XRP faces significant downside risk after breaking a key technical level, potentially targeting $0.37. Ethereum experienced a notable price drop following a large deposit from a long-dormant wallet, exacerbating existing market pressures.

What to Know:

- XRP faces significant downside risk after breaking a key technical level, potentially targeting $0.37.

- Ethereum experienced a notable price drop following a large deposit from a long-dormant wallet, exacerbating existing market pressures.

- Cardano historically performs well in February, presenting a potential bullish opportunity amidst broader market uncertainty.

The digital asset market is currently navigating a complex landscape, with individual assets exhibiting idiosyncratic behavior. XRP is facing renewed bearish pressure, while Ethereum is reacting to substantial inflows onto exchanges. Meanwhile, Cardano is setting up as a potential outperformer based on historical seasonal trends. These dynamics highlight the importance of nuanced analysis in the current environment.

XRP’s Technical Breakdown

XRP’s monthly chart recently flashed a warning signal, closing below its mid-Bollinger Band for the first time in over a year. This level has historically acted as a demarcation between bullish and bearish trends. The breach of this level suggests a potential downside target of $0.37, a staggering 77% below current levels. This breakdown is not just technical; it’s psychological, as the mid-band often serves as a confidence anchor for long-term trend followers.

The loss of this key support level could trigger further selling pressure, potentially accelerating the decline. The $0.37 target coincides with the lower Bollinger Band, further reinforcing its significance. This situation is reminiscent of XRP’s 2021-2022 breakdown, where the price plummeted from $1.90 to $0.30 in a matter of months. Such historical parallels underscore the need for caution.

Order book analysis reveals significant sell-side liquidity around the $1.7-$1.75 range, adding to the downward pressure. Unless buyers can swiftly reclaim the $1.93 level, the path of least resistance appears to be lower, with potential interim stops at $1.45 before the ultimate target of $0.37. This technical picture paints a concerning outlook for XRP holders.

Ethereum Whale Activity and Price Impact

An intriguing development in the Ethereum market involves a substantial deposit of 99,999 ETH, worth $242.7 million, onto Binance from a wallet associated with early Bitcoin mining activity. This wallet, dormant for years, suddenly became active, and its first move was to transfer a large sum of ETH to an exchange. The timing of this transfer coincided with an 8.5% drop in Ethereum’s price, raising questions about potential market impact.

This influx of ETH onto Binance has likely contributed to the recent price decline, exacerbating existing pressures from ETF outflows and broader risk-off sentiment. Large transfers from dormant wallets often trigger algorithmic trading responses, further amplifying price movements. The market’s reaction to this event underscores the sensitivity of Ethereum’s price to significant on-chain activity.

While the whale’s portfolio still holds a substantial amount of ETH and BTC, the immediate impact was felt by Ethereum. This event serves as a reminder of the potential for large, unexpected transactions to influence market dynamics, particularly in an environment already characterized by uncertainty. Traders will be closely monitoring any further activity from this wallet.

Cardano’s February Anomaly

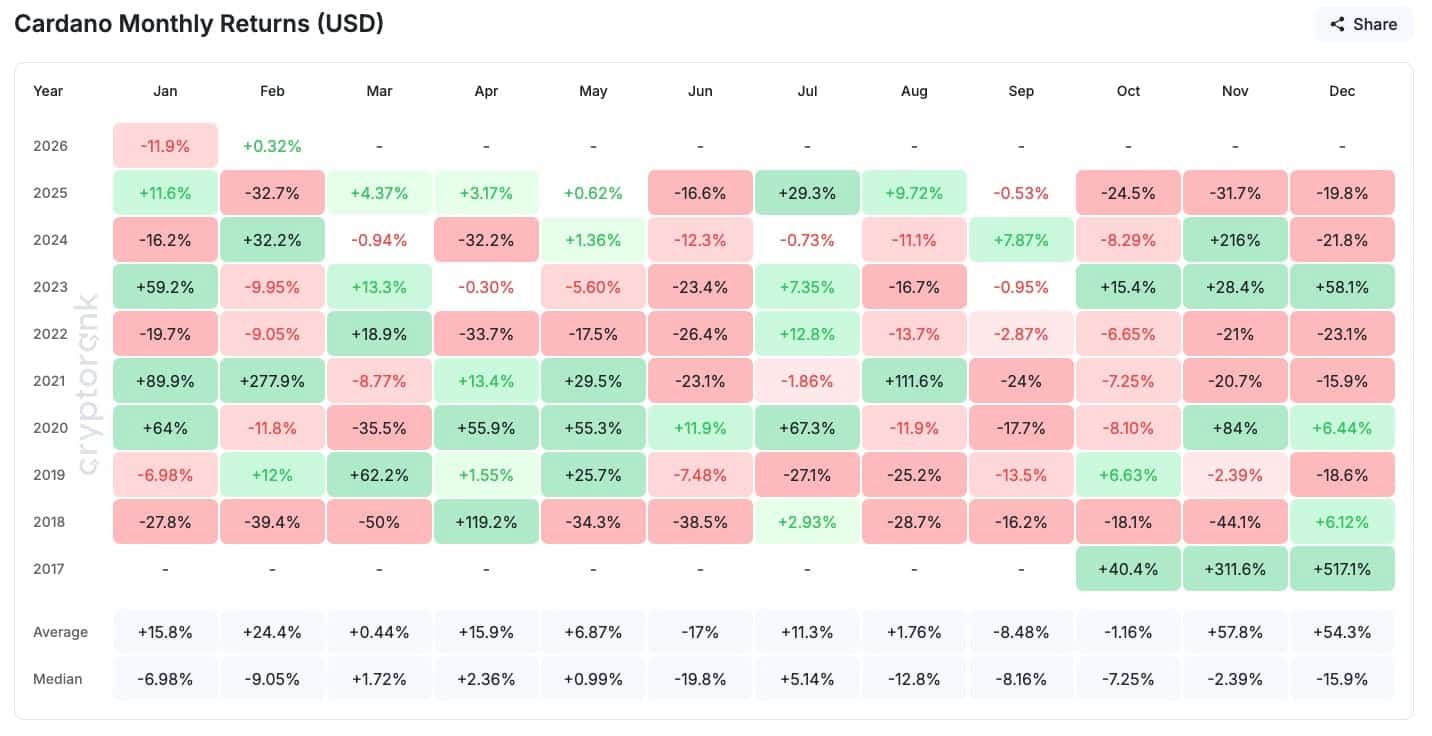

Amidst the cautious sentiment surrounding XRP and Ethereum, Cardano presents a contrasting picture. Historical data indicates that February has been a particularly strong month for ADA, with an average return of +24.4%. This seasonal trend is notable, especially when compared to Ethereum’s negative median return in February.

Cardano’s price action often lags behind Bitcoin’s, suggesting that if Bitcoin remains range-bound, ADA could be poised for a potential breakout. The historical pattern of flat or down performance in early February, followed by a breakout later in the month, appears to be repeating this year. This setup presents a potentially attractive opportunity for investors seeking undervalued assets.

This “quiet” setup in Cardano offers a unique opportunity amidst the broader market recalibration. While other major cryptocurrencies grapple with negative headlines and technical breakdowns, ADA is quietly positioning itself for a potential upward move. Investors should closely monitor Cardano’s price action for signs of a late-month rally.

Navigating the Crypto Landscape

The current crypto market environment is characterized by caution and selectivity. Investors are closely watching XRP’s attempt to find support, monitoring Ethereum’s reaction to whale activity, and assessing Cardano’s potential for a February rally. The overall market tone remains tentative, with the potential for shifts depending on ETF flows and macroeconomic developments.

Until broader market catalysts emerge, expect choppy trading conditions and isolated opportunities like Cardano to stand out. Bitcoin faces short-term resistance at $81,300 and support at $73,786, while Ethereum’s upside is capped at $2,700 with support around $2,200. XRP’s key resistance lies at $2.00, with structural support at $1.45. Cardano’s resistance is at $0.40, with breakout targets at $0.48 and $0.53.

The digital asset market is currently in a state of flux, with individual assets exhibiting divergent behavior. While challenges persist for XRP and Ethereum, Cardano’s historical performance suggests a potential for outperformance in February. Investors must remain vigilant and adapt their strategies to navigate this evolving landscape.

Related: Crypto Liquidity Signals XRP, Bitcoin, Ethereum Targets

Source: Original article

Quick Summary

XRP faces significant downside risk after breaking a key technical level, potentially targeting $0.37. Ethereum experienced a notable price drop following a large deposit from a long-dormant wallet, exacerbating existing market pressures. Cardano historically performs well in February, presenting a potential bullish opportunity amidst broader market uncertainty.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.