XRP spot ETFs have seen significant net inflows since launch, totaling nearly $1 billion. This development occurs amid broader regulatory changes and institutional interest in crypto assets.

What to Know:

- XRP spot ETFs have seen significant net inflows since launch, totaling nearly $1 billion.

- This development occurs amid broader regulatory changes and institutional interest in crypto assets.

- Despite ETF success, XRP’s price has decreased, highlighting a potential disconnect between investment product performance and underlying asset value.

Following regulatory shifts in the United States, hopes rose for spot ETFs tracking various altcoins, including XRP. Five XRP ETFs have launched, with Canary Capital’s XRPC being the first. This update examines the performance of these ETFs in their initial month and their impact on XRP’s price.

XRP ETF Launches and Performance

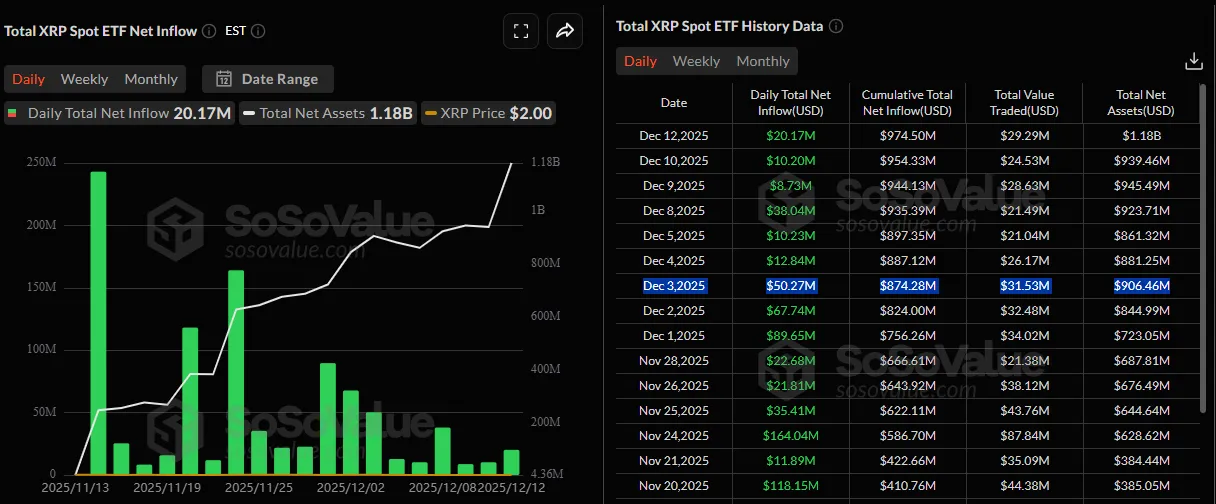

Canary Capital’s XRPC set a 2025 record for trading volume on its debut, exceeding Bitwise’s SOL ETF launch with nearly $60 million in volume and $243 million in inflows. Subsequently, 21Shares’ TOXR, Grayscale’s GXRP (converted from a trust), Bitwise’s XRP, and Franklin Templeton’s XRPZ also launched. The inflow streak has been consistently positive, with total net inflows climbing to $974.50 million by the end of the review period. Total net assets in these ETFs have surpassed $1 billion, reaching $1.18 billion, according to SoSoValue data.

Divergence Between ETF Success and XRP Price

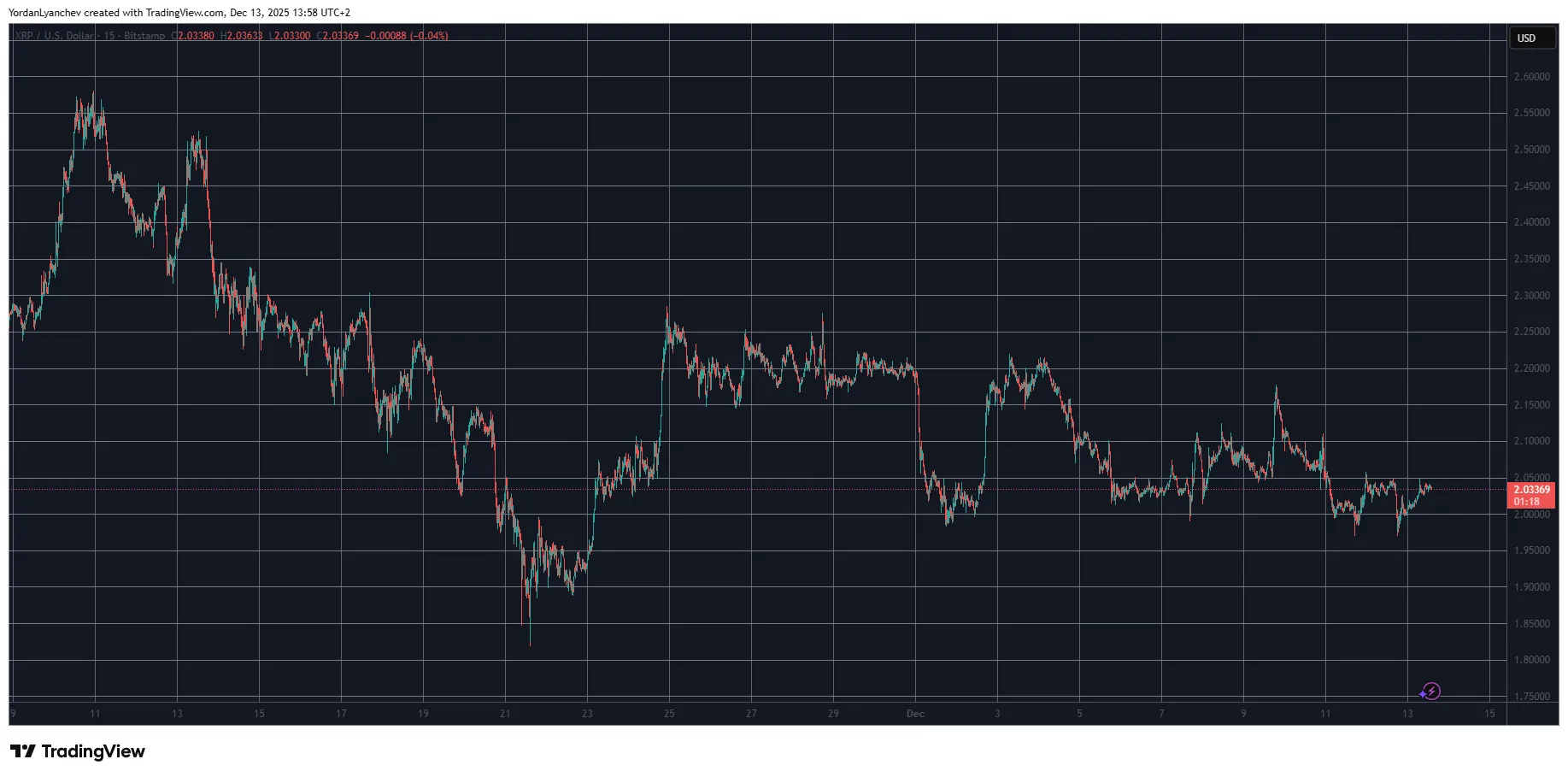

Despite the strong performance of XRP spot ETFs, XRP’s price has not reflected this success. Leading up to the launch of XRPC, XRP traded above $2.50, but subsequently declined, falling below $2.00 on multiple occasions and hitting a low of $1.85 during a market dip in late November. While it has recovered to around $2.00, this represents a 20% decrease in a month, despite the ETFs attracting substantial investment.

Analyzing the Price Discrepancy

Several factors could explain the divergence between XRP ETF inflows and XRP’s price. Broader market conditions, including corrections in Bitcoin and Ethereum, may have exerted downward pressure. Additionally, profit-taking after the initial excitement surrounding the ETF launches could contribute to the price decline. It’s also possible that the market had already priced in the expectation of an XRP ETF, leading to a “buy the rumor, sell the news” scenario.

Impact on Market Liquidity

The introduction of XRP ETFs should, in theory, enhance market liquidity for XRP. These ETFs provide an additional avenue for investors to gain exposure to XRP, potentially attracting new capital and increasing trading volumes. However, the observed price decline suggests that other factors are currently outweighing the positive impact of increased liquidity. Further observation is needed to determine the long-term effects on XRP market depth and stability.

Future Outlook

The launch and positive inflows of XRP ETFs are undoubtedly a positive development for the XRP market structure. However, the lack of immediate price appreciation highlights the complexities of crypto asset valuation. As the market matures and institutional adoption continues, the relationship between ETF performance and underlying asset prices may become more aligned. For now, investors should remain cautious and consider a range of factors when assessing XRP’s potential.

In conclusion, while the initial month of XRP ETFs has been marked by impressive inflows and growing assets under management, XRP’s price performance has been underwhelming. This divergence underscores the multifaceted nature of crypto markets and the need for a comprehensive understanding of market dynamics beyond ETF developments.

Related: XRP Price Prediction: XRP in 2026?

Source: Original article

Quick Summary

XRP spot ETFs have seen significant net inflows since launch, totaling nearly $1 billion. This development occurs amid broader regulatory changes and institutional interest in crypto assets. Despite ETF success, XRP’s price has decreased, highlighting a potential disconnect between investment product performance and underlying asset value.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.