XRP spot ETFs experienced their first-ever outflow, totaling $40.8 million, ending a 54-day inflow streak. The outflow significantly impacted total ETF assets, reducing them from $1.65 billion to $1.53 billion. XRP’s market price mirrored the ETF activity, declining 14% from recent highs.

What to Know:

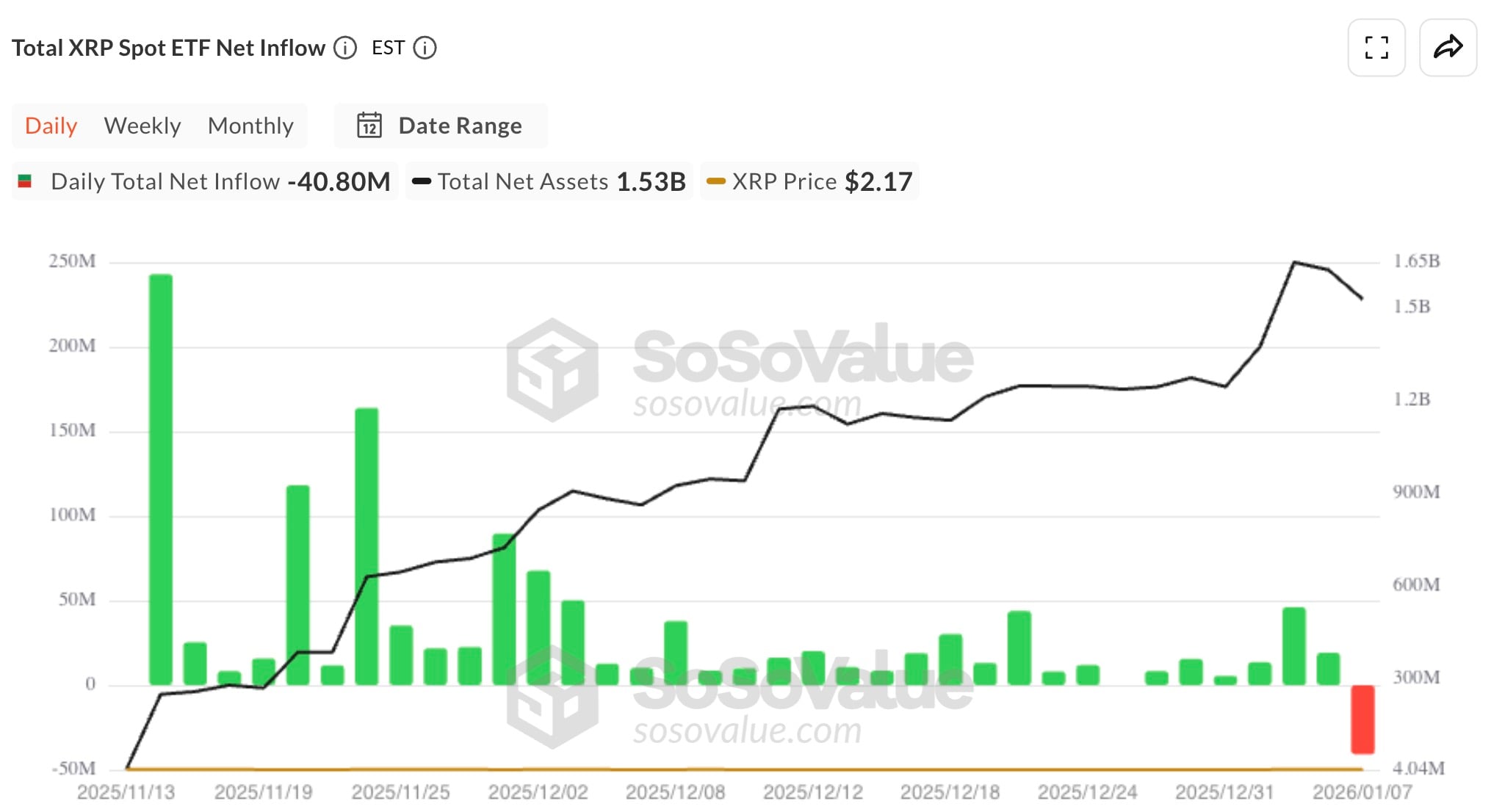

- XRP spot ETFs experienced their first-ever outflow, totaling $40.8 million, ending a 54-day inflow streak.

- The outflow significantly impacted total ETF assets, reducing them from $1.65 billion to $1.53 billion.

- XRP’s market price mirrored the ETF activity, declining 14% from recent highs.

The digital asset XRP has garnered significant attention from institutional investors, particularly with the advent of spot ETFs. These ETFs provide a regulated and accessible avenue for traditional finance to engage with XRP. Recent market activity, however, presents a mixed picture, with the initial enthusiasm surrounding these investment vehicles facing its first real test.

First Outflow and ETF Performance

After a 54-day period of continuous inflows, XRP spot ETFs experienced a notable outflow of $40.8 million. This marks the first instance of such a reversal and effectively nullifies the gains achieved in the initial week of the year, bringing total cumulative inflows down to $1.20 billion. The sudden shift from record demand to record selling raises questions about the sustainability of the initial bullish sentiment. When similar events have occurred with Bitcoin ETFs, the market has often corrected sharply before finding a new equilibrium.

Disparities Among ETF Providers

The outflows were not uniform across all ETF providers. 21Shares TOXR product experienced the most significant redemptions, totaling $47.25 million, pushing its cumulative flow into negative territory. In contrast, Franklin held steady with no change, while Bitwise, Canary, and Grayscale saw minor withdrawals. Such disparities can reflect differences in fund management strategies, investor base, or perceived risk profiles, all of which are crucial factors for institutional investors to consider.

Impact on Market Price

The outflow from XRP ETFs coincided with a downturn in the spot market price. XRP slid from highs of $2.42 on Jan. 5 to as low as $2.08 during the early session on Binance on Jan. 8, a 14% drop. This correlation underscores the interconnectedness between ETF activity and broader market sentiment. It also highlights the potential for ETF flows to exacerbate price volatility, particularly in assets with relatively lower liquidity compared to more established cryptocurrencies like Bitcoin or Ethereum.

Institutional Appetite and Market Structure

The ETF inflow-to-outflow flip serves as an initial indicator of institutional appetite for XRP. While the initial inflows suggested strong demand, the subsequent outflow raises concerns about the depth and conviction of institutional interest. This is a critical juncture for XRP, as sustained institutional adoption is essential for long-term price stability and market maturity. The market structure around XRP, including its liquidity profile and regulatory clarity, will play a crucial role in shaping future institutional investment decisions.

Broader Market Implications

The performance of XRP ETFs has implications beyond the specific asset itself. It provides insights into the broader landscape of digital asset ETFs and their potential impact on market dynamics. As more cryptocurrencies seek ETF listings, understanding the factors that drive inflows and outflows will be essential for investors and regulators alike. This includes assessing the role of market sentiment, regulatory developments, and macroeconomic conditions in shaping the performance of these investment vehicles.

Looking Ahead

While the initial outflow from XRP ETFs may raise concerns, it is essential to maintain a balanced perspective. Market corrections are a natural part of any investment cycle, and the long-term success of XRP ETFs will depend on a variety of factors, including continued regulatory support, growing institutional adoption, and ongoing development of the XRP ecosystem. Investors should closely monitor these developments and adjust their strategies accordingly.

Related: XRP Liquidity Signals Supply Shock

Source: Original article

Quick Summary

XRP spot ETFs experienced their first-ever outflow, totaling $40.8 million, ending a 54-day inflow streak. The outflow significantly impacted total ETF assets, reducing them from $1.65 billion to $1.53 billion. XRP’s market price mirrored the ETF activity, declining 14% from recent highs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.