XRP crash headlines a turbulent day in the crypto markets, as Bitcoin and Ethereum joined a market-wide downturn that erased nearly $1 billion in leveraged positions. The sharp declines have left traders reeling and incited a fresh round of market speculation about the sustainability of current support levels.

XRP crash headlines a turbulent day in the crypto markets, as Bitcoin and Ethereum joined a market-wide downturn that erased nearly $1 billion in leveraged positions. The sharp declines have left traders reeling and incited a fresh round of market speculation about the sustainability of current support levels.

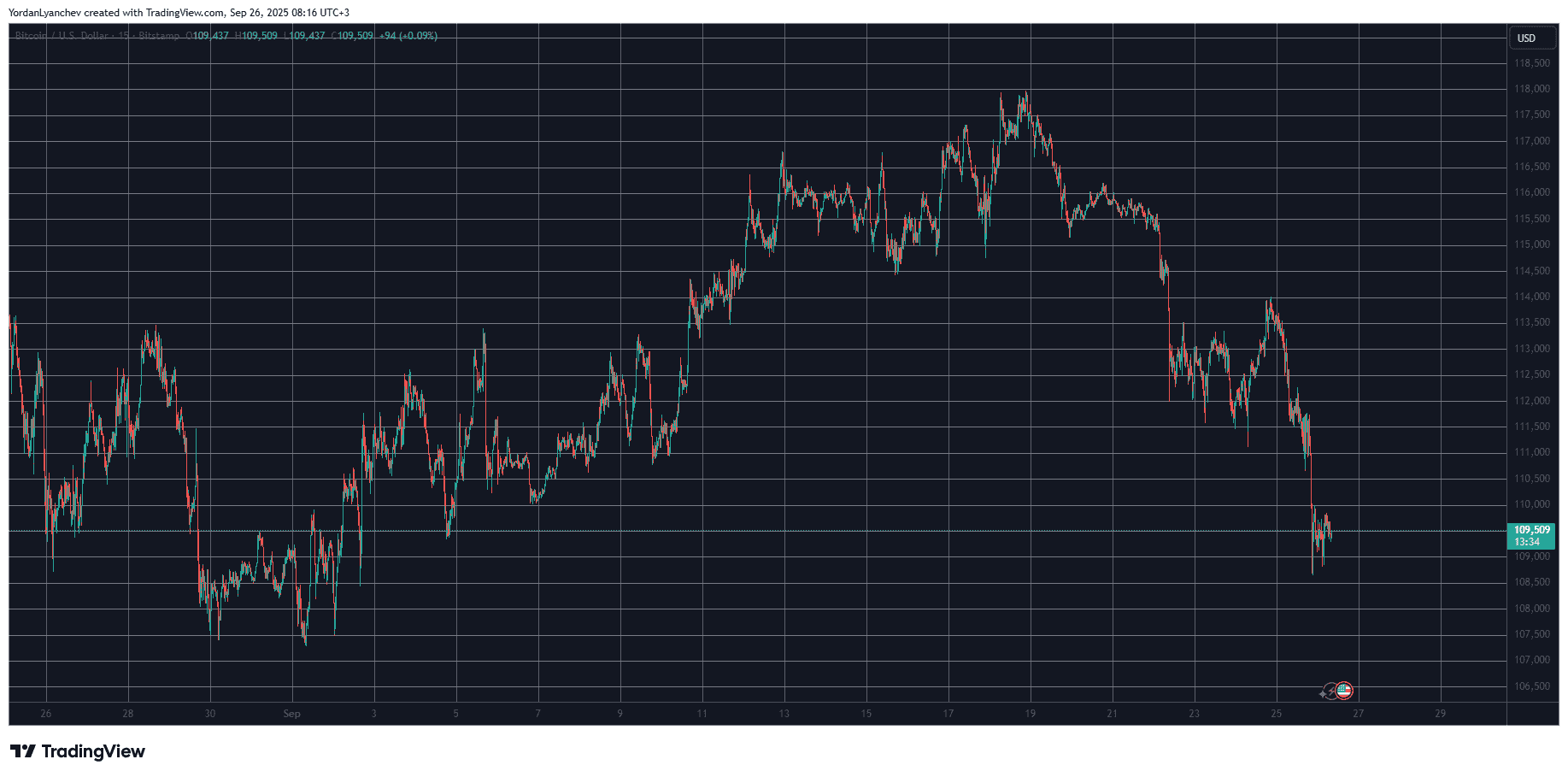

Bitcoin Breaks Below Key Support After Stellar Week

Just days ago, Bitcoin surged to $118,000 following the U.S. Federal Reserve’s decision to lower interest rates for the first time this year. That optimism quickly faded, however, as bearish momentum set in. The market saw troubling movement on Monday, September 22, when BTC dropped from $115,500 to $112,000. A slight mid-week recovery was short-lived as another drop occurred on Thursday, September 25, which sent Bitcoin to a monthly low of $108,600 on Bitstamp.

Currently, the digital asset is hovering between $109,000 and $110,000, struggling to hold a crucial support floor. Analyst Ali Martinez highlighted that the $110,000 region is shaping up to be a key battleground for bulls and bears. As it stands, the next line of defense lies at $108,530.

Bitcoin’s recent downturn brings it to its lowest level since early September, triggering heavy sell-offs.

XRP and Ethereum Join the Slide

Altcoins mirrored Bitcoin’s decline, but most suffered even steeper losses. Ethereum dropped below its critical $4,000 marker, settling under $3,900 by the end of the trading day. XRP also took a major hit, diving 10% over the week and struggling to maintain footing around the $2.80 mark.

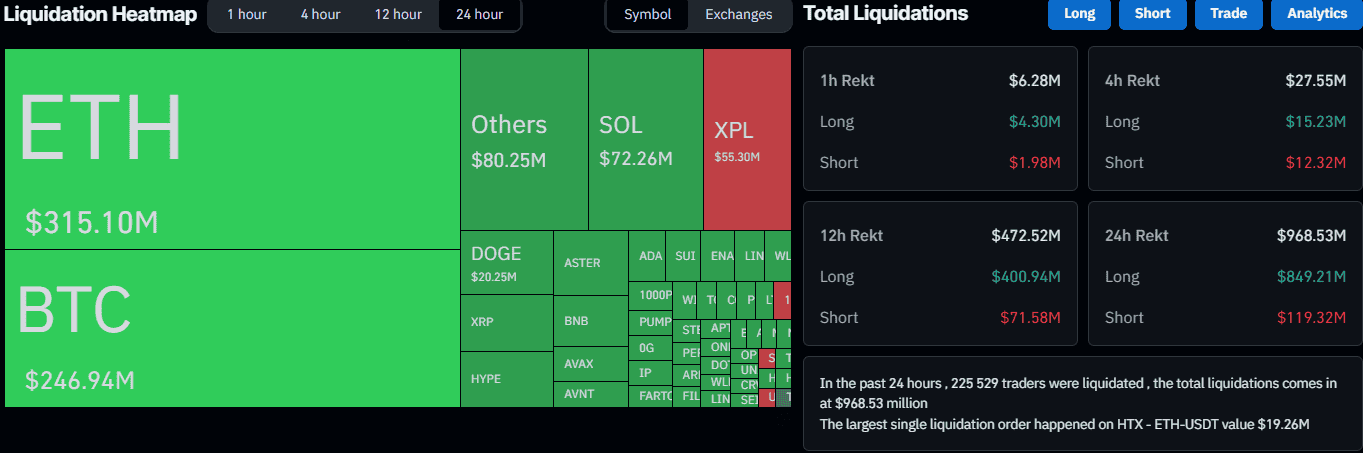

This broad sell-off has hit over-leveraged traders the hardest. According to CoinGlass data, almost $1 billion in positions were liquidated across the market. That number includes over 225,000 individual traders facing forced liquidations within just 24 hours.

Massive liquidations ripple across crypto markets, as seen in this heat map from CoinGlass.

Market Outlook Divided Between Doom and Resilience

The current turbulence has caused a rift among analysts and industry observers. Noted critic Peter Schiff called it the start of a prolonged bear market, warning investors to tread carefully.

In contrast, others remain optimistic. Crypto strategist Captain Fabrik labeled the pullback as a “healthy correction” and projected that Bitcoin could rally to $140,000, provided it recaptures the $113,000 resistance level in the near term.

Related: XRP Price: $12M Max Pain for Bears

Until then, crypto traders are bracing for more volatility. If XRP, Bitcoin, and Ethereum fail to hold their respective support zones, we may see even deeper retracements. However, any sign of bullish strength might provide relief in what’s been a challenging week for the digital asset ecosystem.

Quick Summary

XRP crash headlines a turbulent day in the crypto markets, as Bitcoin and Ethereum joined a market-wide downturn that erased nearly $1 billion in leveraged positions. The sharp declines have left traders reeling and incited a fresh round of market speculation about the sustainability of current support levels.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.