XRP is at a critical juncture as analysts warn that failure to break above a key resistance level could trigger a steep downward move. Amid broader market corrections, Ripple’s native cryptocurrency now finds itself balancing between vital support and resistance zones.

XRP is at a critical juncture as analysts warn that failure to break above a key resistance level could trigger a steep downward move. Amid broader market corrections, Ripple’s native cryptocurrency now finds itself balancing between vital support and resistance zones.

Market Volatility Pressures XRP

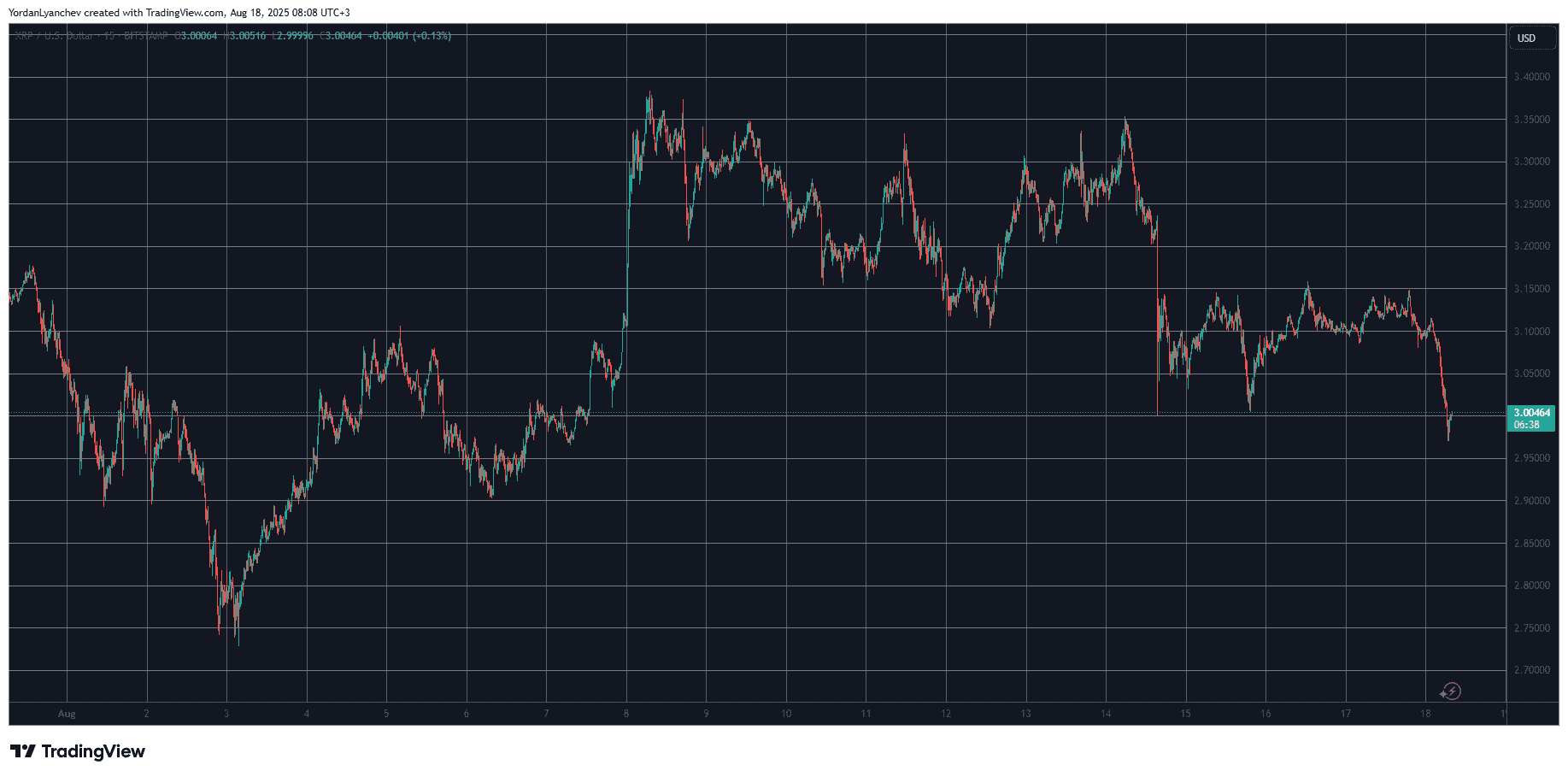

For the better part of yesterday, XRP hovered around $3.15 as cryptocurrency markets largely moved sideways. However, early morning shifts in sentiment—likely influenced by recent geopolitical developments involving former U.S. President Donald Trump’s remarks on the Ukraine-Russia conflict—sparked renewed volatility across the board.

The result was a rapid decline in XRP’s value, reaching an 11-day low of $2.97 (on Bitstamp), briefly slipping under the significant $3.00 psychological threshold. Although the token recovered slightly and pushed back above the $3.00 mark, concerns remain that further downside could be imminent.

Technical analysis shows XRP hovering between strong resistance and support levels. Source: TradingView

Breakout Above $3.30 Is Essential

Ali Martinez, a widely followed crypto market analyst, emphasizes the importance of the $3.30 resistance level. According to Martinez, reclaiming this threshold is crucial if XRP is to maintain its bullish outlook. Should XRP fail to close above $3.30, the token may be poised for a sharp drop—possibly as low as $2.60 or even $2.00.

Backing his warning with technical analysis, Martinez believes that XRP’s inability to build upward momentum toward this target places it in a vulnerable position. His insights are especially critical as XRP continues to underperform relative to other digital assets during recent market swings.

Support Levels in Focus

Martinez previously identified $2.81 as a crucial support level. Holding the line at this zone is critical for XRP’s broader bullish structure. If prices were to fall below $2.81, this could mark the end of the token’s current upward trend and signal a more extensive corrective phase.

As of now, XRP trades somewhere in the range between $2.97 and $3.30—caught in a narrow band that could break in either direction depending on market catalysts and upcoming political developments.

Geopolitical Factors May Add Fuel to the Fire

Looking ahead, more volatility is anticipated. Political figures from Ukraine and several European countries are slated to hold discussions with Donald Trump to explore potential resolutions to the ongoing war with Russia. These high-level talks could influence investor sentiment and global markets, including crypto. Any escalation or peaceful development may significantly sway XRP’s next move.

Related: XRP Price: $12M Max Pain for Bears

In conclusion, XRP remains on thin ice. Without a convincing push above the $3.30 resistance, the risk of a 33% pullback remains on the table. Meanwhile, holding current support levels offers a glimmer of hope, but the next few days could prove decisive for XRP’s short-term trajectory.

Quick Summary

XRP is at a critical juncture as analysts warn that failure to break above a key resistance level could trigger a steep downward move. Amid broader market corrections, Ripple’s native cryptocurrency now finds itself balancing between vital support and resistance zones.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.