in XRP reserves held on Binance, the world’s largest cryptocurrency exchange. This dwindling supply, coupled with fresh demand from the ETF market, could set the stage for notable price movements in the near term.

Shrinking Exchange Reserves

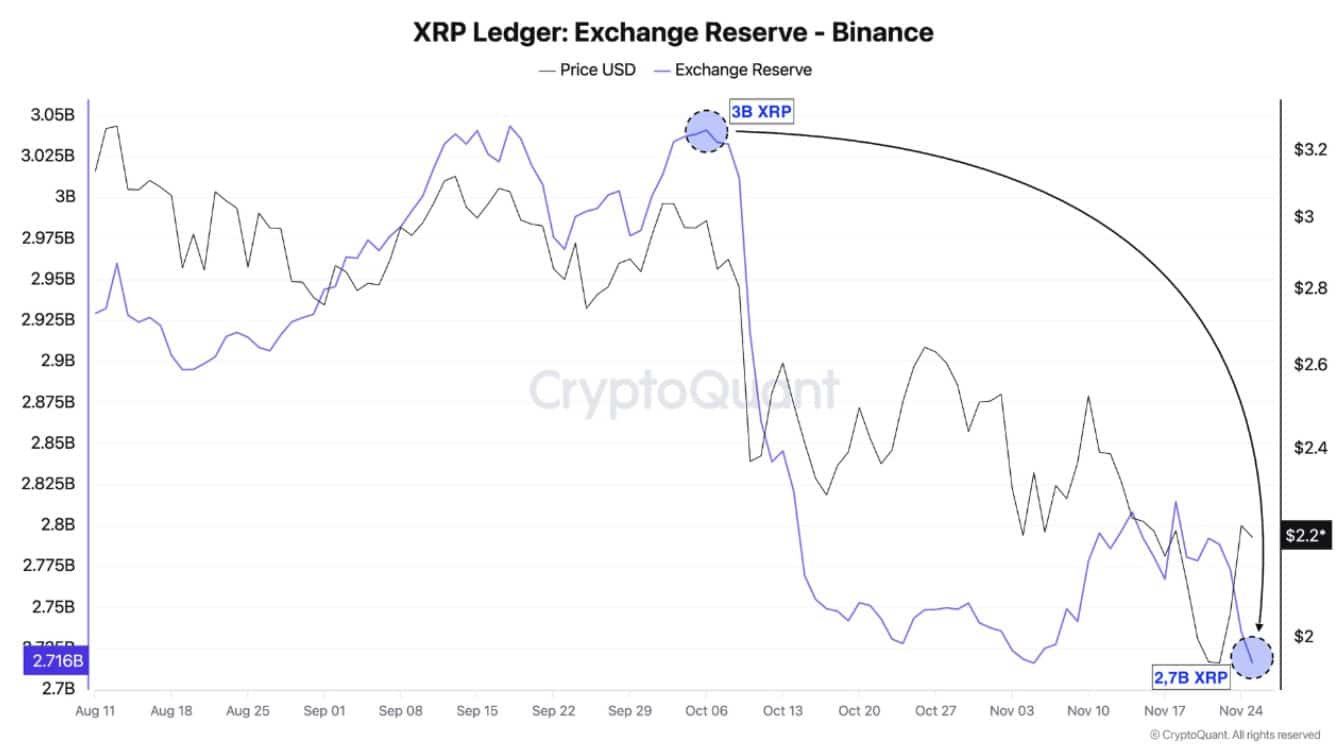

According to CryptoQuant data, Binance’s XRP holdings have decreased from approximately 3.02 billion on October 6th to 2.71 billion currently. This represents a reduction of 310 million XRP, valued at nearly $690 million. The consistent outflow suggests a tightening of supply within the exchange’s order book.

This decline in reserves has implications for market liquidity and price discovery. As the available supply on exchanges decreases, even moderate buy-side interest can exert upward pressure on prices. The last time Binance’s XRP reserves were at similar levels, institutional demand was significantly lower, making the current situation potentially more impactful.

ETF-Driven Demand

The recent launch of spot Bitcoin ETFs in the U.S. has introduced a new dynamic to the crypto market. These ETFs represent a significant source of institutional demand, potentially drawing in $30-$50 million per week without straining overall market flow. This influx of capital, combined with the decreasing XRP supply on Binance, could amplify price volatility.

The ETF effect is reminiscent of previous instances where new investment vehicles have altered market dynamics. The introduction of gold ETFs, for example, broadened access to the precious metal and contributed to increased demand and price appreciation. A similar scenario could unfold for XRP as ETFs attract a wider range of investors.

Price Target Scenarios

If Binance’s XRP reserves continue to decline and fall below the 2.6 billion mark, the asset could enter a zone where even average buying interest could drive the price higher. Under such conditions, a return to the $2.60-$2.75 range becomes a distinct possibility. This reflects the basic supply and demand dynamics at play.

Should ETF inflows exceed $50 million per week while Binance’s XRP balances drop toward 2.5 billion, a more aggressive price surge could materialize, potentially pushing XRP towards the $3 level faster than anticipated. This scenario underscores the potential for significant price appreciation if demand outstrips available supply.

Historical Context and Market Structure

It’s important to remember that past performance is not necessarily indicative of future results. However, examining historical market behavior can provide valuable context. Previous instances of supply squeezes in other assets have often led to sharp price increases, particularly when coupled with increased demand.

The market structure for XRP is also evolving. Increased regulatory clarity, driven in part by the Ripple case, has improved institutional sentiment. The development of more robust derivatives markets and settlement systems further enhances the asset’s appeal to sophisticated investors.

Regulatory Outlook

The regulatory landscape remains a critical factor influencing the price of XRP. While the partial victory in the Ripple case provided some clarity, ongoing regulatory scrutiny and potential appeals continue to cast a shadow over the asset. A more favorable regulatory environment could unlock further institutional adoption and drive additional demand.

Conversely, adverse regulatory developments could dampen investor sentiment and negatively impact prices. Monitoring regulatory announcements and legal proceedings is essential for assessing the long-term prospects of XRP.

Conclusion

The confluence of declining XRP reserves on Binance and fresh demand from spot Bitcoin ETFs presents a compelling scenario for potential price appreciation. While uncertainties remain, particularly regarding the regulatory environment, the current market dynamics suggest that XRP could be poised for significant price movements in the near term. Investors should closely monitor exchange balances, ETF flows, and regulatory developments to assess the evolving landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Binance’s XRP reserves have decreased by 310 million in less than two months, signaling a potential supply squeeze. The launch of spot Bitcoin ETFs introduces new demand for XRP, exacerbating the impact of declining exchange reserves.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.